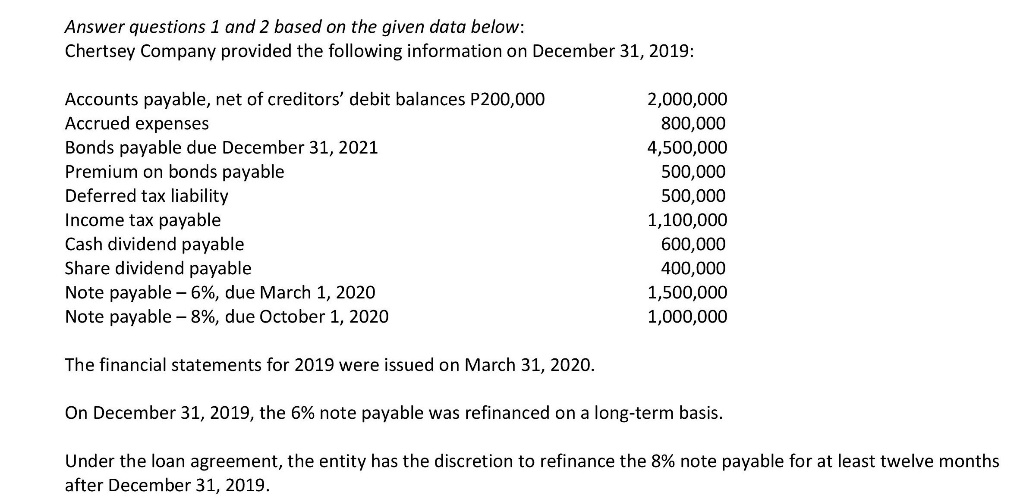

Question: Answer questions 1 and 2 based on the given data below: Chertsey Company provided the following information on December 31, 2019: Accounts payable, net of

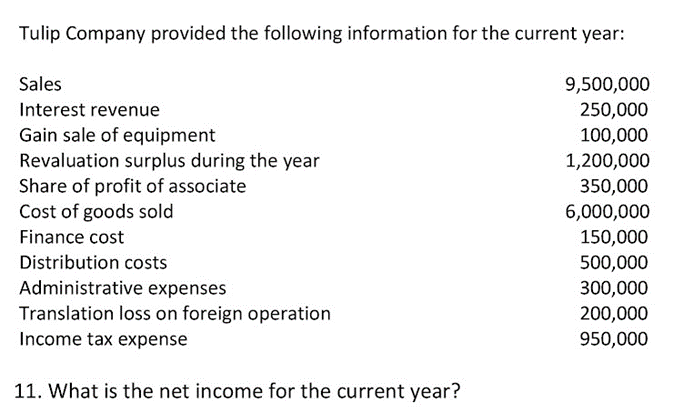

Answer questions 1 and 2 based on the given data below: Chertsey Company provided the following information on December 31, 2019: Accounts payable, net of creditors\" debit balances P200,000 2,000,000 Accrued expenses 800,000 Bonds payable due December 31, 2021 4,500,000 Premium on bonds payable 500,000 Deferred tax liability 500,000 Income tax payable 1,100,000 Cash dividend payable 600,000 Share dividend payable 400.000 Note payable 6%, due March 1, 2020 1,500,000 Note payable 8%, due October 1, 2020 1,000,000 The nancial statements for 2019 were issued on March 31, 2020. On December 31, 2019, the 6% note payable was renanced on a long-term basis. Under the loan agreement, the entity has the discretion to renance the 8% note payable for at least twelve months after December 31, 2019. Tulip Company provided the foliowing information for the current year: Sales 9,500,000 Interest revenue 250,000 Gain sale of equipment 100,000 Revaluation surplus during the year 1,200,000 Share of profit of associate 350,000 Cost of goods sold 5,000,000 Finance cost 150,000 Distribution costs 500,000 Administrative expenses 300,000 Translation loss on foreign operation 200,000 Income tax expense 950,000 11. What is the net income for the current year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts