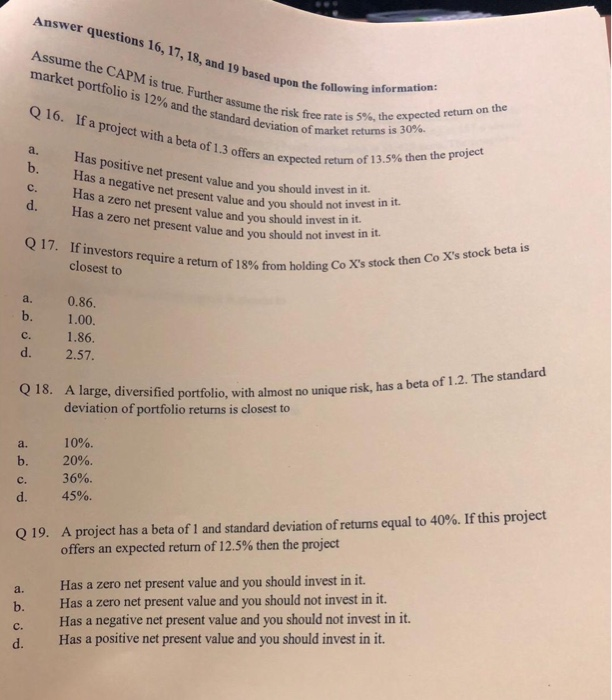

Question: Answer questions 16, 17, 18, and 19 based upon the follon Assum e the CAPM is true. Further market portfolio is 12% and the standard

Answer questions 16, 17, 18, and 19 based upon the follon Assum e the CAPM is true. Further market portfolio is 12% and the standard deviation of market ret assume the risk free rate is 5%, the ex the Q16. If a project with a beta of 1.3 offers an expected , then the p return of 13.5% then the project a. Has positive net present value and you b. Has a negative net present value and c. H d. should invest in it. vou should not invest in it. as a zero net present value and you should invest in ift. Has a zero net present value and you should not invest in it. Q17. If investors require a return from holding Co. closest to um of 18% from holding Co X's stock then Co X's stock beta is a. 0.86. b. 1.00 c. 1.86 arge, diversified portfolio, with almost no unique risk has a beta of 1.2. The standard deviation of portfolio returns is closest to d. 2.57. a, b. c. d. 10%. 20%. 36%. A project has a beta of 1 and standard deviation ofretums equal to 40%. If this project offers an expected return of 12.5% then the project 45%. Q 19. Has a zero net present value and you should not invest in it. Has a negative net present value and you should not invest in it. Has a zero net present value and you should invest in it. a. b. C. Has a positive net present value and you should invest in it. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts