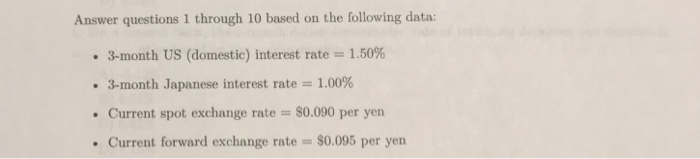

Question: Answer questions 1 through 10 based on the following data: -3-month US (domestic) interest rate 1.50% 3-month Japanese interest rate 1.00% Current spot exchange rate

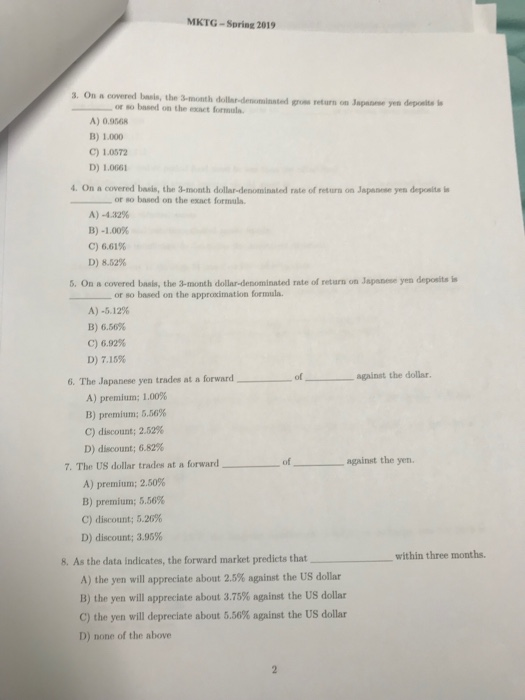

Answer questions 1 through 10 based on the following data: -3-month US (domestic) interest rate 1.50% 3-month Japanese interest rate 1.00% Current spot exchange rate = S0.090 per yen . Current forward exchange rate = $0.095 per yen MKTG-Spring 2019 s. On a covered baln, the 3-month daollar-demcominnted gos return on Japaonse yen yen deposits le -orsobased on the exact frmula. A) 0.9568 B) 1.000 C)1.0572 D) 1.0661 4. On a covered basis, the 3-month dollar-denominated rate of return on Japanse yen depositsi , orso based on the exact formula A)-432% B)-1.00% C) 6.61% D) 852% 5. On a covered basls, the 3-month dollar-denominated rate of return on Japanese yen deposits is so based on the approximation formula. A)-5.12% B)6.50% C) 6.92% D) 7.15% of api 6. The Japanese yen trades at a forward of_ against the dollar. A) premium; i,00% B) premium: 5.56% C) discount, 2.52% D) discount: 6.82% 7. The US dollar trades at n forward of against the yen. A) premium; 2.50% B) premium: 5.56% C) discount; 5.26% D) discount: 3.95% within three months. 8. As the data indicates, the forward market predicts that A) the yen will appreciate about 25% against the US dollar B) the yen will appreciate about 3.75% against the US dollar C) the yen will depreciate about 5.56% against the US dollar D) none of the above Answer questions 1 through 10 based on the following data: -3-month US (domestic) interest rate 1.50% 3-month Japanese interest rate 1.00% Current spot exchange rate = S0.090 per yen . Current forward exchange rate = $0.095 per yen MKTG-Spring 2019 s. On a covered baln, the 3-month daollar-demcominnted gos return on Japaonse yen yen deposits le -orsobased on the exact frmula. A) 0.9568 B) 1.000 C)1.0572 D) 1.0661 4. On a covered basis, the 3-month dollar-denominated rate of return on Japanse yen depositsi , orso based on the exact formula A)-432% B)-1.00% C) 6.61% D) 852% 5. On a covered basls, the 3-month dollar-denominated rate of return on Japanese yen deposits is so based on the approximation formula. A)-5.12% B)6.50% C) 6.92% D) 7.15% of api 6. The Japanese yen trades at a forward of_ against the dollar. A) premium; i,00% B) premium: 5.56% C) discount, 2.52% D) discount: 6.82% 7. The US dollar trades at n forward of against the yen. A) premium; 2.50% B) premium: 5.56% C) discount; 5.26% D) discount: 3.95% within three months. 8. As the data indicates, the forward market predicts that A) the yen will appreciate about 25% against the US dollar B) the yen will appreciate about 3.75% against the US dollar C) the yen will depreciate about 5.56% against the US dollar D) none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts