Question: Answer questions 8 and 9 based upon the following information: You have decided to use June futures to hedge the risk of a sale of

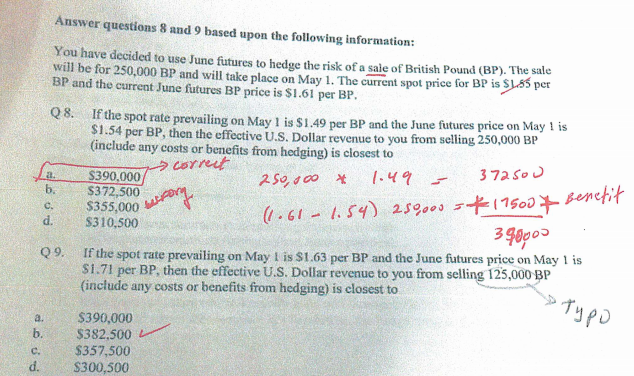

Answer questions 8 and 9 based upon the following information: You have decided to use June futures to hedge the risk of a sale of British Pound (BP). The sale will be for 250,000 BP and will take place on May 1. The current spot price for BPis S5 per BP and the current June futures BP price is $1.61 per BP Q8. If the spot rate prevailing on May 1 is S1.49 per BP and the June futures price on May 1 is $1.54 per BP, then the effective U.S. Dollar revenue to you from selling 250,000 BP (include any costs or benefits from hedging) is closest to orre S390,000 a. b. $372,500 $355,000 d. S310,500 If the spot rate prevailing on May l is $1.63 per BP and the June futures price on May 1 is Q9. 1.71 per BP, then the effective U.S. Dollar revenue to you from selling 125,000 BP (include any costs or benefits from hedging) is closest to ! a. S390,000 b. S382,500 c. $357,500 d. S300,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts