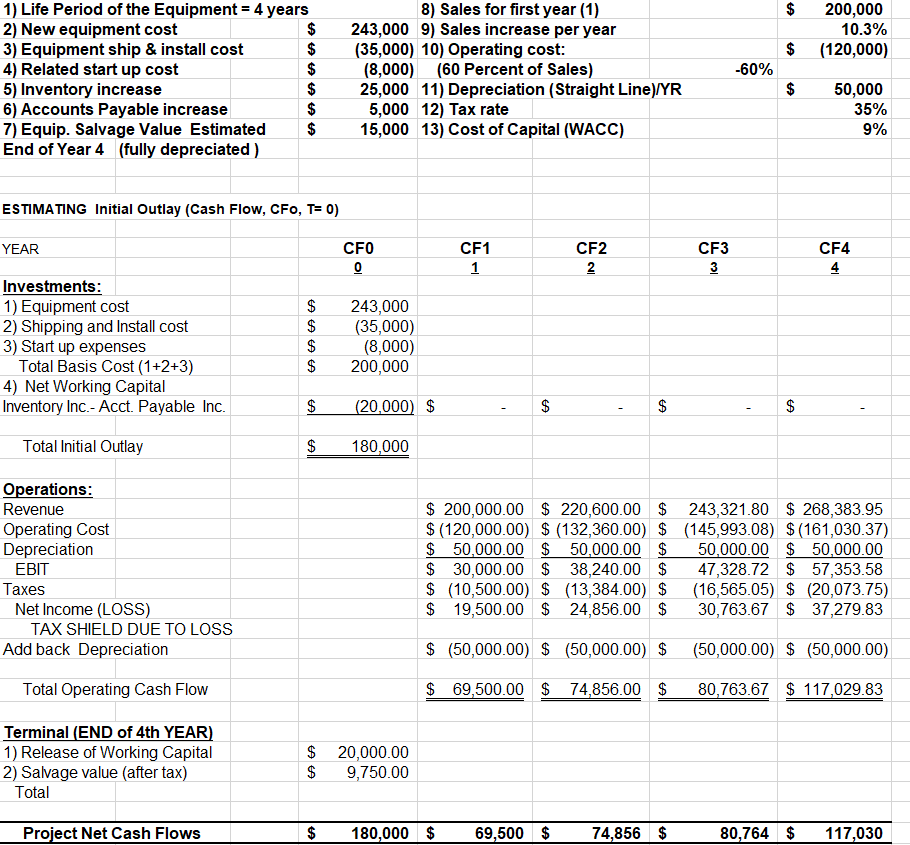

Question: Answer Questions #1-2 based on the spreadsheet below Answer Questions #1-2 based on the spreadsheet below $ 200,000 10.3% (120,000) $ $ 1) Life Period

Answer Questions #1-2 based on the spreadsheet below

Answer Questions #1-2 based on the spreadsheet below

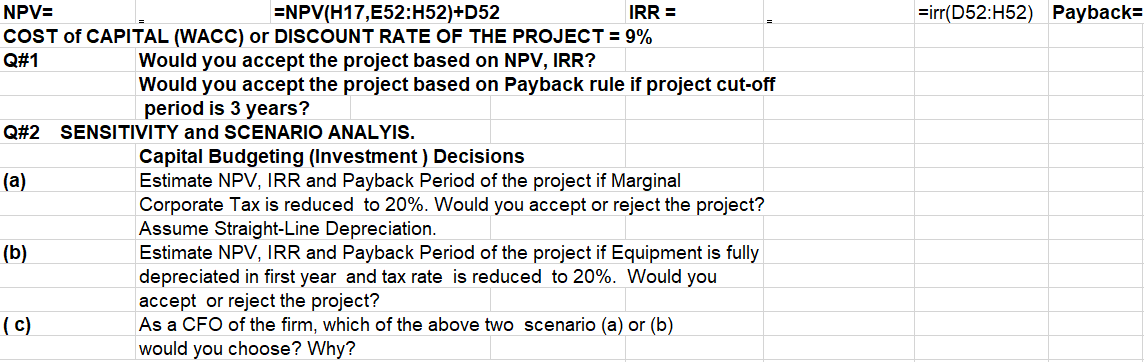

$ 200,000 10.3% (120,000) $ $ 1) Life Period of the Equipment = 4 years 2) New equipment cost 3) Equipment ship & install cost 4) Related start up cost 5) Inventory increase 6) Accounts Payable increase 7) Equip. Salvage Value Estimated End of Year 4 (fully depreciated) 8) Sales for first year (1) 243,000 9) Sales increase per year (35,000) 10) Operating cost: (8,000) (60 Percent of Sales) 25,000 11) Depreciation (Straight Line)/YR 5,000 12) Tax rate 15,000 13) Cost of Capital (WACC) -60% $ 50,000 35% 9% ESTIMATING Initial Outlay (Cash Flow, CFO, T=0) YEAR CFO CF1 CF2 CF3 CF4 A $ Investments: 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Basis Cost (1+2+3) 4) Net Working Capital Inventory Inc.- Acct. Payable Inc. 243,000 (35,000) (8,000) 200,000 (20,000) $ Total Initial Outlay 180,000 Operations: Revenue Operating Cost Depreciation EBIT Taxes Net Income (LOSS) TAX SHIELD DUE TO LOSS Add back Depreciation $ 200,000.00 $ 220,600.00 $ $(120,000.00) $ (132,360.00) $ $ 50,000.00 $ 50,000.00 $ $ 30,000.00 $ 38,240.00 $ $ (10,500.00) $ (13,384.00) $ $ 19,500.00 $ 24,856.00 $ 243,321.80 $ 268,383.95 (145,993.08) $ (161,030.37) 50,000.00 $ 50,000.00 47,328.72 $ 57,353.58 (16,565.05) $ (20.073.75) 30,763.67 $ 37,279.83 $ (50,000.00) $ (50,000.00) $ (50,000.00) $ (50,000.00) Total Operating Cash Flow $ 69,500.00 $ 74,856.00 $ 80,763.67 $ 117,029.83 Terminal (END of 4th YEAR) 1) Release of Working Capital 2) Salvage value (after tax) Total $ $ 20,000.00 9,750.00 Project Net Cash Flows $ 180,000 $ 69,500 $ 74,856 $ 80,764 $ 117,030 =irr(D52:H52) Payback= NPV= =NPV(H17,E52:H52)+D52 IRR = COST of CAPITAL (WACC) or DISCOUNT RATE OF THE PROJECT = 9% Q#1 Would you accept the project based on NPV, IRR? Would you accept the project based on Payback rule if project cut-off period is 3 years? Q#2 SENSITIVITY and SCENARIO ANALYIS. Capital Budgeting (Investment ) Decisions Estimate NPV, IRR and Payback period of the project if Marginal Corporate Tax is reduced to 20%. Would you accept or reject the project? Assume Straight-Line Depreciation. Estimate NPV, IRR and Payback period of the project if Equipment is fully depreciated in first year and tax rate is reduced to 20%. Would you accept or reject the project? (C) As a CFO of the firm, which of the above two scenario (a) or (b) would you choose? Why? (a) (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts