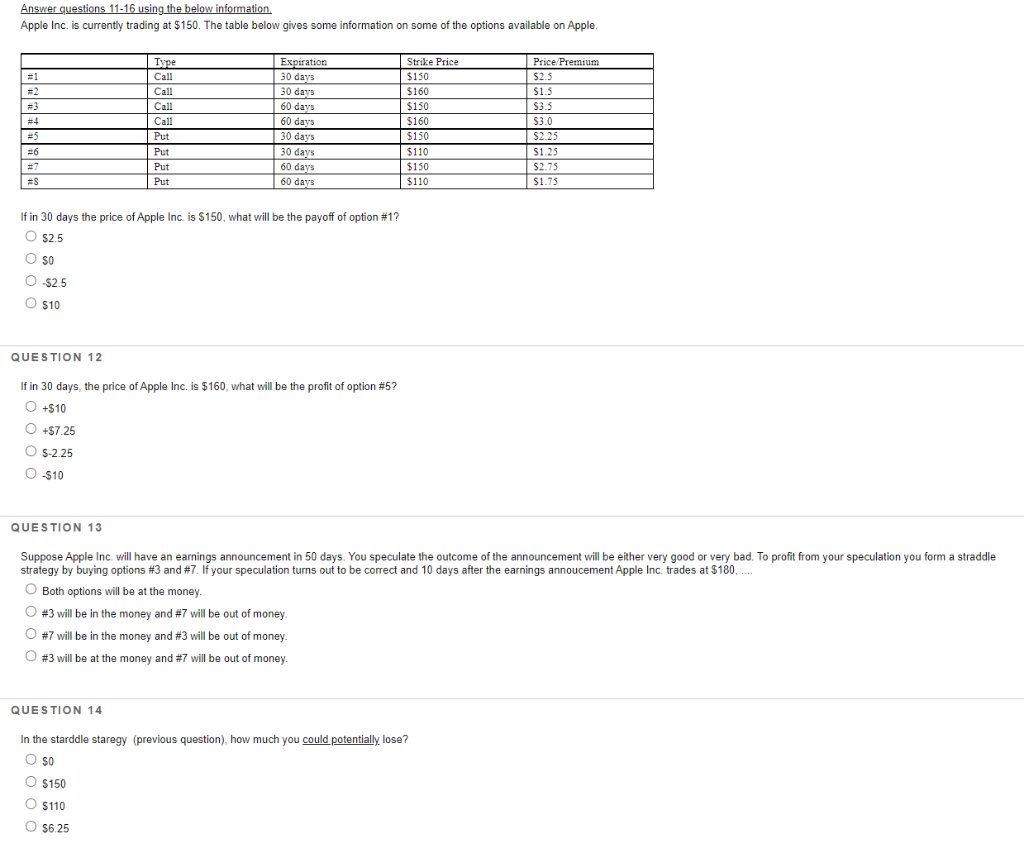

Question: Answer questions 11-16 using the below information, Apple Inc. is currently trading at $150. The table below gives some information on some of the options

Answer questions 11-16 using the below information, Apple Inc. is currently trading at $150. The table below gives some information on some of the options available on Apple. Type Call Call Call Call Put Put Put Put Expiration 30 days 30 days 60 days 60 days =1 =2 #3 =4 =5 =6 =7 =8 =8 Strike Price $150 $160 $ $ $150 $160 $150 $ $110 $150 $110 Price Premium $2.5 $1.5 $3.3 $3.0 $2.25 $1.25 $2.75 $1.75 30 days 30 days 60 days 60 days If in 30 days the price of Apple Inc. is $150, what will be the payoff of option #1? O $2.5 O SO - O $10 O $2.5 QUESTION 12 If in 30 days, the price of Apple Inc. is $160, what will be the profit of option #5? O +$10 O +$7.25 O S-2.25 O $10 QUESTION 13 Suppose Apple Inc. will have an earnings announcement in 50 days. You speculate the outcome of the announcement will be either very good or very bad. To profit from your speculation you form a straddle strategy by buying options #3 and #7. If your speculation turns out to be correct and 10 days after the earnings annoucement Apple Inc. trades at $180, O Both options will be at the money. #3 will be in the money and #7 will be out of money #7 will be in the money and #3 will be out of money. #3 will be at the money and #7 will be out of money. QUESTION 14 In the starddle staregy (previous question), how much you could potentially lose? O $0 S150 O $110 O $6.25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts