Question: Answer questions below. Thanks :) Anle Corporation has a current stock price of $20.00 and is expected to pay a dividend of 1.00 in one

Answer questions below. Thanks :)

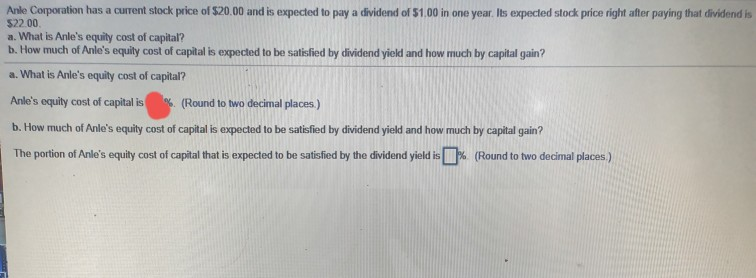

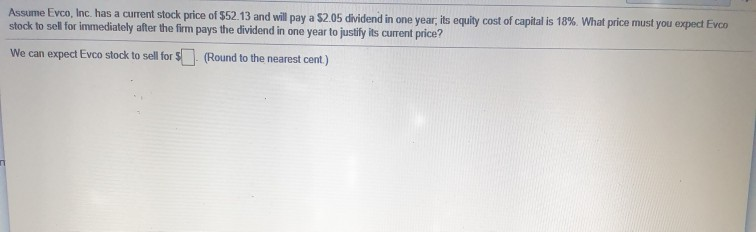

Anle Corporation has a current stock price of $20.00 and is expected to pay a dividend of 1.00 in one year. Its expected stock price right after paying that dividend is $22.00 a. What is Anle's equity cost of capital? b. How much of Anle's equity cost of capital is expected to be satisfied by dividend yield and how much by capital gain? a. What is Anle's equity cost of capital? Anle's equity cost of capital is %. (Round to two decimal places.) b. How much of Anle's equity cost of capital is expected to be satisfied by dividend yield and how much by capital gain? The portion of Anle's equity cost of capital that is expected to be satisfied by the dividend yield is % (Round to two decimal places.) Assume Evco, Inc. has a current stock price of $52.13 and will pay a $2.05 dividend in one year, its equity cost of capital is 18%. What price must you exped Evco stock to sell for immediately after the firm pays the dividend in one year to justify its current price? We can expect Evco stock to sell for $ (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts