Question: Answer questions Answer questions 1-4 from the following financial data as of 12/31/20 and for the year then ended or as shown on ACME Corporation,

Answer questions

Answer questions

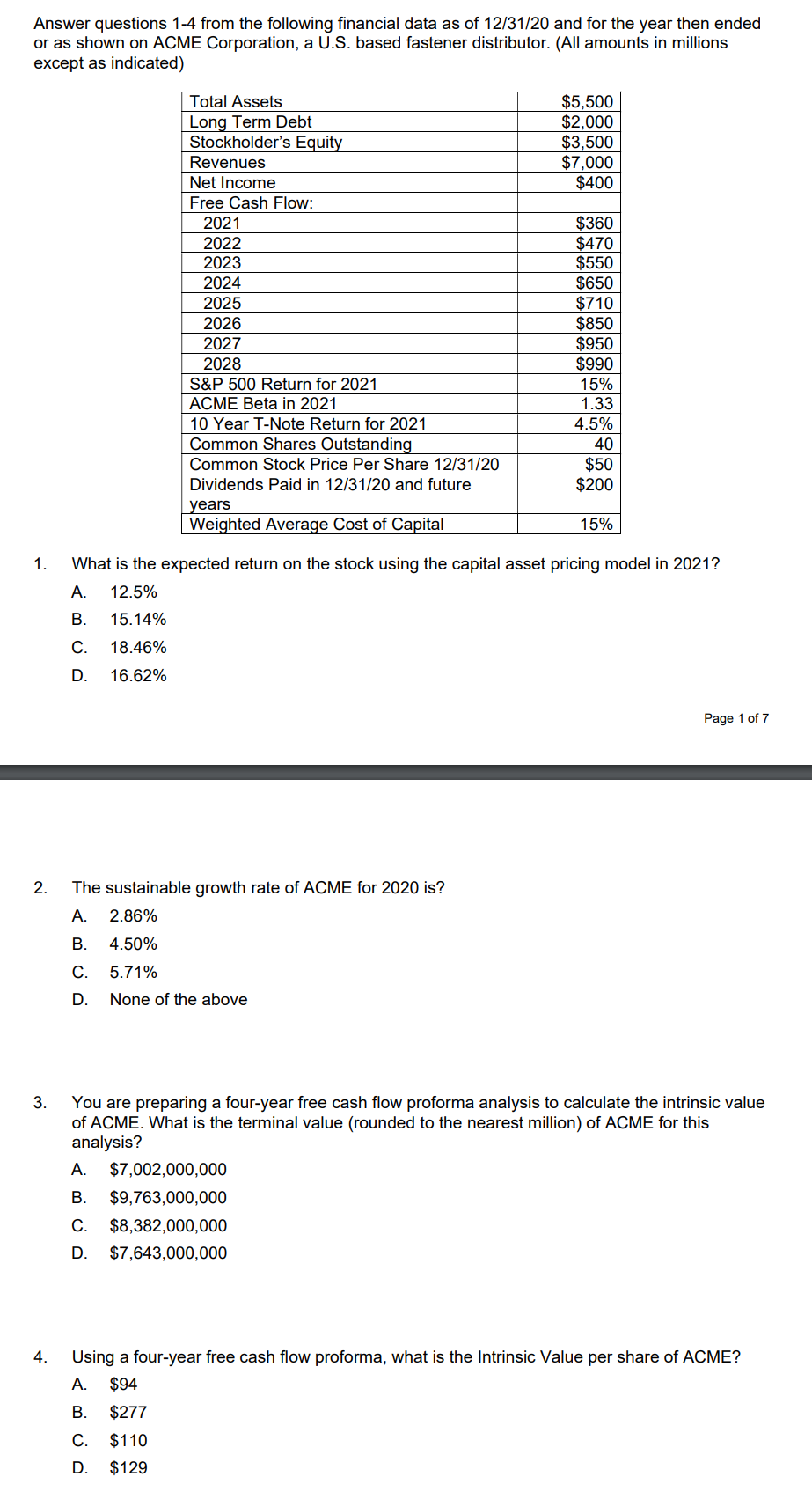

Answer questions 1-4 from the following financial data as of 12/31/20 and for the year then ended or as shown on ACME Corporation, a U.S. based fastener distributor. (All amounts in millions except as indicated) 1. What is the expected return on the stock using the capital asset pricing model in 2021 ? A. 12.5% B. 15.14% C. 18.46% D. 16.62% Page 1 of 7 2. The sustainable growth rate of ACME for 2020 is? A. 2.86% B. 4.50% C. 5.71% D. None of the above 3. You are preparing a four-year free cash flow proforma analysis to calculate the intrinsic value of ACME. What is the terminal value (rounded to the nearest million) of ACME for this analysis? A. $7,002,000,000 B. $9,763,000,000 C. $8,382,000,000 D. $7,643,000,000 4. Using a four-year free cash flow proforma, what is the Intrinsic Value per share of ACME? A. $94 B. $277 C. $110 D. $129

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts