Question: Answer questions 4, 5 and 6 based upon the following information Company Y's management is evaluating a piece of machinery that costs $1.5 million. This

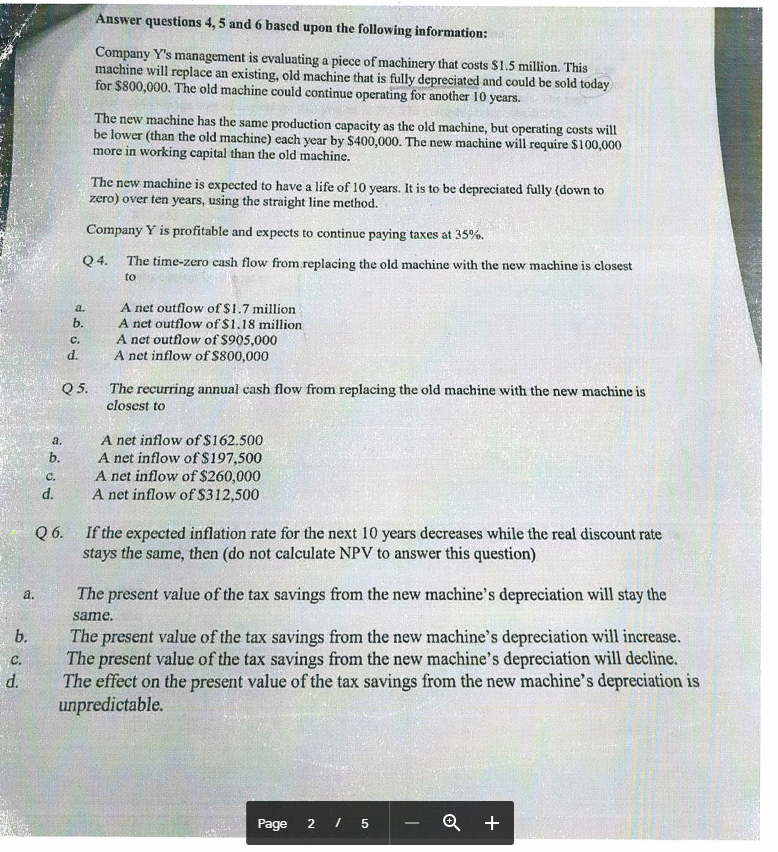

Answer questions 4, 5 and 6 based upon the following information Company Y's management is evaluating a piece of machinery that costs $1.5 million. This machine will replace an existing, old machine that is fully depreciated and could be sold today for $800,000. The old machine could continue operating for another 10 years. The new machine has the same production capacity as the old machine, but operating costs will be lower (than the old machine) each year by S400,000. The new machine will require $100,000 more in working capital than the old machine. The new machine is expected to have a life of 10 years. It is to be depreciated fully (down to zero) over ten years, using the straight line method. Company Y is profitable and expects to continue paying taxes at 35%. Q4. The time-zero cash flow from replacing the old machine with the new machine is closest to a. A net outflow of $1.7 million b. A net outflow of S1.18 million c. d. A net outflow of $905,000 A net inflow of $800,000 The recurring annual cash flow from replacing the old machine with the new machine is closest to Q5. a. b. c. A net inflow of $162.500 A net inflow of $197,500 A net inflow of $260,000 d. A net inflow of $312,500 Q6. If the expected inflation rate for the next 10 years decreases while the real discount rate stays the same, then (do not calculate NPV to answer this question) a. The present value of the tax savings from the new machine's depreciation will stay the same b. The present value of the tax savings from the new machine's depreciation will increase. c. The present value of the tax savings from the new machine's depreciation will decline. d. The effect on the present value of the tax savings from the new machine's depreciation is unpredictable. Page 2 5 a +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts