Question: answer questions 1 and 2 QUESTION 1-LOAN AMORTIZATION (30 marks) Rohanna is planning on getting married and wants to purchase a house for $11 800

answer questions 1 and 2

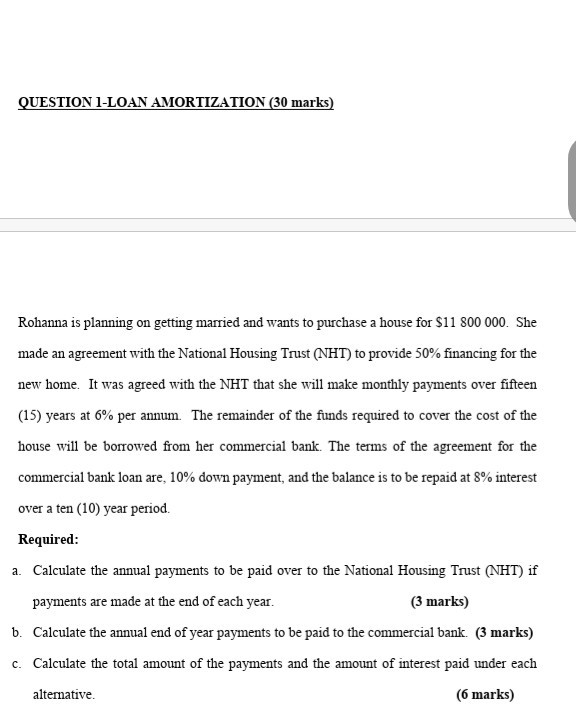

QUESTION 1-LOAN AMORTIZATION (30 marks) Rohanna is planning on getting married and wants to purchase a house for $11 800 000. She made an agreement with the National Housing Trust (NHT) to provide 50% financing for the new home. It was agreed with the NHT that she will make monthly payments over fifteen (15) years at 6% per annum. The remainder of the funds required to cover the cost of the house will be borrowed from her commercial bank. The terms of the agreement for the commercial bank loan are, 10% down payment, and the balance is to be repaid at 8% interest over a ten (10) year period Required: a. Calculate the annual payments to be paid over to the National Housing Trust (NHT) if payments are made at the end of each year. (3 marks) 6. Calculate the annual end of year payments to be paid to the commercial bank. (3 marks) c. Calculate the total amount of the payments and the amount of interest paid under each alternative. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts