Question: ANSWER QUESTIONS 5-7 ONLY!!!! The deliverable for this assignment is written answers to the questions outlined below. Scenario A Consider the following household: - Mary

ANSWER QUESTIONS 5-7 ONLY!!!!

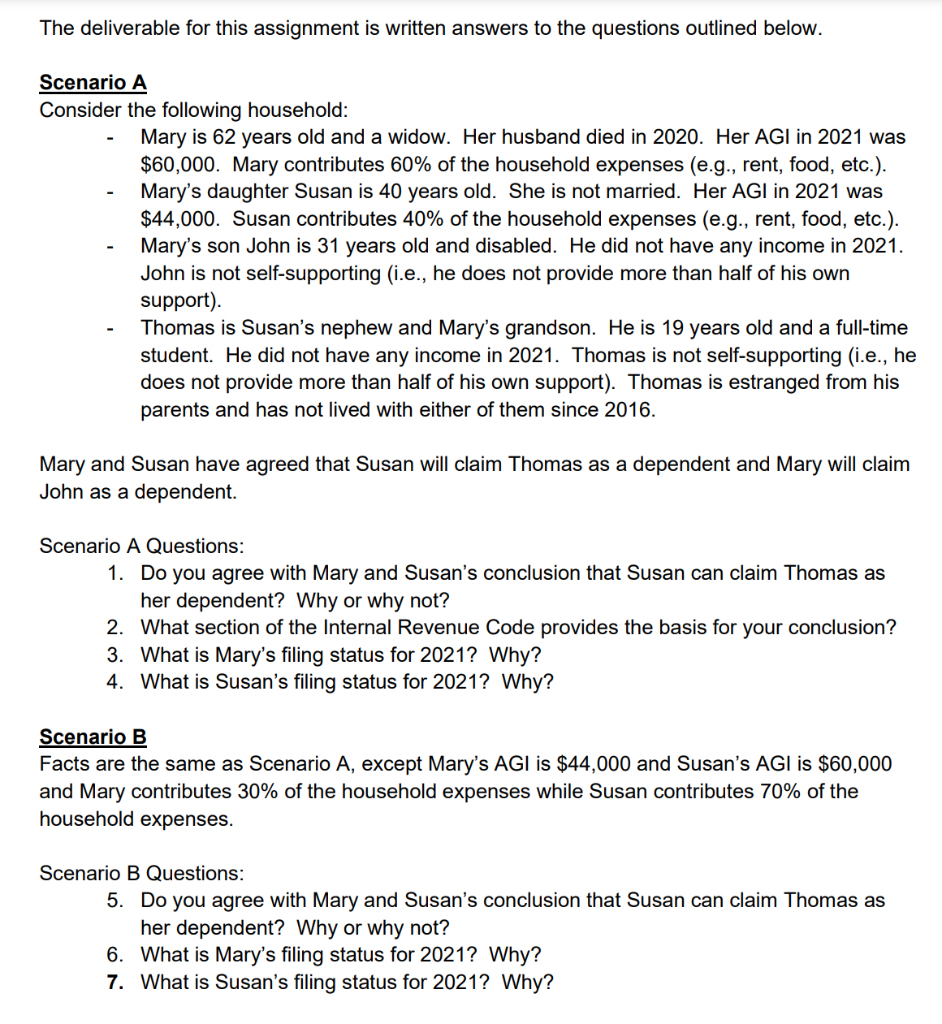

The deliverable for this assignment is written answers to the questions outlined below. Scenario A Consider the following household: - Mary is 62 years old and a widow. Her husband died in 2020. Her AGI in 2021 was $60,000. Mary contributes 60% of the household expenses (e.g., rent, food, etc.). - Mary's daughter Susan is 40 years old. She is not married. Her AGI in 2021 was $44,000. Susan contributes 40% of the household expenses (e.g., rent, food, etc.). - Mary's son John is 31 years old and disabled. He did not have any income in 2021. John is not self-supporting (i.e., he does not provide more than half of his own support). - Thomas is Susan's nephew and Mary's grandson. He is 19 years old and a full-time student. He did not have any income in 2021. Thomas is not self-supporting (i.e., he does not provide more than half of his own support). Thomas is estranged from his parents and has not lived with either of them since 2016. Mary and Susan have agreed that Susan will claim Thomas as a dependent and Mary will claim John as a dependent. Scenario A Questions: 1. Do you agree with Mary and Susan's conclusion that Susan can claim Thomas as her dependent? Why or why not? 2. What section of the Internal Revenue Code provides the basis for your conclusion? 3. What is Mary's filing status for 2021? Why? 4. What is Susan's filing status for 2021? Why? Scenario B Facts are the same as Scenario A, except Mary's AGI is $44,000 and Susan's AGI is $60,000 and Mary contributes 30% of the household expenses while Susan contributes 70% of the household expenses. Scenario B Questions: 5. Do you agree with Mary and Susan's conclusion that Susan can claim Thomas as her dependent? Why or why not? 6. What is Mary's filing status for 2021? Why? 7. What is Susan's filing status for 2021? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts