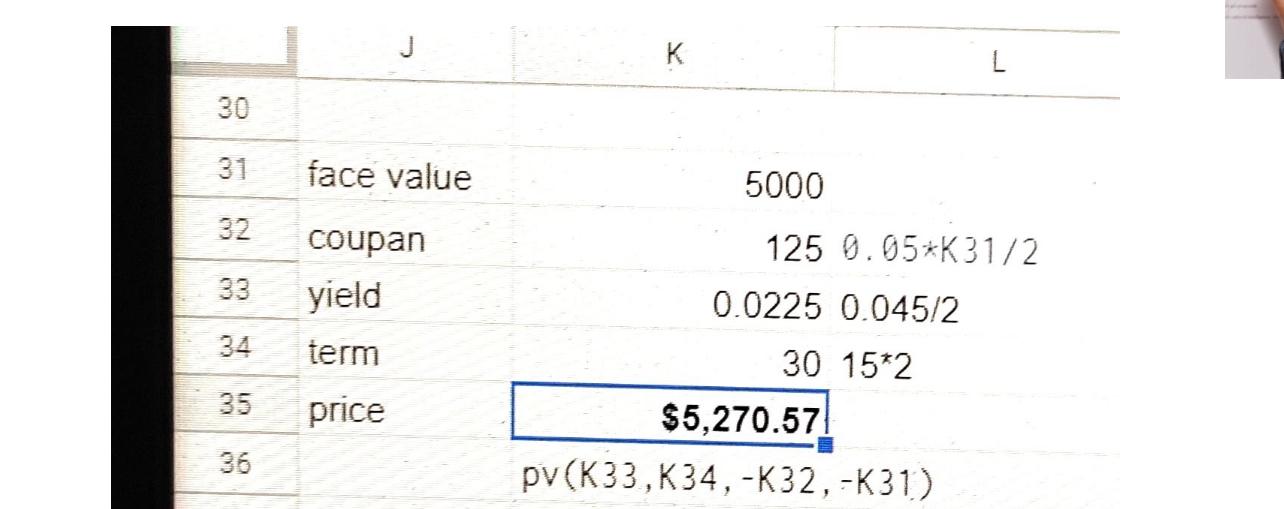

Question: ANSWER SECOND QUESTION ON EXCEL PLEASE. K L 30 31 face value 5000 32 33 coupan yield term 34 125 0.05*K31/2 0.0225 0.045/2 30 15*2

ANSWER SECOND QUESTION ON EXCEL PLEASE.

ANSWER SECOND QUESTION ON EXCEL PLEASE.

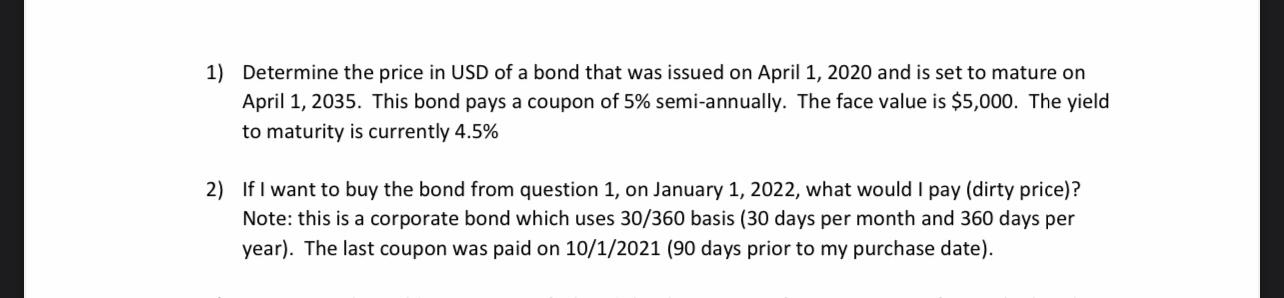

K L 30 31 face value 5000 32 33 coupan yield term 34 125 0.05*K31/2 0.0225 0.045/2 30 15*2 $5,270.57 pv(K33,K34,-K32,-K31) 35 price 36 6 1) Determine the price in USD of a bond that was issued on April 1, 2020 and is set to mature on April 1, 2035. This bond pays a coupon of 5% semi-annually. The face value is $5,000. The yield to maturity is currently 4.5% 2) If I want to buy the bond from question 1, on January 1, 2022, what would I pay (dirty price)? Note: this is a corporate bond which uses 30/360 basis (30 days per month and 360 days per year). The last coupon was paid on 10/1/2021 (90 days prior to my purchase date)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts