Question: Answer Self-study problem 5.6, showing how you derived your answer. Then, suppose Franks doctor recommended that they install a high-efficiency air conditioner with a very

Answer Self-study problem 5.6, showing how you derived your answer. Then, suppose Franks doctor recommended that they install a high-efficiency air conditioner with a very powerful air filtration system to help with Franks chronic lung condition. The air condition and filtration system will cost $12,500 and will increase the appraisal value of their house by $7,250. How much of the improvements, if any, can they deduct as medical expenses? How did you come to that conclusion?

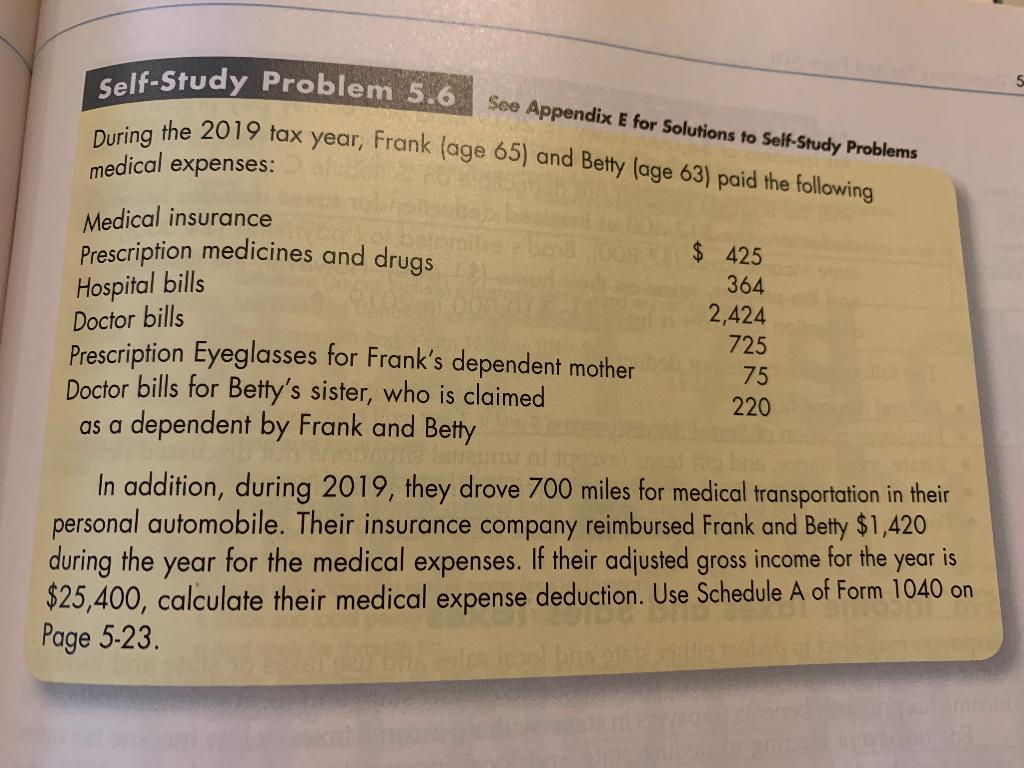

5 See Appendix E for Solutions to Self-Study Problems Self-Study Problem 5.6 During the 2019 tax year, Frank (age 65) and Betty (age 63) paid the following medical expenses: Hospital bills Doctor bills Medical insurance Prescription medicines and drugs $ 425 364 2,424 725 Prescription Eyeglasses for Frank's dependent mother 75 Doctor bills for Betty's sister, who is claimed 220 as a dependent by Frank and Betty In addition, during 2019, they drove 700 miles for medical transportation in their personal automobile. Their insurance company reimbursed Frank and Betty $1,420 during the year for the medical expenses. If their adjusted gross income for the $25,400, calculate their medical expense deduction. Use Schedule A of Form 1040 on Page 5-23. year is 5 See Appendix E for Solutions to Self-Study Problems Self-Study Problem 5.6 During the 2019 tax year, Frank (age 65) and Betty (age 63) paid the following medical expenses: Hospital bills Doctor bills Medical insurance Prescription medicines and drugs $ 425 364 2,424 725 Prescription Eyeglasses for Frank's dependent mother 75 Doctor bills for Betty's sister, who is claimed 220 as a dependent by Frank and Betty In addition, during 2019, they drove 700 miles for medical transportation in their personal automobile. Their insurance company reimbursed Frank and Betty $1,420 during the year for the medical expenses. If their adjusted gross income for the $25,400, calculate their medical expense deduction. Use Schedule A of Form 1040 on Page 5-23. year is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts