Question: answer second part. The common stock and debt of Android Corp. are valued at $67 milion and $22 milion, respectively. Investors curtently require a 11%

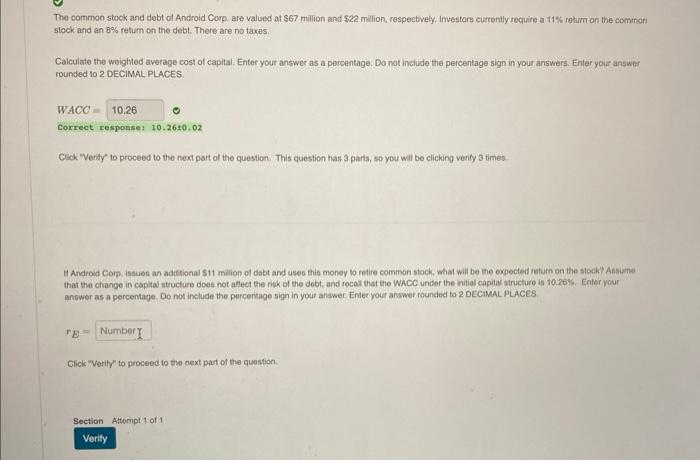

The common stock and debt of Android Corp. are valued at $67 milion and $22 milion, respectively. Investors curtently require a 11% return on the common slock and an 8% retum on the debt. There are no taxes. Calculate the weighted average cost of capital. Enter your answer as a percentage. Do not include the percentage sign in your answers. Enter your answer rounded to 2 DECIMAL PLACES. WACC= Correct response: 10.2640 .02 Csick "Venty" to proceed to the nexi part of the question. This question hat 3 parts, so you wil be clicking verity 3 times HA Android Comp. issues an adstional 511 million of dabt and uses this money to retire common stock, what will be the expected retum on the stock? Aasume that the change in capial structure does not alect the ritk of the dobt, and recal that the WhCC under the initial capital tiructure is 10.26\%. Entor your anower as a percentage. Do not include the porcentage sign in your answer. Enerec your answer rounded to 2 DECIMAL PLACES r= Click "Verily" to proceed to the nexi part of the question. Section Afternpt 1 of 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts