Question: Answer questions BE8.7 and BE 8.9 BE8.7 (LO 2) (Record write-off and compare carrying amount.) At the end of 2023, Searcy Corp. has accounts receivable

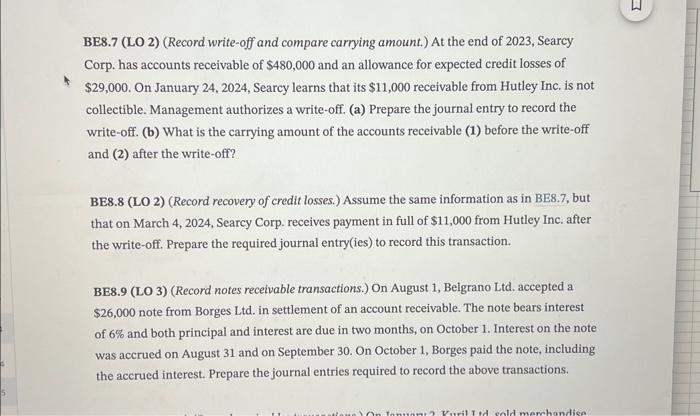

BE8.7 (LO 2) (Record write-off and compare carrying amount.) At the end of 2023, Searcy Corp. has accounts receivable of $480,000 and an allowance for expected credit losses of $29,000. On January 24,2024 , Searcy learns that its $11,000 receivable from Hutley Inc. is not collectible. Management authorizes a write-off. (a) Prepare the journal entry to record the write-off. (b) What is the carrying amount of the accounts receivable (1) before the write-off and (2) after the write-off? BE8.8 (LO 2) (Record recovery of credit losses.) Assume the same information as in BE8.7, but that on March 4, 2024, Searcy Corp. receives payment in full of $11,000 from Hutley Inc. after the write-off. Prepare the required journal entry(ies) to record this transaction. BE8.9 (LO 3) (Record notes receivable transactions.) On August 1, Beigrano Ltd. accepted a $26,000 note from Borges Ltd. in settlement of an account receivable. The note bears interest of 6% and both principal and interest are due in two months, on October 1 . Interest on the note was accrued on August 31 and on September 30. On October 1, Borges paid the note, including the accrued interest. Prepare the journal entries required to record the above transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts