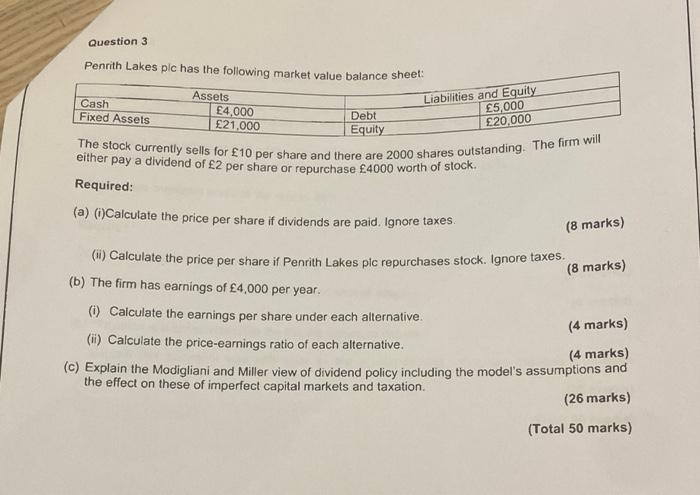

Question: answer showing all calculations with formula Question 3 Penrith Lakes plc has the following market value balance sheet: Assets Cash 4,000 Debt Fixed Assets 21,000

Question 3 Penrith Lakes plc has the following market value balance sheet: Assets Cash 4,000 Debt Fixed Assets 21,000 Equity The stock currently sells for 10 per share and there are 2000 shares outstanding. The firm will Liabilities and Equity 5,000 20,000 either pay a dividend of 2 per share or repurchase 4000 worth of stock. Required: (a) (1)Calculate the price per share if dividends are paid. Ignore taxes. (8 marks) (8 marks) (1) Calculate the price per share if Penrith Lakes pic repurchases stock. Ignore taxes. (b) The firm has earnings of 4,000 per year. () Calculate the earnings per share under each alternative (4 marks) (ii) Calculate the price-earnings ratio of each alternative. (4 marks) (c) Explain the Modigliani and Miller view of dividend policy including the model's assumptions and the effect on these of imperfect capital markets and taxation. (26 marks) (Total 50 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts