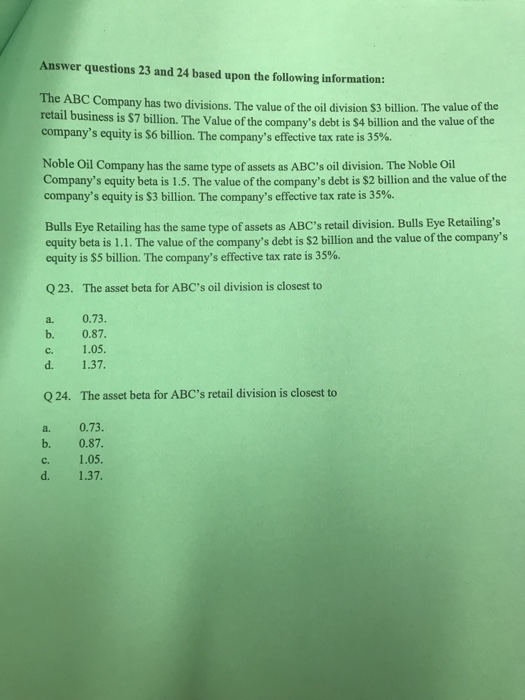

Question: Answer questions 23 and 24 based upon the following information: The ABC Company has two divisions. retail business is $7 billion. The Value of the

Answer questions 23 and 24 based upon the following information: The ABC Company has two divisions. retail business is $7 billion. The Value of the company's debt is S4 billion and the value of the company's equity is S6 billion. The company's effective tax rate is 35% The value of the oil division $3 billion. The value of the Noble Oil Company has the same type of assets as ABC's oil division. The Noble Oil Company's equity beta is 1.5. The value of the company's debt is $2 billion and the value of the company's equity is S3 billion. The company's effective tax rate is 35%. Bulls Eye Retailing has the same type of assets as ABC's retail division. Bulls Eye Retailing's equity beta is 1.1The value of the company's debt is $2 billion and the value of the company's equity is $5 billion. The company's effective tax rate is 35%. Q 23 The asset beta for ABC's oil division is closest to a. 0.73 b. 0.87. C. 1.05. d. 1.37. Q 24 The asset beta for ABC's retail division is closest to a. 0.73. b. 0.87. c. 1.05. d. 1.37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts