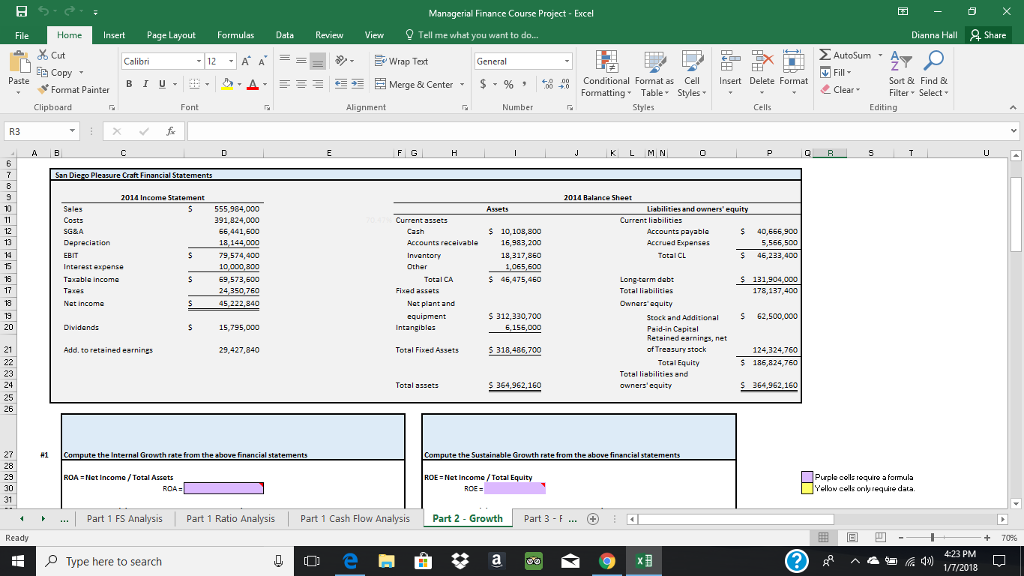

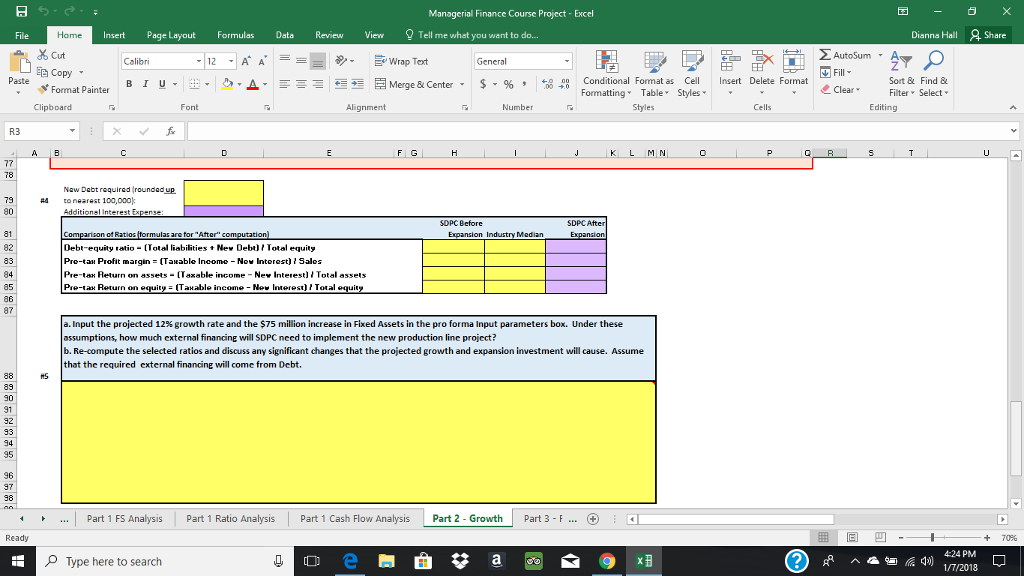

Question: Answer questions 1, 2, and 3 using the financial statement attached. The questions are in relation to the assigned boxes. I am attaching the financial

Answer questions 1, 2, and 3 using the financial statement attached. The questions are in relation to the assigned boxes. I am attaching the financial statements and the questions 1, 2, and 3 boxes again.

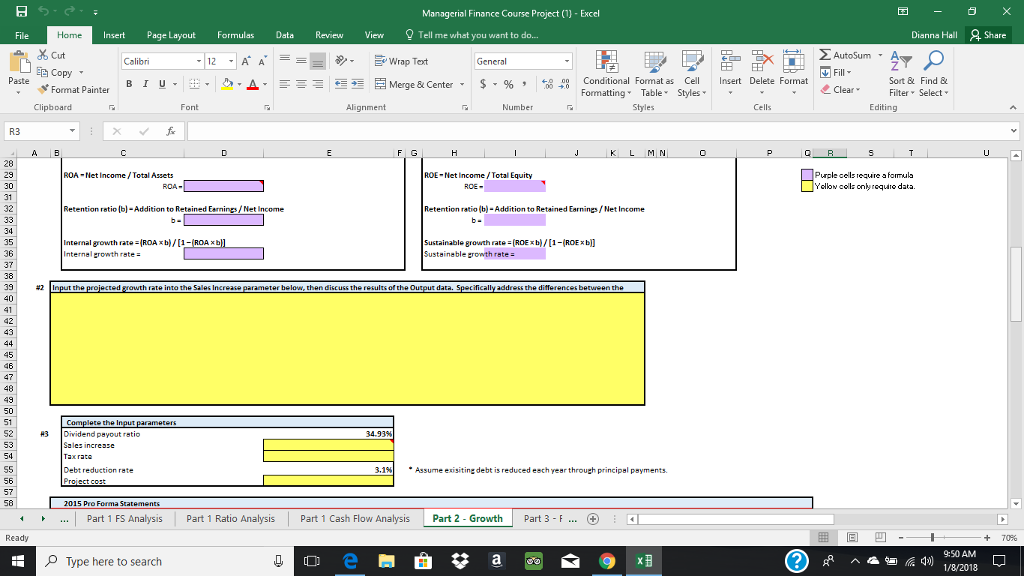

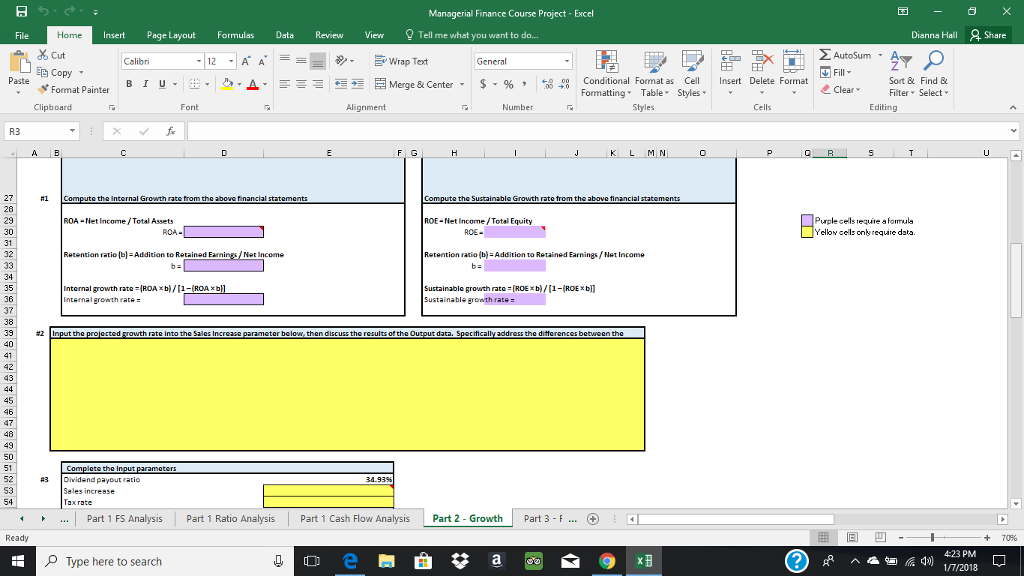

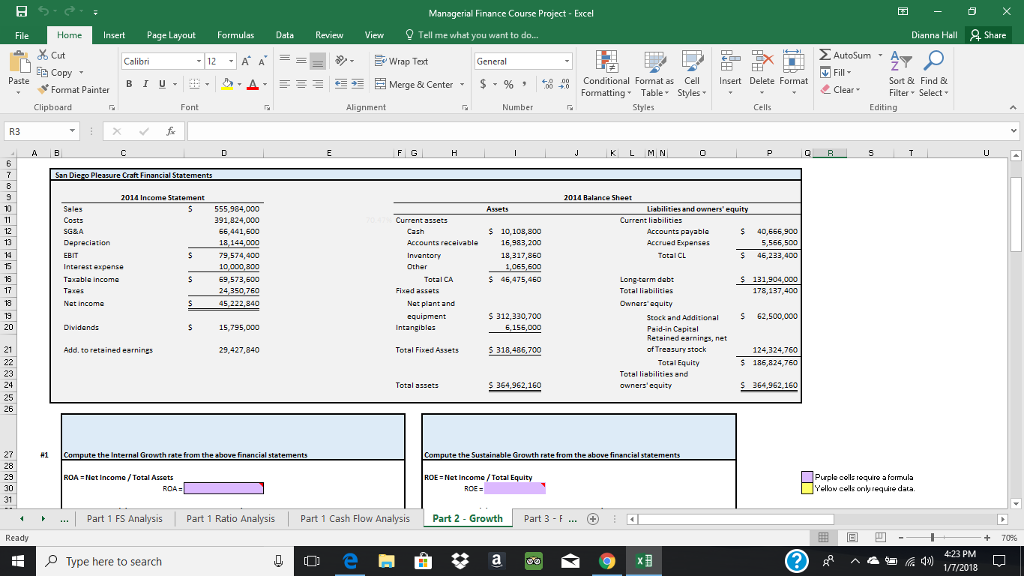

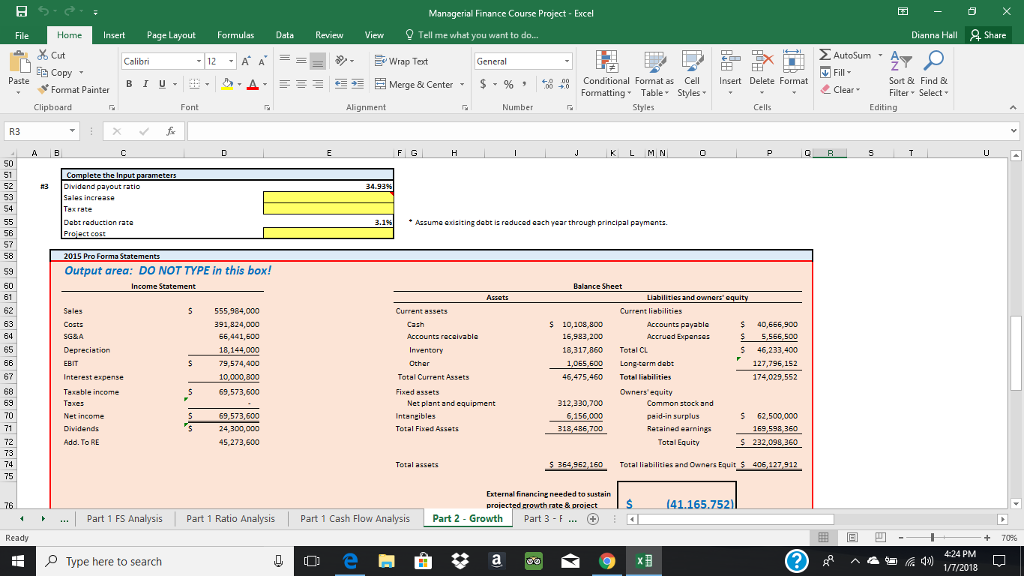

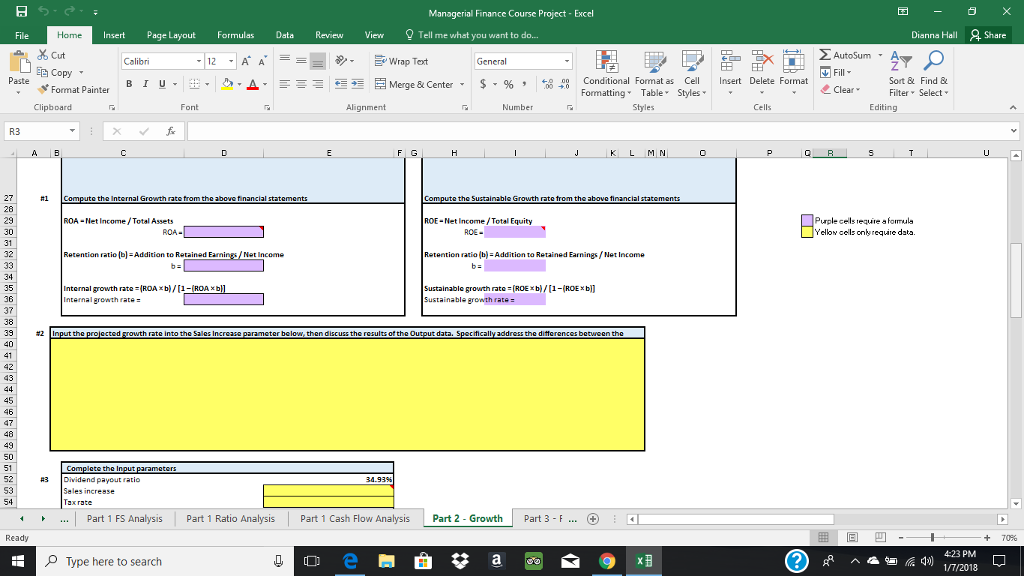

Managerial Finance Course Project (1)- Excel Insert Page Layout FormulasData Review View Tell me what you want to do... Dianna Hall s Cut AutoSum , A Copy Format Painter Fill Merge & Center. $, % , Conditional Format as Cell Formatting Table Styles Paste Insert Delete Format B l u. | Er ., Sort & Find & Filter Select Clipboard Font Alignment Number Cells Editing R3 ROA Net Income/Total Assets ROE-Net Income /Total Equity Puplecells requre a formula Yellow colla onroque data. Retention retio (bl-Addition to Reteined Earnings/Net Income Retention ratio (b)- Addition to Retained Earnings/ Net Income Internal growth rate (ROAxb)/[1 Internel erowth rste- Sustainable growth rate (ROEX b)/ [1-ROEX bl Sustaineble growth rate: 36 42 45 47 49 52 #3 Dividend payout ratio Sales increase 34.93% Debt reduction rate 3.1% * Assume exisiting debt is reduced eech year through principal payments. M...Part 1 FS Analysis Part 1 Ratio Analysis Part 1 Cash Flow Analysis Part 2 Growth Part 3 -F .. +70% 9:50 AM OType here to search fa ^41) 1/8/2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts