Question: Answer required for QUESTION 2 ONLY. A company is planning to undertake an investment project. The following data have been calculated for two alternatives, A

Answer required for QUESTION 2 ONLY.

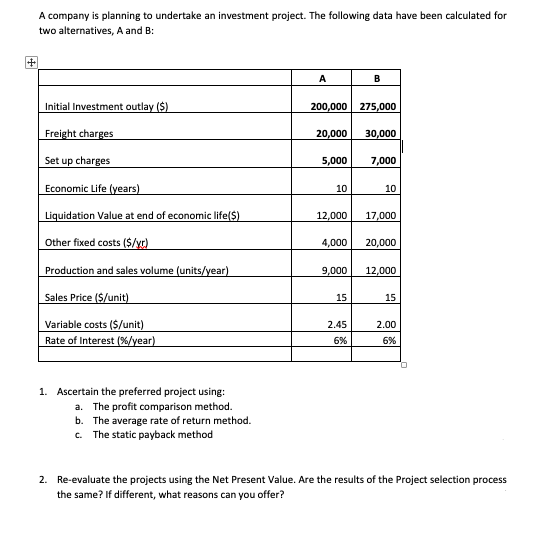

A company is planning to undertake an investment project. The following data have been calculated for two alternatives, A and B: + A B Initial Investment outlay ($) 200,000 275,000 20,000 30,000 Freight charges Set up charges 5,000 7,000 10 10 12,000 17,000 4,000 20,000 Economic Life (years) Liquidation Value at end of economic life($) Other fixed costs ($/40) Production and sales volume (units/year) Sales Price ($/unit) Variable costs ($/unit) Rate of Interest (%/year) 9,000 12,000 15 15 2.45 6% 2.00 6% 1. Ascertain the preferred project using: a. The profit comparison method. b. The average rate of return method. c. The static payback method 2. Re-evaluate the projects using the Net Present Value. Are the results of the Project selection process the same? If different, what reasons can you offer? A company is planning to undertake an investment project. The following data have been calculated for two alternatives, A and B: + A B Initial Investment outlay ($) 200,000 275,000 20,000 30,000 Freight charges Set up charges 5,000 7,000 10 10 12,000 17,000 4,000 20,000 Economic Life (years) Liquidation Value at end of economic life($) Other fixed costs ($/40) Production and sales volume (units/year) Sales Price ($/unit) Variable costs ($/unit) Rate of Interest (%/year) 9,000 12,000 15 15 2.45 6% 2.00 6% 1. Ascertain the preferred project using: a. The profit comparison method. b. The average rate of return method. c. The static payback method 2. Re-evaluate the projects using the Net Present Value. Are the results of the Project selection process the same? If different, what reasons can you offer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts