Question: Answer questions 8 and 9 based upon the following information: Company X plans to issue $20 million in bonds, three months from now. The bonds

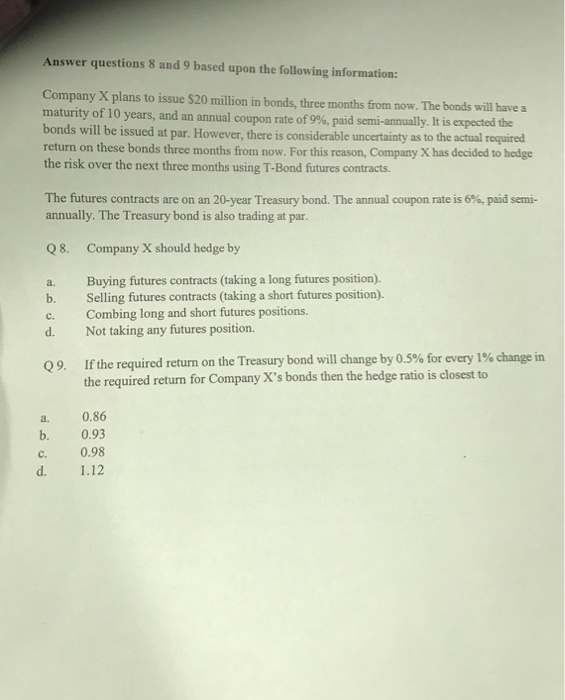

Answer questions 8 and 9 based upon the following information: Company X plans to issue $20 million in bonds, three months from now. The bonds will have a maturity of 10 years, and an annual coupon rate of 9%, paid semi-annually. It is expected the bonds will be issued at par. However, there is considerable uncertainty as to return on these bonds three months from now. For this reason, Company X has decided to hedge the risk over the next three months using T-Bond futures contracts. the actual required The futures contracts are on an 20-year Treasury bond. The annual coupon rate is 6%, paid semi- annually. The Treasury bond is also trading at par. Company X should hedge by Q 8. a. Buying futures contracts (taking a long futures position). b. Selling futures contracts (taking a short futures position). c. Combing long and short futures positions d. Not taking any futures position. If the required return on the Treasury bond will change by 0.5% for every 1% change in the required return for Company X's bonds then the hedge ratio is closest to Q 9. a. 0.86 b. 0.93 c. 0.98 d. 1.12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts