Question: answer showing all calculation and formulas Question 4 Megaladon Ltd has identified two alternative capital structures: Structure 1: Equity of 80% of the value of

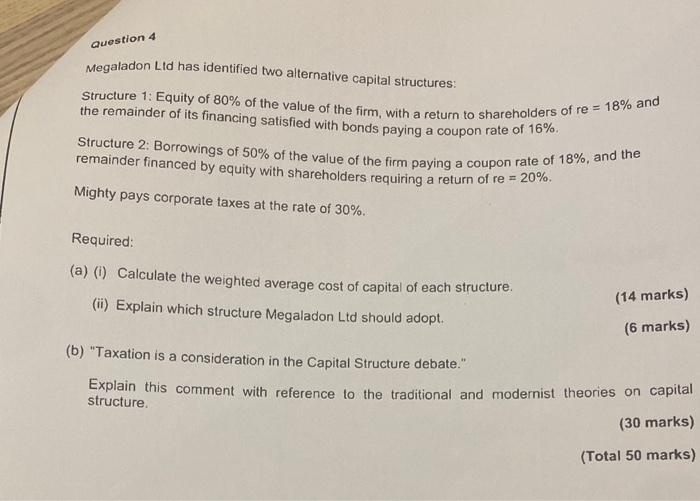

Question 4 Megaladon Ltd has identified two alternative capital structures: Structure 1: Equity of 80% of the value of the firm, with a return to shareholders of re = 18% and 16%. remainder financed by equity with shareholders requiring a return of re = 20%. Structure 2: Borrowings of 50% of the value of the firm paying a coupon rate of 18%, and the Mighty pays corporate taxes at the rate of 30%. Required: (a) (0) Calculate the weighted average cost of capital of each structure. (ii) Explain which structure Megaladon Ltd should adopt. (14 marks) (6 marks) (b) "Taxation is a consideration in the Capital Structure debate." Explain this comment with reference to the traditional and modernist theories on capital structure (30 marks) (Total 50 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts