Question: Answer second part only please! Ice Cream Sandwich Co. expects EBIT of $200,000 next year, and expects earnings to grow at a rate of 3%

Answer second part only please!

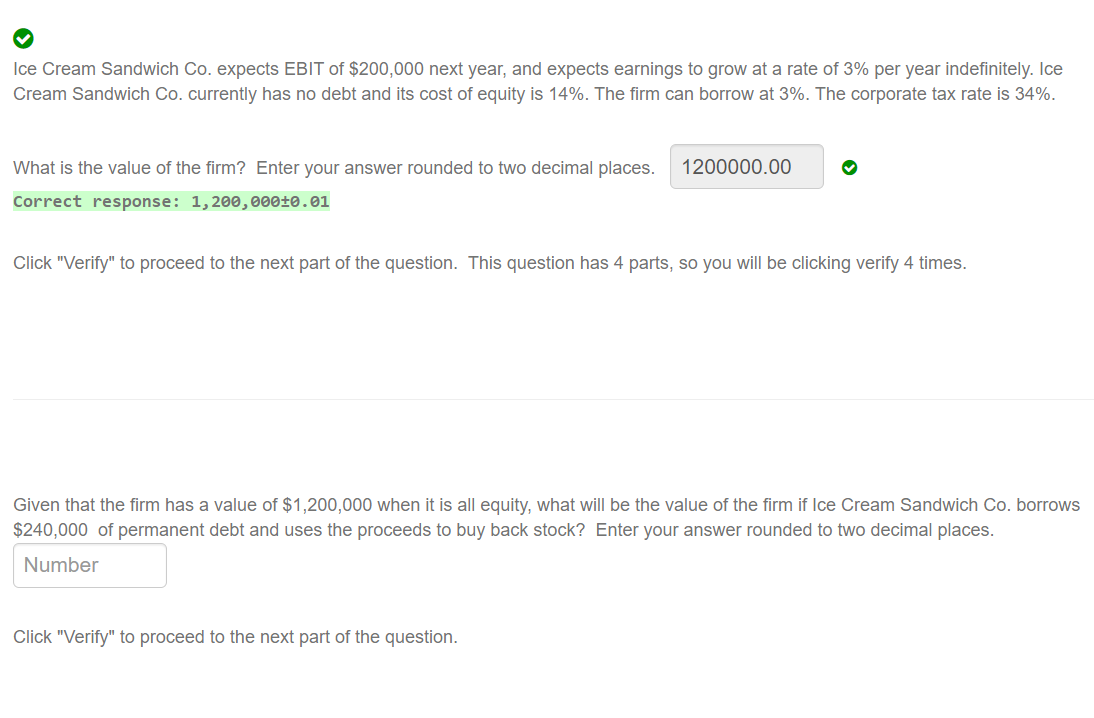

Ice Cream Sandwich Co. expects EBIT of $200,000 next year, and expects earnings to grow at a rate of 3% per year indefinitely. Ice Cream Sandwich Co. currently has no debt and its cost of equity is 14%. The firm can borrow at 3%. The corporate tax rate is 34%. 1200000.00 What is the value of the firm? Enter your answer rounded to two decimal places. Correct response: 1,200,000+0.01 Click "Verify" to proceed to the next part of the question. This question has 4 parts, so you will be clicking verify 4 times. Given that the firm has a value of $1,200,000 when it is all equity, what will be the value of the firm if Ice Cream Sandwich Co. borrows $240,000 of permanent debt and uses the proceeds to buy back stock? Enter your answer rounded to two decimal places. Number Click "Verify" to proceed to the next part of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts