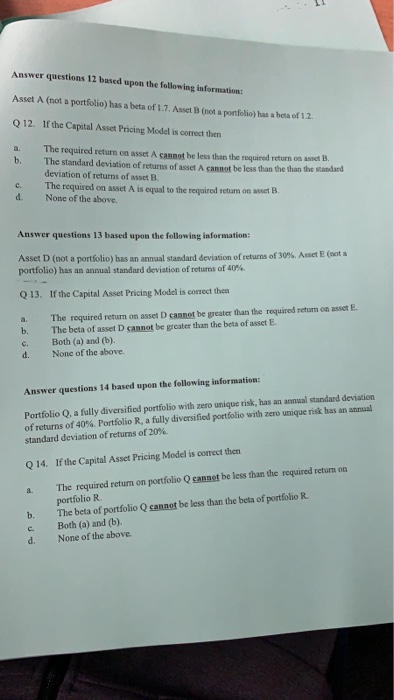

Question: Answer questions 12 based upon the following information: Asset A (not a portfolio) has a beta of 1.7. Asset B (not a portfolio) hat abeta

Answer questions 12 based upon the following information: Asset A (not a portfolio) has a beta of 1.7. Asset B (not a portfolio) hat abeta of 12 Q12. If the Capital Asset Pricing Model is correct then b. The required return on asset A cannot be less than the required return on The standard deviation of returns ofasst A cannot be less than the than the standard deviation of returns of asset B. The required on asset A is equal to the required retam one B None of the above. Answer questions 13 based upon the following information: Asset D (not a portfolio) has an annual standard deviation of returns of 30%. Asset E (nota portfolio) has an annual standard deviation of retums of 40% Q 13. If the Capital Asset Pricing Model is correct then The required return on asset cannot be greater than the required retum on set b. The beta of asset D cannot be greater than the bea of asset E. Both (a) and (b). d. None of the above Answer questions 14 based upon the following information: Portfolio Q. a fully diversified portfolio with zero unique risk, has an annual standard deviation of returns of 40%. Portfolio R, a fully diversified portfolio with zero unique risk has an annual standard deviation of returns of 20% Q14. If the Capital Asset Pricing Model is correct then b. c. d. The required return on portfolio Q cannot be less than the required return on portfolio R The beta of portfolio Q cannot be less than the beta of portfolio R. Both (a) and (b). None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts