Question: ANSWER QUESTIONS 12 TO 16 USING THE FOLLOWING INFORMATION A firm is considering an investment in capital equipment. The equipment requires an initial cash outflow

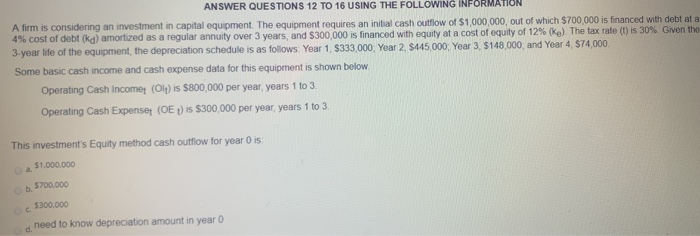

ANSWER QUESTIONS 12 TO 16 USING THE FOLLOWING INFORMATION A firm is considering an investment in capital equipment. The equipment requires an initial cash outflow of $1,000,000, out of which $700,000 is financed with debt at a 4% cost of debt (ka) amortized as a regular annuity over 3 years, and $300,000 is financed with equity at a cost of equity of 12% (ke) The tax rate() is 30%. Given the 3-year life of the equipment, the depreciation schedule is as follows: Year 1, $333,000 Year 2, $445,000 Year 3. $148,000, and Year 4 $74,000 Some basic cash income and cash expense data for this equipment is shown below. Operating Cash Incomet (Olt) is $800,000 per year, years 1 to 3. Operating Cash Expenset (OE) is $300,000 per year, years 1 to 3. This investment's Equity method cash outflow for year is: 51.000.000 b5700.000 5300.000 need to know depreciation amount in year 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts