Question: answer questions 2 and 3 below please 2. (2 points) A new electric saw for cutting small pieces of lumber in a furniture manufacturing plant

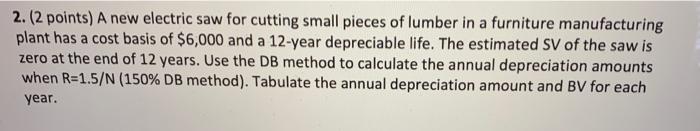

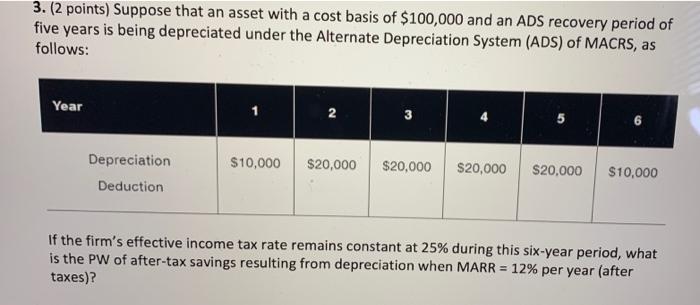

2. (2 points) A new electric saw for cutting small pieces of lumber in a furniture manufacturing plant has a cost basis of $6,000 and a 12-year depreciable life. The estimated SV of the saw is zero at the end of 12 years. Use the DB method to calculate the annual depreciation amounts when R=1.5/N (150% DB method). Tabulate the annual depreciation amount and BV for each year. 3. (2 points) Suppose that an asset with a cost basis of $100,000 and an ADS recovery period of five years is being depreciated under the Alternate Depreciation System (ADS) of MACRS, as follows: Year 2 3 5 $10,000 Depreciation Deduction $20,000 $20,000 $20,000 $20,000 $10,000 If the firm's effective income tax rate remains constant at 25% during this six-year period, what is the PW of after-tax savings resulting from depreciation when MARR = 12% per year (after taxes)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts