Question: Answer Questions 1,2 and 3 using the info provided in the pictures thanks!!! Since 1936, Abt Electronics has provided customers with high customer satisfaction and

Answer Questions 1,2 and 3 using the info provided in the pictures thanks!!!

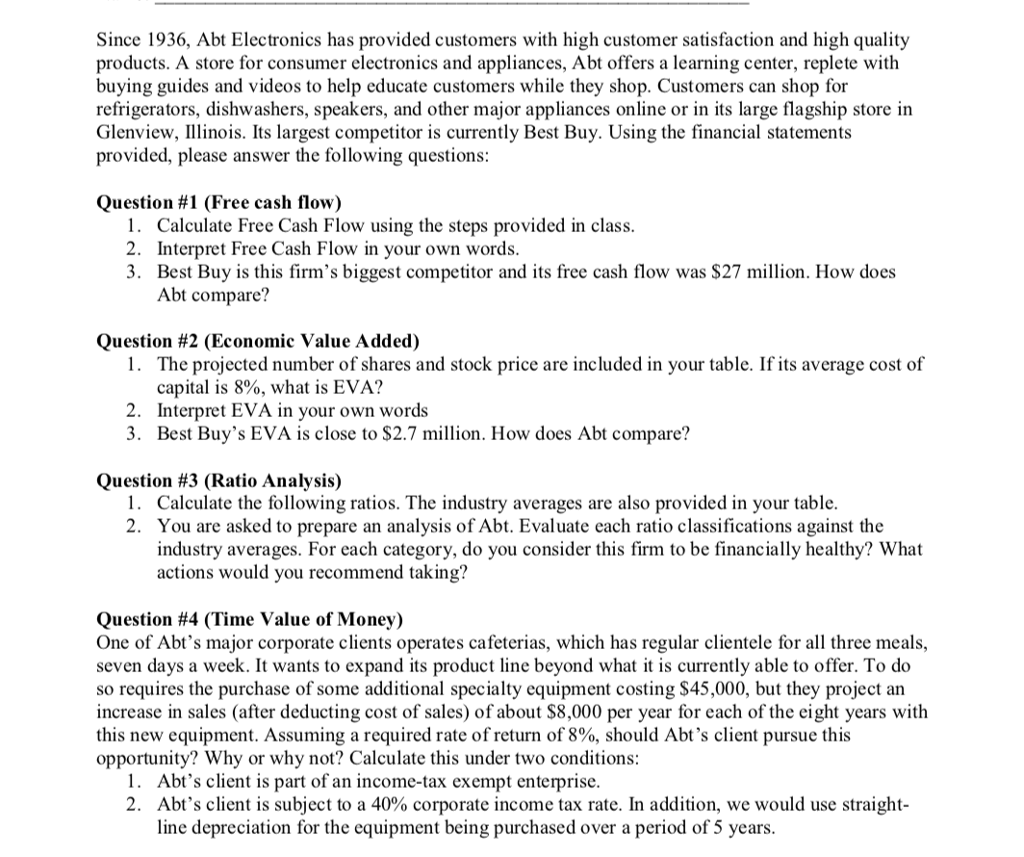

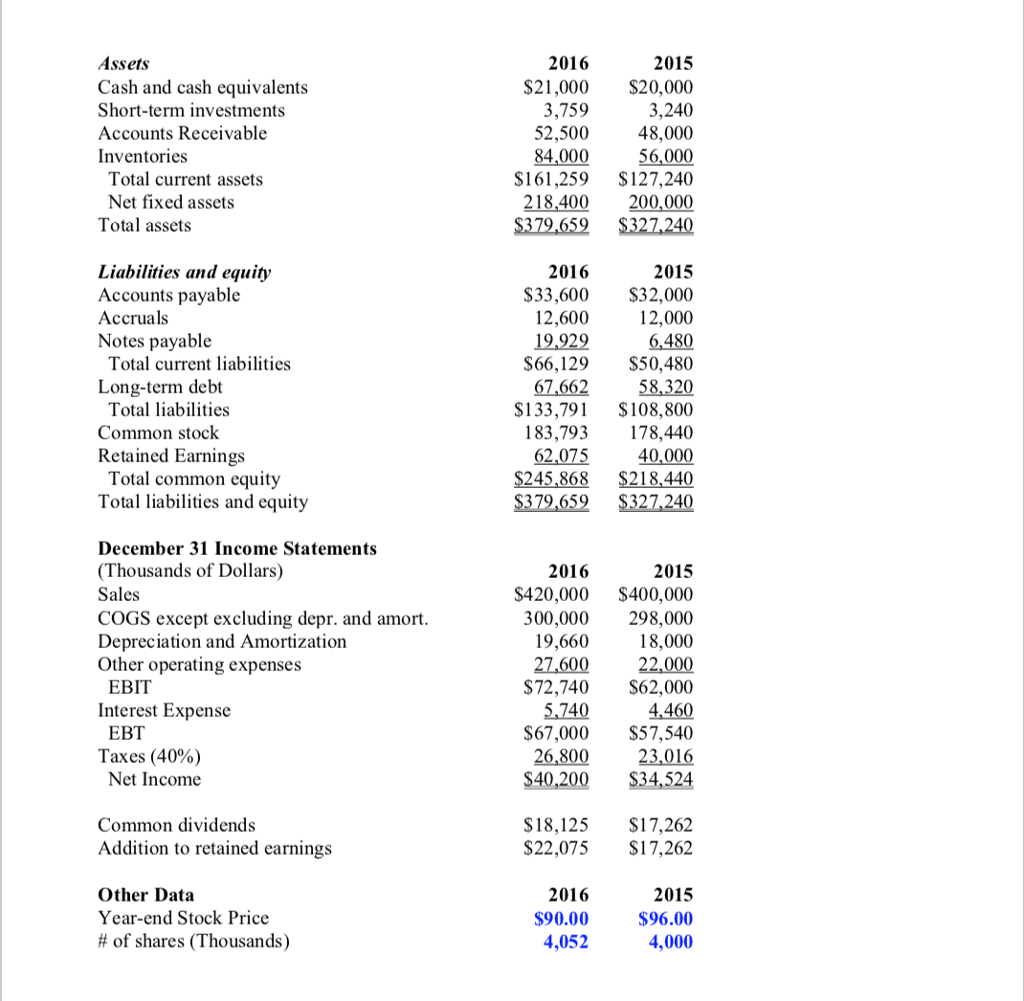

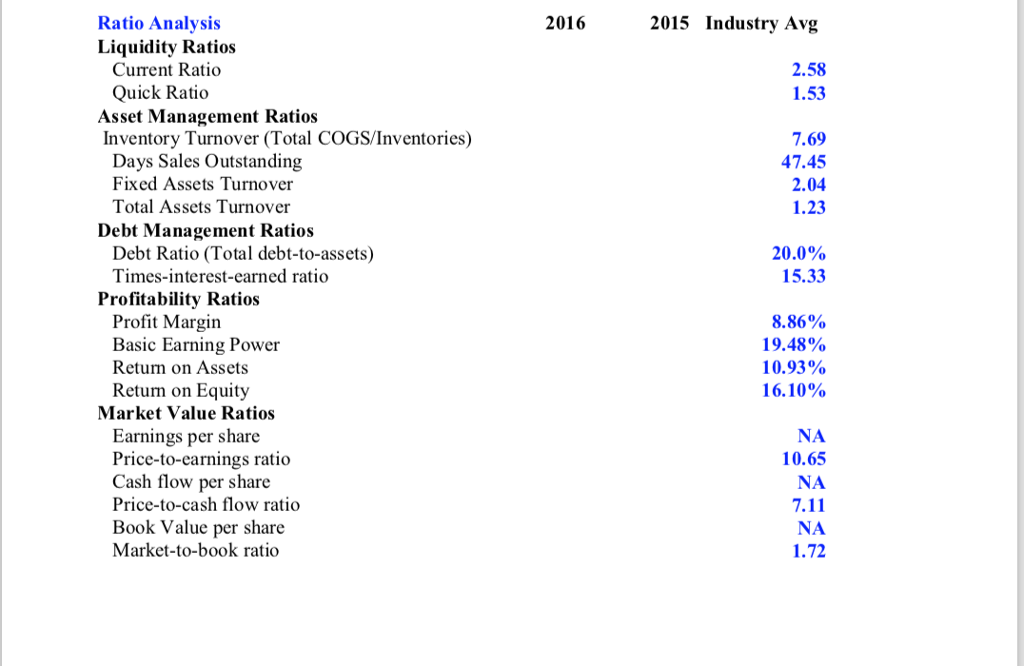

Since 1936, Abt Electronics has provided customers with high customer satisfaction and high quality products. A store for consumer electronics and appliances, Abt offers a learning center, replete with buying guides and videos to help educate customers while they shop. Customers can shop for refrigerators, dishwashers, speakers, and other major appliances online or in its large flagship store in Glenview, Illinois. Its largest competitor is currently Best Buy. Using the financial statements provided, please answer the following questions Question #1 (Free cash flow) 1. Calculate Free Cash Flow using the steps provided in class. 2. Interpret Free Cash Flow in your own words 3. Best Buy is this firm's biggest competitor and its free cash flow was $27 million. How does Abt compare? Question #2 (Economic Value Added) 1. The projected number of shares and stock price are included in your table. If its average cost of capital is 8%, what is EVA? 2. Interpret EVA in your own words 3. Best Buy's EVA is close to $2.7 million. How does Abt compare? Question #3 (Ratio Analysis) 1. Calculate the following ratios. The industry averages are also provided in your table. 2. You are asked to prepare an analysis of Abt. Evaluate each ratio classifications against the industry averages. For each category, do you consider this firm to be financially healthy? What actions would you recommend taking? Question #4 (Time Value of Money One of Abt's major corporate clients operates cafeterias, which has regular clientele for all three meals, seven days a week. It wants to expand its product line beyond what it is currently able to offer. To do so requires the purchase of some additional specialty equipment costing $45,000, but they project an increase in sales (after deducting cost of sales) of about $8,000 per year for each of the eight years with this new equipment. Assuming a required rate of return of 8%, should Abt's client pursue this opportunity? Why or why not? Calculate this under two conditions: 1. 2, Abt's client is part of an income-tax exempt enterprise Abt's client is subject to a 40% corporate income tax rate. In addition, we would use straight- line depreciation for the equipment being purchased over a period of 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts