Question: Answer questions 4-10 using the information below: Fullerton, Inc. makes and sells a single snowboard model, the Titan. In the fall of 2019, Fullerton gathered

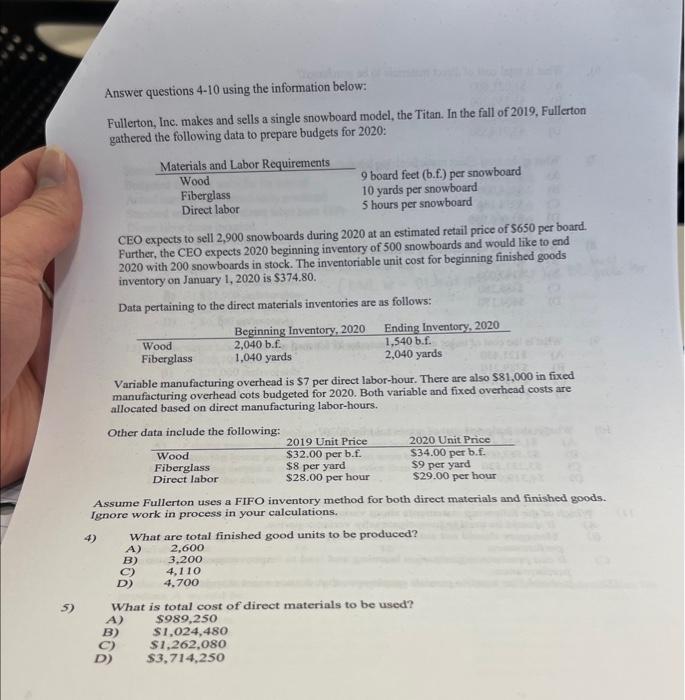

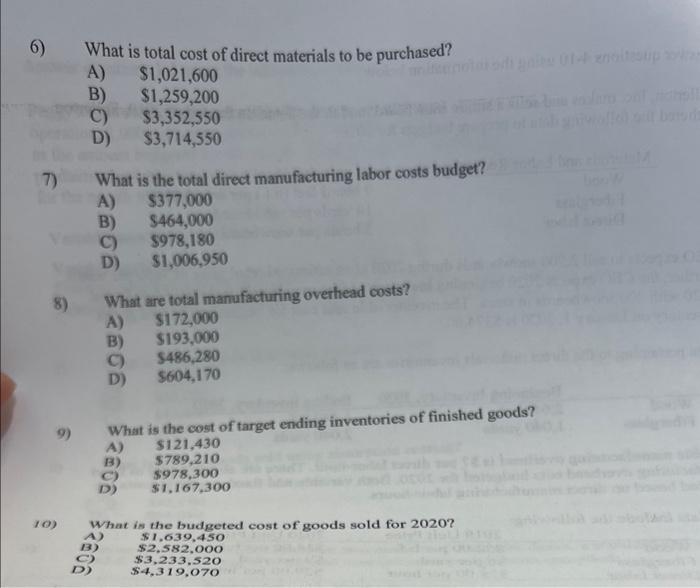

Answer questions 4-10 using the information below: Fullerton, Inc. makes and sells a single snowboard model, the Titan. In the fall of 2019, Fullerton gathered the following data to prepare budgets for 2020: CEO expects to sell 2,900 snowboards during 2020 at an estimated retail price of 5650 per board. Further, the CEO expects 2020 beginning inventory of 500 snowboards and would like to end 2020 with 200 snowboards in stock. The inventoriable unit cost for beginning finished goods inventory on January 1,2020 is $374.80. Data pertaining to the direct materials inventories are as follows: Variable manufacturing overhead is $7 per direct labor-hour. There are also $81,000 in fixed manufacturing overhead cots budgeted for 2020. Both variable and fixed overhead costs are allocated based on direct manufacturing labor-hours. Other datn inelnde the following: Assume Fullerton uses a FIFO inventory method for both direet materials and finished goods. Ignore work in process in your calculations. 4) finished good units to be produced? 5) What is total cost of direct materials to be used? A) $989,250 B) $1,024,480 C) $1,262,080 D) $3,714,250 6) What is total cost of direct materials to be purchased? A) $1,021,600 B) $1,259,200 C) $3,352,550 D) $3,714,550 7) What is the total direct manufacturing labor costs budget? A) 5377,000 B) $464,000 C) 5978,180 D) 51,006,950 8) What are total manufacturing overhead costs? A) 5172,000 B) 5193,000 C) 5486,280 D) 5604,170 9) What is the cost of target ending inventories of finished goods? A)B)C)D)$121,430$789,210$978,300$1,167,300 10) Answer questions 4-10 using the information below: Fullerton, Inc. makes and sells a single snowboard model, the Titan. In the fall of 2019, Fullerton gathered the following data to prepare budgets for 2020: CEO expects to sell 2,900 snowboards during 2020 at an estimated retail price of 5650 per board. Further, the CEO expects 2020 beginning inventory of 500 snowboards and would like to end 2020 with 200 snowboards in stock. The inventoriable unit cost for beginning finished goods inventory on January 1,2020 is $374.80. Data pertaining to the direct materials inventories are as follows: Variable manufacturing overhead is $7 per direct labor-hour. There are also $81,000 in fixed manufacturing overhead cots budgeted for 2020. Both variable and fixed overhead costs are allocated based on direct manufacturing labor-hours. Other datn inelnde the following: Assume Fullerton uses a FIFO inventory method for both direet materials and finished goods. Ignore work in process in your calculations. 4) finished good units to be produced? 5) What is total cost of direct materials to be used? A) $989,250 B) $1,024,480 C) $1,262,080 D) $3,714,250 6) What is total cost of direct materials to be purchased? A) $1,021,600 B) $1,259,200 C) $3,352,550 D) $3,714,550 7) What is the total direct manufacturing labor costs budget? A) 5377,000 B) $464,000 C) 5978,180 D) 51,006,950 8) What are total manufacturing overhead costs? A) 5172,000 B) 5193,000 C) 5486,280 D) 5604,170 9) What is the cost of target ending inventories of finished goods? A)B)C)D)$121,430$789,210$978,300$1,167,300 10)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts