Question: answer quick please a. Buy put, buy call, short equity index, invest at the risk-free rate b. Buy call, write put, buy equity index, borrow

answer quick please

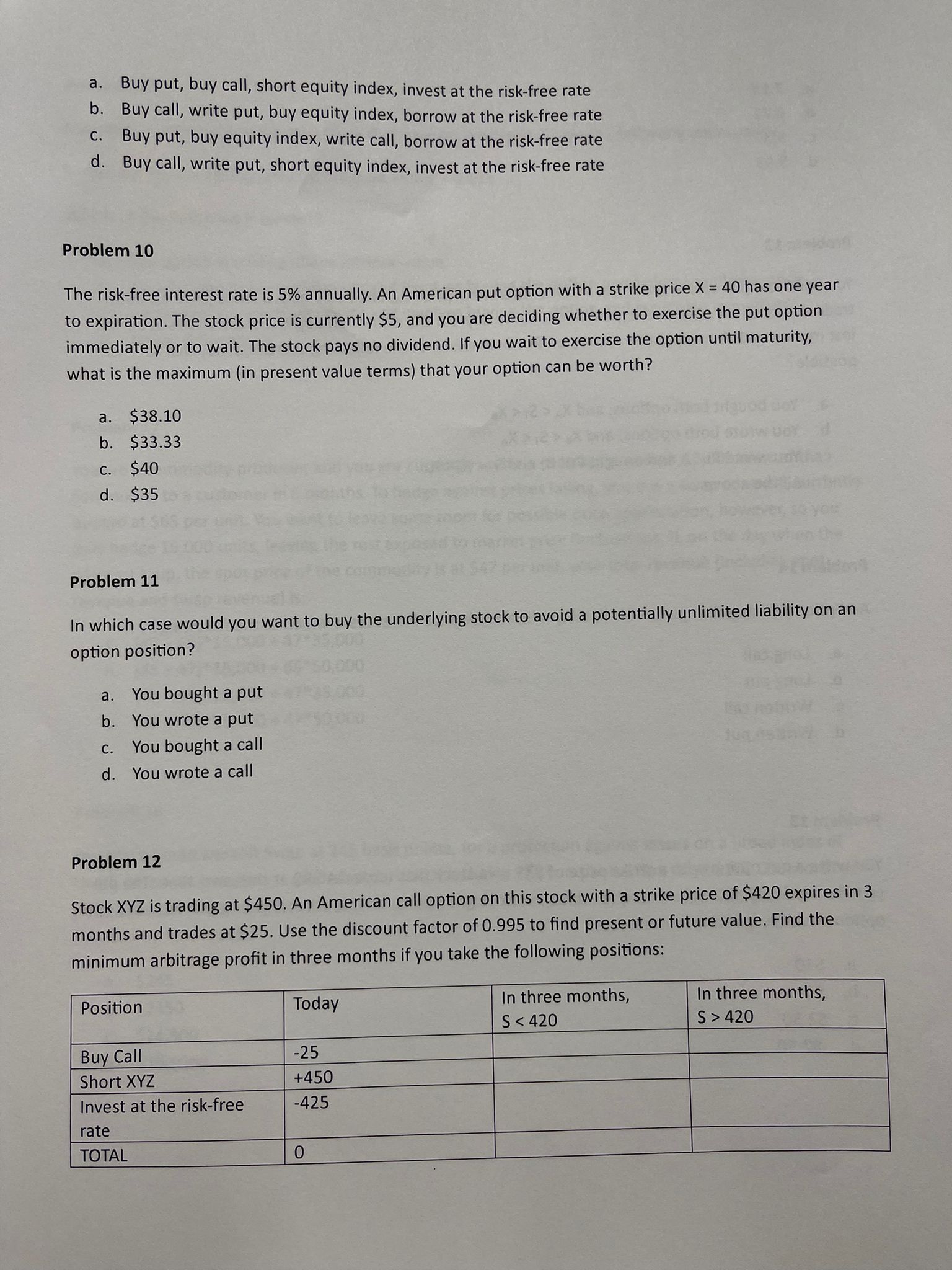

a. Buy put, buy call, short equity index, invest at the risk-free rate b. Buy call, write put, buy equity index, borrow at the risk-free rate c. Buy put, buy equity index, write call, borrow at the risk-free rate d. Buy call, write put, short equity index, invest at the risk-free rate Problem 10 The risk-free interest rate is 5% annually. An American put option with a strike price X=40 has one year to expiration. The stock price is currently $5, and you are deciding whether to exercise the put option immediately or to wait. The stock pays no dividend. If you wait to exercise the option until maturity, what is the maximum (in present value terms) that your option can be worth? a. $38.10 b. $33.33 c. $40 d. $35 Problem 11 In which case would you want to buy the underlying stock to avoid a potentially unlimited liability on an option position? a. You bought a put b. You wrote a put c. You bought a call d. You wrote a call Problem 12 Stock XYZ is trading at $450. An American call option on this stock with a strike price of $420 expires in 3 months and trades at $25. Use the discount factor of 0.995 to find present or future value. Find the minimum arbitrage profit in three months if you take the following positions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts