Question: Answer questions 5 and 6, please. Thank you. BTC EOD N4Jl.5:41 PM 0 Offline structure.com projects. 2. Provide one reason for foregoing value- added projects

Answer questions 5 and 6, please. Thank you.

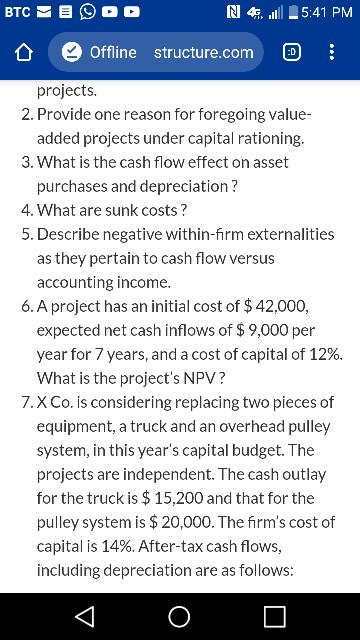

BTC EOD N4Jl.5:41 PM 0 Offline structure.com projects. 2. Provide one reason for foregoing value- added projects under capital rationing. 3. What is the cash flow effect on asset purchases and depreciation ? 4. What are sunk costs? 5. Describe negative within-firm externalities as they pertain to cash flow versus accounting income. 6. A project has an initial cost of $ 42,000, expected net cash inflows of $9,000 per year for 7 years, and a cost of capital of 12%. What is the project's NPV? 7. X Co. is considering replacing two pieces of equipment, a truck and an overhead pulley system, in this year's capital budget. The projects are independent. The cash outlay for the truck is $ 15,200 and that for the pulley system is $ 20,000. The firm's cost of capital is 14%. After-tax cash flows, including depreciation are as follows: V O D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts