Question: Answer ( s ) : ( Your response ( s ) are shown below, followed by the correct answer ( s ) . ) Sharon

Answers: Your responses are shown below, followed by the correct answers

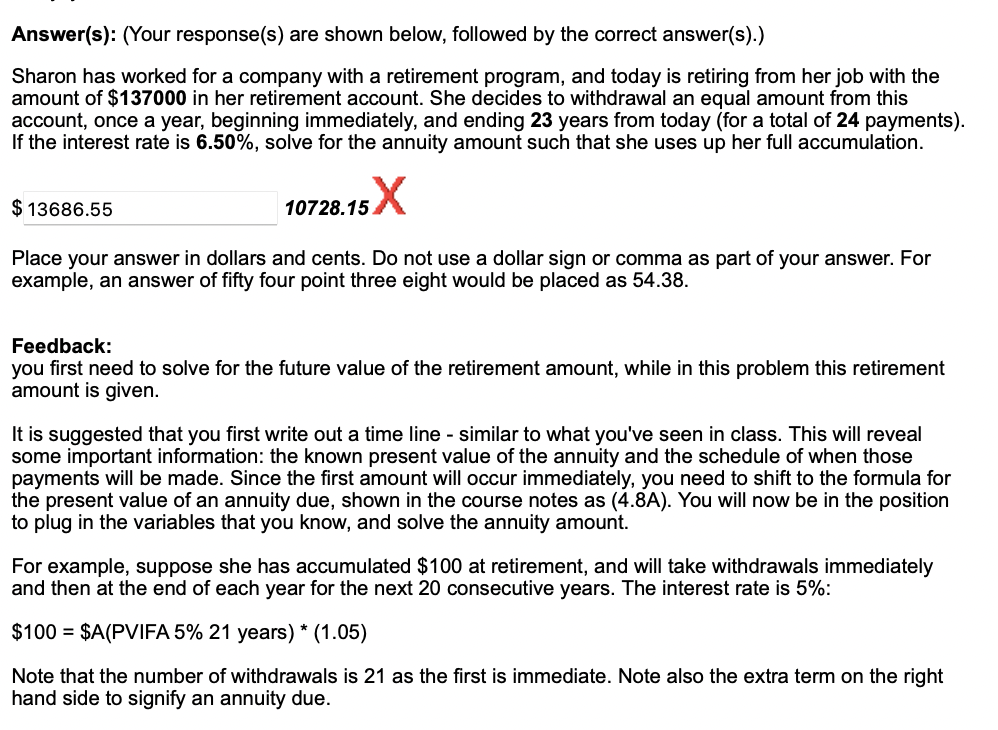

Sharon has worked for a company with a retirement program, and today is retiring from her job with the

amount of $ in her retirement account. She decides to withdrawal an equal amount from this

account, once a year, beginning immediately, and ending years from today for a total of payments

If the interest rate is solve for the annuity amount such that she uses up her full accumulation.

Place your answer in dollars and cents. Do not use a dollar sign or comma as part of your answer. For

example, an answer of fifty four point three eight would be placed as

Feedback:

you first need to solve for the future value of the retirement amount, while in this problem this retirement

amount is given.

It is suggested that you first write out a time line similar to what you've seen in class. This will reveal

some important information: the known present value of the annuity and the schedule of when those

payments will be made. Since the first amount will occur immediately, you need to shift to the formula for

the present value of an annuity due, shown in the course notes as A You will now be in the position

to plug in the variables that you know, and solve the annuity amount.

For example, suppose she has accumulated $ at retirement, and will take withdrawals immediately

and then at the end of each year for the next consecutive years. The interest rate is :

$$ years

Note that the number of withdrawals is as the first is immediate. Note also the extra term on the right

hand side to signify an annuity due.

Please show the process

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock