Question: answer questions using BMW SEC REPORT 10-K (ANUAL REPORT). ABOUT BMW, through years 2018-2020 III. Analyzing Long-Lived Assets On individual basis, each team member should

answer questions using BMW SEC REPORT 10-K (ANUAL REPORT). ABOUT BMW, through years 2018-2020

answer questions using BMW SEC REPORT 10-K (ANUAL REPORT). ABOUT BMW, through years 2018-2020

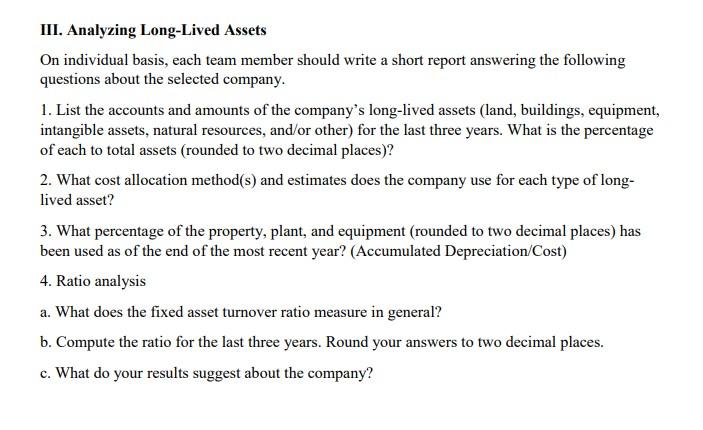

III. Analyzing Long-Lived Assets On individual basis, each team member should write a short report answering the following questions about the selected company. 1. List the accounts and amounts of the company's long-lived assets (land, buildings, equipment, intangible assets, natural resources, and/or other) for the last three years. What is the percentage of each to total assets (rounded to two decimal places)? 2. What cost allocation method(s) and estimates does the company use for each type of long- lived asset? 3. What percentage of the property, plant, and equipment (rounded to two decimal places) has been used as of the end of the most recent year? (Accumulated Depreciation/Cost) 4. Ratio analysis a. What does the fixed asset turnover ratio measure in general? b. Compute the ratio for the last three years. Round your answers to two decimal places. c. What do your results suggest about the company? III. Analyzing Long-Lived Assets On individual basis, each team member should write a short report answering the following questions about the selected company. 1. List the accounts and amounts of the company's long-lived assets (land, buildings, equipment, intangible assets, natural resources, and/or other) for the last three years. What is the percentage of each to total assets (rounded to two decimal places)? 2. What cost allocation method(s) and estimates does the company use for each type of long- lived asset? 3. What percentage of the property, plant, and equipment (rounded to two decimal places) has been used as of the end of the most recent year? (Accumulated Depreciation/Cost) 4. Ratio analysis a. What does the fixed asset turnover ratio measure in general? b. Compute the ratio for the last three years. Round your answers to two decimal places. c. What do your results suggest about the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts