Question: ANSWER QUESTIONS 20 TO 22 USING THE FOLLOWING INFORMATION A $10,000,000 real estate investment is financed with $8,000,000 in debt at an annual 5% interest

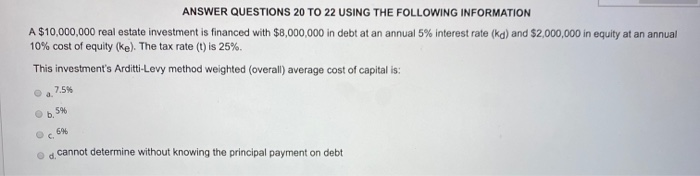

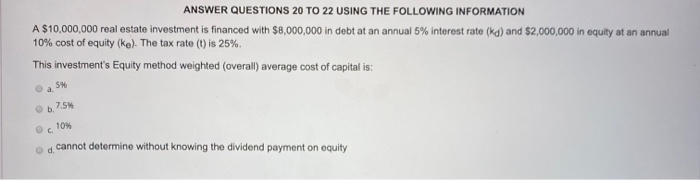

ANSWER QUESTIONS 20 TO 22 USING THE FOLLOWING INFORMATION A $10,000,000 real estate investment is financed with $8,000,000 in debt at an annual 5% interest rate (ka) and $2,000,000 in equity at an annual 10% cost of equity (ke). The tax rate (t) is 25%. This investment's Arditti-Levy method weighted (overall) average cost of capital is: 4.7.5% 0.5% 66 cannot determine without knowing the principal payment on debt ANSWER QUESTIONS 20 TO 22 USING THE FOLLOWING INFORMATION A $10,000,000 real estate investment is financed with $8,000,000 in debt at an annual 5% interest rate (ka) and $2,000,000 in equity at an annual 10% cost of equity (ke). The tax rate (t) is 25% This investment's Equity method weighted (overall) average cost of capital is: 5 b.7.5% o c10% cannot determine without knowing the dividend payment on equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts