Question: answer right i previously asked this and was given the wrong answer below are the tables not sure which one is correct Citrus Company is

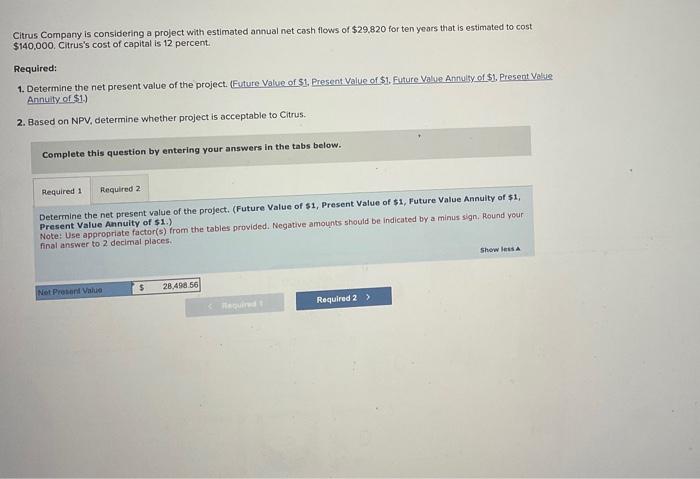

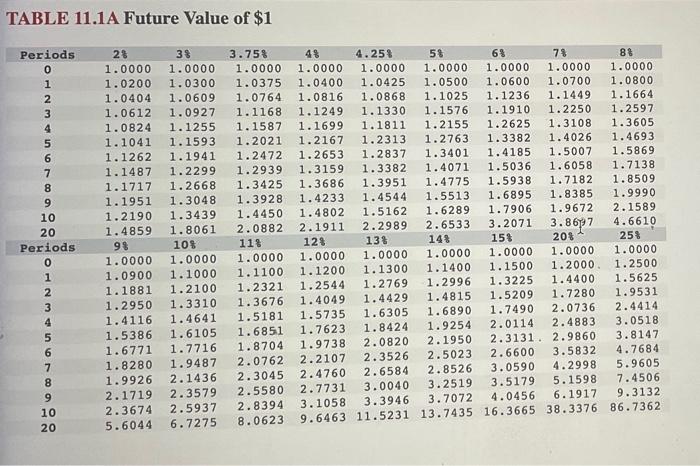

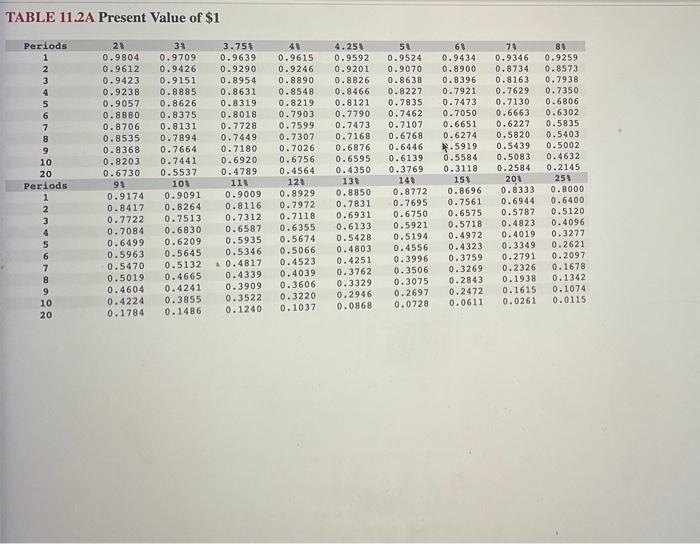

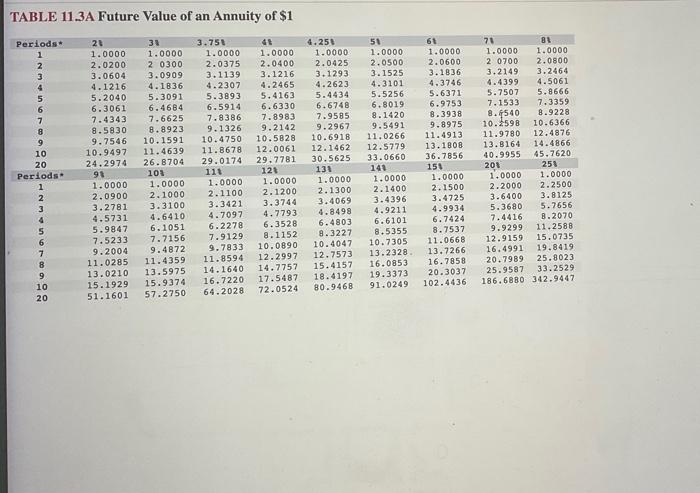

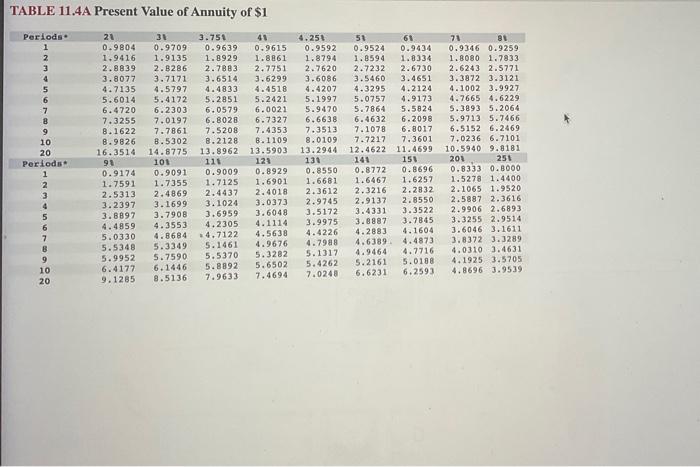

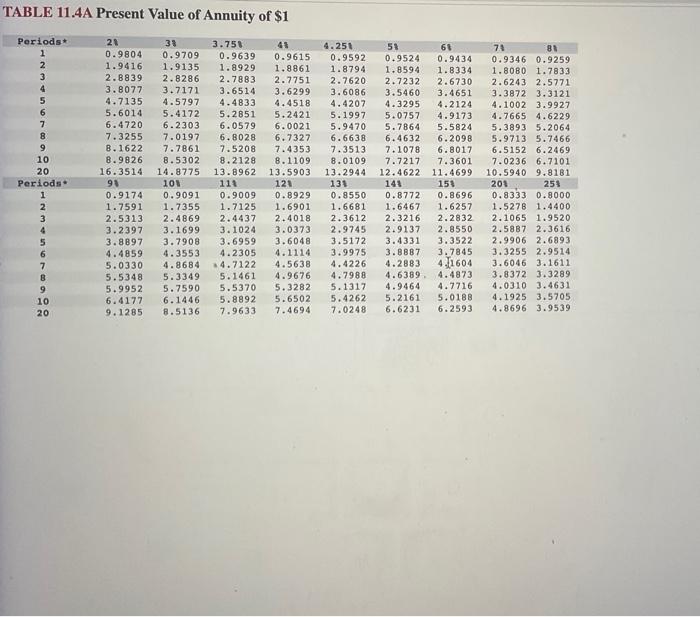

Citrus Company is considering a project with estimated annual net cash flows of $29.820 for ten years that is estimated to cost $140,000, Citrus's cost of capital is 12 percent. Required: 1. Determine the net present value of the project. (Future Value of S1, Present Value of \$1, Future Value Annuly ef \$1, Present Vessie Annuity of $1.) 2. Based on NPV, determine whether project is acceptable to Citrus. Complete this question by entering your answers in the tabs below. Determine the net present value of the project. (Future Value of $1, Present Value of $1, Future Value Annuity of $1; Present Value Annuity of $1.) Present Value Annuity of \$1.) Note: Use appropriate factor(s) from the tables provided. Negative amounts should be indicated by a minus sign. Hound your final answer to 2 decimal places. TABLE 11.1A Future Value of $1 TABLE 11.2A Present Value of $1 TABLE 11.3A Future Value of an Annuity of \$1 TABLE 11.4A Present Value of Annuity of $1 TABLE 11.4A Present Value of Annuity of $1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts