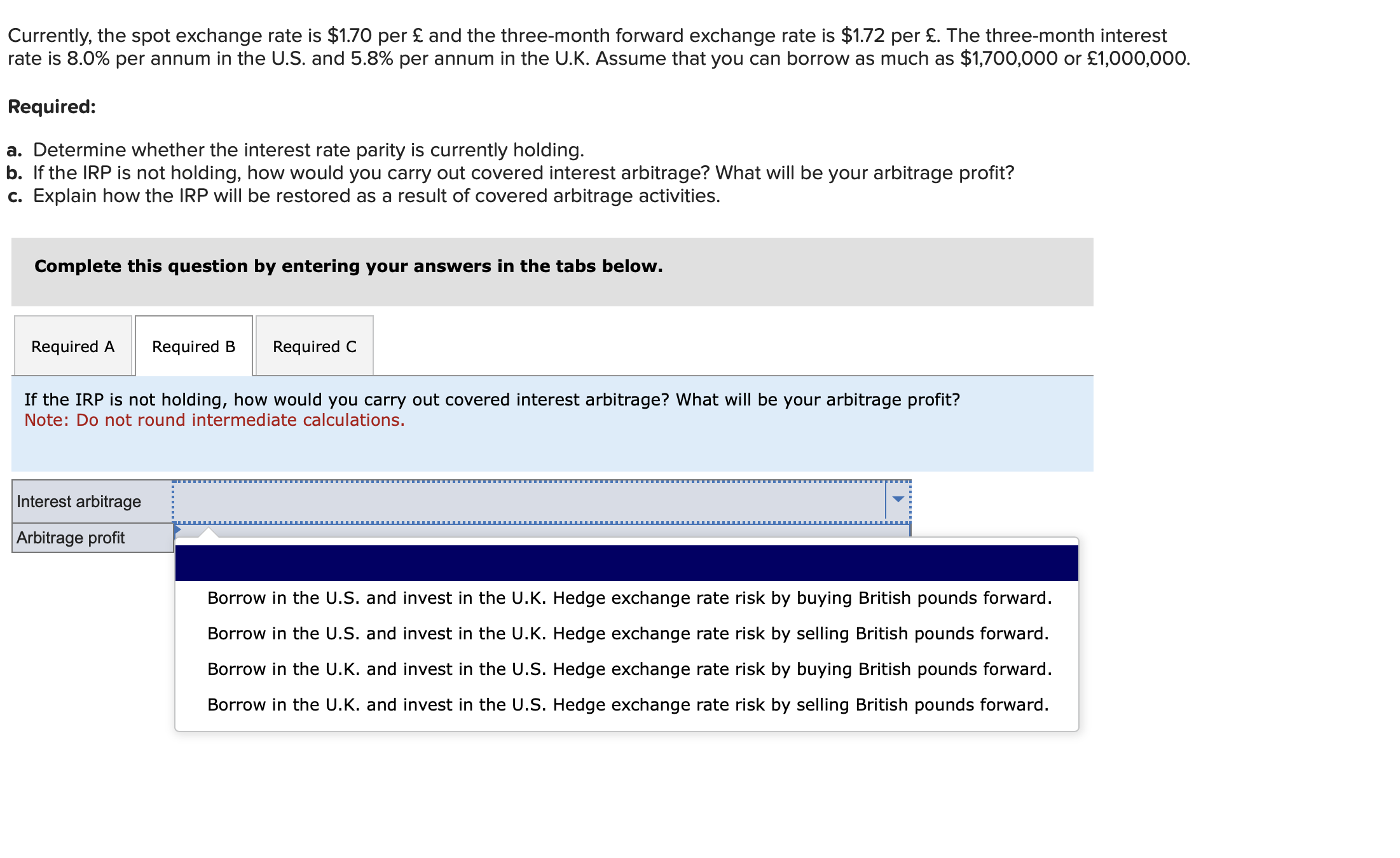

Question: Answer Required B , Covered Arbitrage and Arbitrage Profit. Currently, the spot exchange rate is ( $ 1 . 7 0 )

Answer Required B Covered Arbitrage and Arbitrage Profit. Currently, the spot exchange rate is $ per and the threemonth forward exchange rate is $ per The threemonth interest rate is per annum in the US and per annum in the UK Assume that you can borrow as much as $ or Required: a Determine whether the interest rate parity is currently holding. b If the IRP is not holding, how would you carry out covered interest arbitrage? What will be your arbitrage profit? c Explain how the IRP will be restored as a result of covered arbitrage activities. Complete this question by entering your answers in the tabs below. If the IRP is not holding, how would you carry out covered interest arbitrage? What will be your arbitrage profit? Note: Do not round intermediate calculations. Arbitrage protit Borrow in the US and invest in the UK Hedge exchange rate risk by buying British pounds forward. Borrow in the US and invest in the UK Hedge exchange rate risk by selling British pounds forward. Borrow in the UK and invest in the US Hedge exchange rate risk by buying British pounds forward. Borrow in the UK and invest in the US Hedge exchange rate risk by selling British pounds forward.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock