Question: Answer questions 1-10 True/False 1. Lower volatility, everything else being equal, makes put options more valuable. 2. Higher volatility, everything else being equal, makes call

Answer questions 1-10

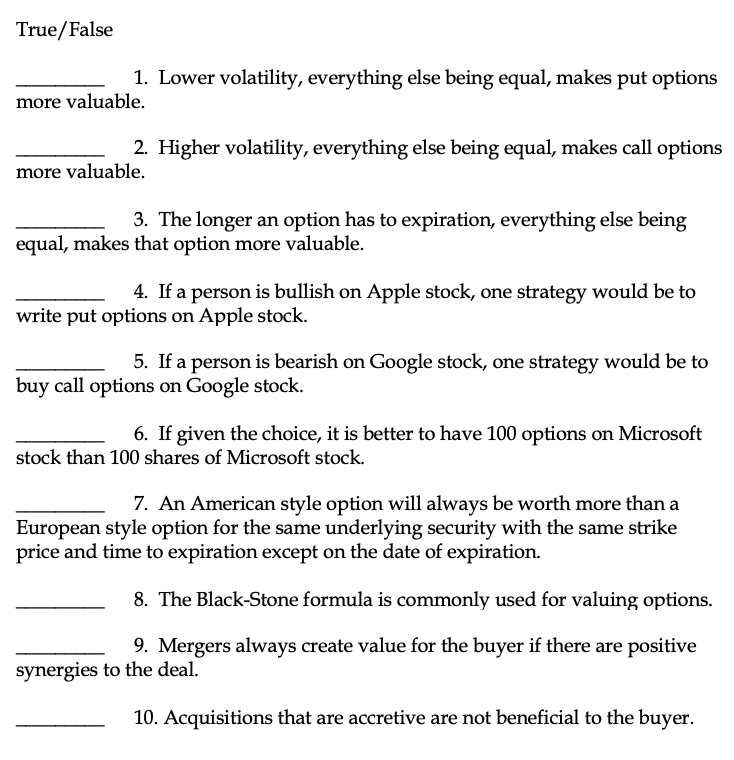

True/False 1. Lower volatility, everything else being equal, makes put options more valuable. 2. Higher volatility, everything else being equal, makes call options more valuable. 3. The longer an option has to expiration, everything else being equal, makes that option more valuable. 4. If a person is bullish on Apple stock, one strategy would be to write put options on Apple stock. 5. If a person is bearish on Google stock, one strategy would be to buy call options on Google stock. 6. If given the choice, it is better to have 100 options on Microsoft stock than 100 shares of Microsoft stock. 7. An American style option will always be worth more than a European style option for the same underlying security with the same strike price and time to expiration except on the date of expiration. 8. The Black-Stone formula is commonly used for valuing options. 9. Mergers always create value for the buyer if there are positive synergies to the deal. 10. Acquisitions that are accretive are not beneficial to the buyer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts