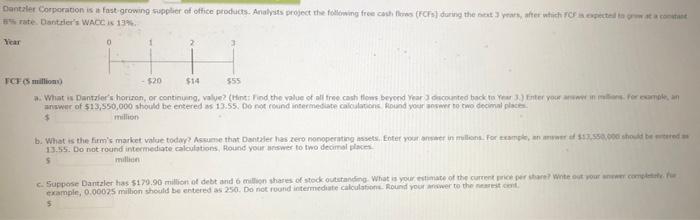

Question: Answer quickly and correctly for automatic thumbs up! Thanks! Dantzler Corporation is a fast growing supplier of office products. Analysts project the following free cathos

Dantzler Corporation is a fast growing supplier of office products. Analysts project the following free cathos (FCFS) durvis the next years, the which catat rate. Dante's WACC I 134 Year 0 1 2 3 $14 TCF million $20 555 What is Dantzer's honzon, or continuing, valye? (Hint Find the value of all tree cash flows beyond Year discounted back to Year 3) Enter your www.Forecaman answer of 513,550,000 should be entered as 13:55. Do not found intermediate calculations found your swer to two decimal places b. What is the firm's market value today? Assume that Dantzler has zero nonoperating sets, Enter your ante in milions. For exam, an mwere 33550.000 shot bed 13.55. Do not round Intermediate calculations, Round your answer to two decimalla 5 million Suppose Dantzler has $179.90 million of debt and 6 million shares of stock outstanding. What is your state of the current proper stare te your comme example, 0.00075 million should be entered as 250. Do not found intermediate calculation Round your answer to the Computech Corporation is expanding rapidly and currently needs to retain all of its earnings, hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $1.75 coming 3 years from today. The dividend should grow capidly-at a rate of 30% per year-during Years 4 and 5, but after Year 5, growth should be a constant 5% per year. If the required return on Computech is 13%, what is the value of the stock today? Do not round intermediate calculations. Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts