Question: answer questions 24 , 25 and 28 please 12:00 Sun Apr 12 956% 3 Aa To a D Fundamentals of Corporate Finance MEE evtalom b.

answer questions 24 , 25 and 28 please

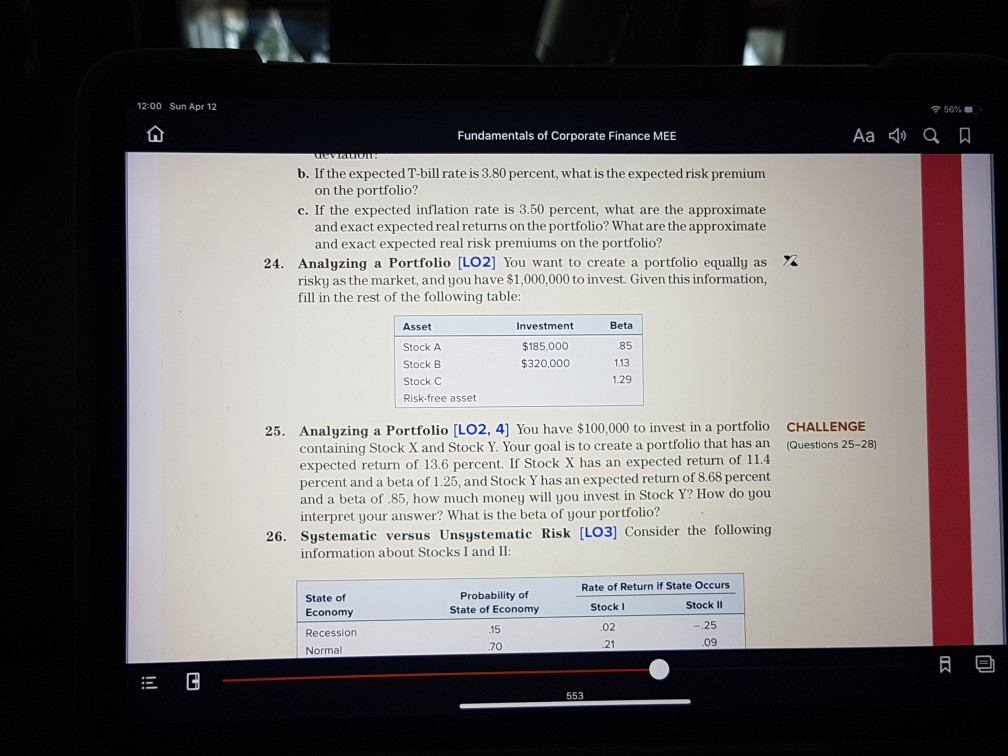

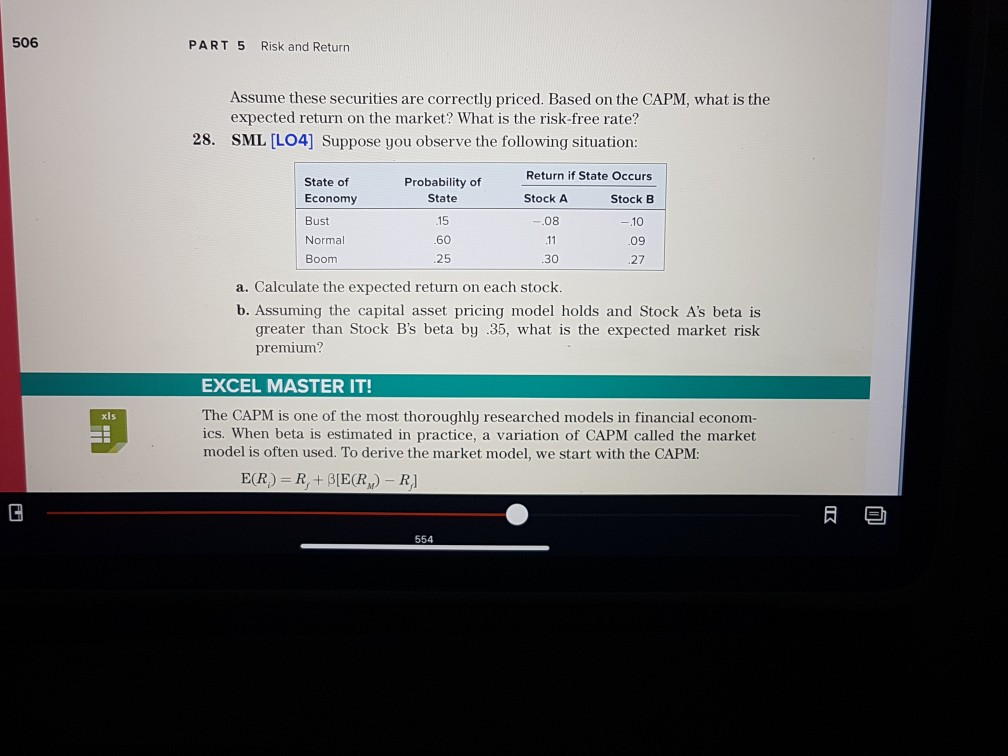

12:00 Sun Apr 12 956% 3 Aa To a D Fundamentals of Corporate Finance MEE evtalom b. If the expected T-bill rate is 3.80 percent, what is the expected risk premium on the portfolio? c. If the expected inflation rate is 3.50 percent, what are the approximate and exact expected real returns on the portfolio? What are the approximate and exact expected real risk premiums on the portfolio? 24. Analyzing a Portfolio (LO2] You want to create a portfolio equally as risky as the market, and you have $1,000,000 to invest. Given this information, fill in the rest of the following table: X Asset Investment $185,000 $320,000 Stock A Stock B Stock C Risk-free asset Beta .85 1.13 1.29 CHALLENGE (Questions 25-28) 25. Analyzing a Portfolio (LO2, 4) You have $100,000 to invest in a portfolio containing Stock X and Stock Y. Your goal is to create a portfolio that has an expected return of 13.6 percent. If Stock X has an expected return of 11.4 percent and a beta of 1.25, and Stock Y has an expected return of 8.68 percent and a beta of .85, how much money will you invest in Stock Y? How do you interpret your answer? What is the beta of your portfolio? 26. Systematic versus Unsystematic Risk [LO3] Consider the following information about Stocks I and II: State of Economy Probability of State of Economy Rate of Return of State Occurs Stock Stock II .02 - 25 Recession 21 09 Normal .70 E G 506 PART 5 Risk and Return Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-free rate? 28. SML [LO4] Suppose you observe the following situation: State of Economy Probability of State .15 Return if State Occurs Stock A Stock B -.08 11 .09 30 27 Bust Normal Boom --10 .60 25 a. Calculate the expected return on each stock. b. Assuming the capital asset pricing model holds and Stock A's beta is greater than Stock B's beta by .35, what is the expected market risk premium? EXCEL MASTER IT! xls The CAPM is one of the most thoroughly researched models in financial econom- ics. When beta is estimated in practice, a variation of CAPM called the market model is often used. To derive the market model, we start with the CAPM: E(R) = R +B[E(R) - R]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts