Question: Answer quickly and correctly for thumbs up! eBook An electric utility is considering a new power plant in northern Arizona Power from the plant would

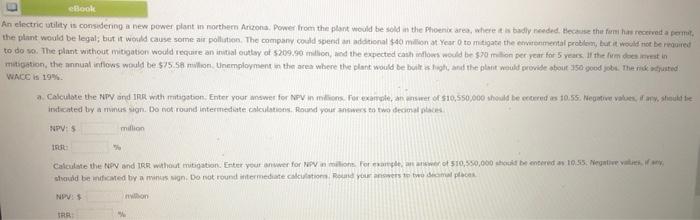

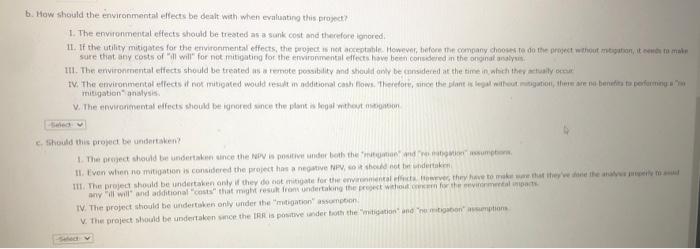

eBook An electric utility is considering a new power plant in northern Arizona Power from the plant would be sold in the Phoenix area, where it is badly needed techise the form has received a permit the plant would be legal, but it would cause some air pollution. The company could spend an additional 40 million Year to mitigate the environmental problem, but it would not be red to do so. The plant without mitigation would require an initial cutlay of 209.90 million, the expected cash flows would be $ 70 million per year for 5 years. If the fim de meest in mitigation, the annual inflows would be 575 58 min. Unemployment in the area where the plant would be built as high and the plant would provide about 150 good job. The mik usted WACC IS 19% a Calculate the NPV and Int with mutigation. Enter your answer for NPV in milion. For example, an answer of $10,550,000 should be carred is 10.55. Weative values for should be indicated by a munus sagr. Do not round intermediate calculation Round your answers to two decimal places NPV:S million t, Calculate the NPV and IRR without mitigation. Enter your aner for NPV million for anot 510,550,000 she entered a 10.55. New should be wted by a mis ugn. Do not found intermediate calculation your answers to top NPVA non TRR b. How should the environmental effects be dealt with when evaluating this project 1. The environmental effects should be treated as a sunk cost and therefore lonored 11. If the utility mitigates for the environmental effects, the project is not accepte. However, before the company choose to do the rest wthout mon tema sure that any costs of "I will" for not mitigating for the environmental efects have been considered in the onginanalys III. The environmental effects should be treated as a remote possibility and should only be considered at the time in which they actually IV. The environmental effects it not mitigated would result additional cash flows. Therefore, since the plant te willegation, the bentitat performing mitigation analysis V. The environmental effects should be ignored since the plant is fool without me Should this project be undertaken 1. The project should be undertaken uince the NPV is positivt under both the super 11. Even when no mitigation is considered the project has a negative NPV should not undertaken II. The project should be undertaken only if they do not mitigate for the cover they have to make the nyl will and additional costs that might result from undertaking the pet with the metal IV. The project should be undertaken only under the consumption V. The project should be undertaken ince the Risposte under the theation and consumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts