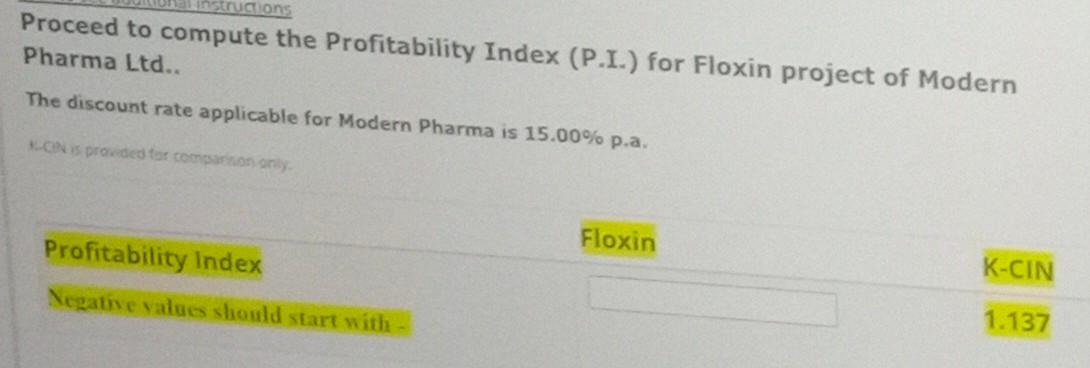

Question: Answer? structions Proceed to compute the Profitability Index (P.I.) for Floxin project of Modern Pharma Ltd. The discount rate applicable for Modern Pharma is 15.00%

Answer?

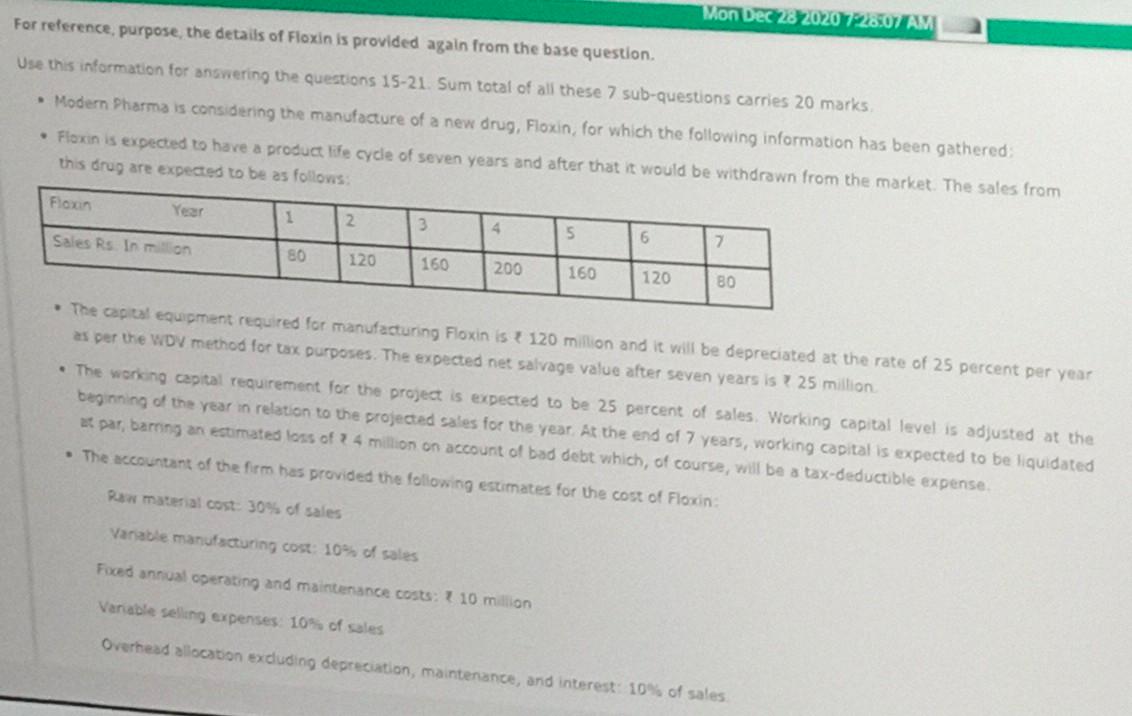

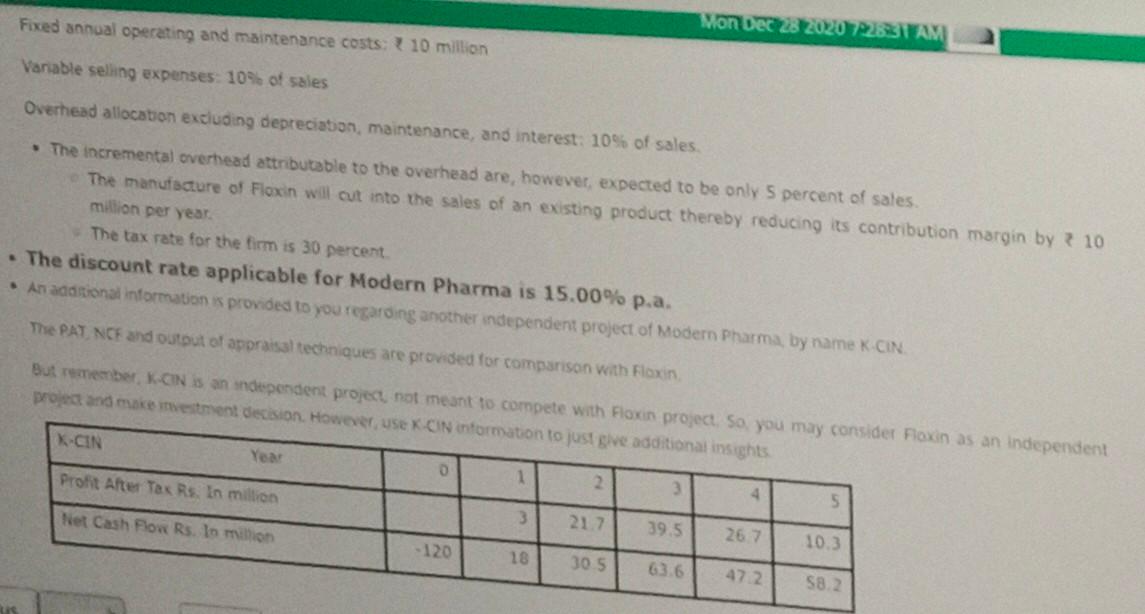

structions Proceed to compute the Profitability Index (P.I.) for Floxin project of Modern Pharma Ltd. The discount rate applicable for Modern Pharma is 15.00% p.a. LONs provided for common only Floxin Profitability Index Negative values should start with K-CIN 1.137 Mon Dec 28 2020 72007 AM For reference, purpose the details of Floxin is provided again from the base question. Use this information for answering the questions 15-21. Sum total of all these 7 sub-questions carries 20 marks Modern Pharma is considering the manufacture of a new drug, Floxin, for which the following information has been gathered Floxin is expected to have a product life cycle of seven years and after that it would be withdrawn from the market. The sales from this drug are expected to be as follows: Florin Year 1 2 3 4 Sales Rs. In mon 5 6 7 80 120 160 200 160 120 80 The capital equipment required for manufacturing Floxin is t 120 million and it will be depreciated at the rate of 25 percent per year as per the WDV method for tax purposes. The expected net salvage value after seven years is ? 25 million The working capital requirement for the project is expected to be 25 percent of sales. Working capital level is adjusted at the beginning of the year in relation to the projected sales for the year. At the end of 7 years, working capital is expected to be liquidated par, barning an estimated loss of 24 million on account of bad debt which, of course, will be a tax-deductible expense The accountant of the firm has provided the following estimates for the cost of Floxin Raw material cost: 30% of sales Variable manufacturing cost: 10% of sales Forced annual operating and maintenance costs: ? 10 million Variable selling expenses 10% of sales Overhead allocation excluding depreciation, maintenance, and interest: 10% of sales Fixed annual operating and maintenance costs: 10 million Mon Dec 28 2020 2283 AM Variable selling expenses: 10% of sales Overhead allocation excluding depreciation, maintenance, and interest: 10% of sales The incremental overhead attributable to the overhead are, however, expected to be only 5 percent of sales. The manufacture of Floxin will cut into the sales of an existing product thereby reducing its contribution margin by? 10 million per year The tax rate for the firm is 30 percent The discount rate applicable for Modern Pharma is 15.00% p.a. An additional information is provided to you regarding another independent project of Modern Pharma by name K-CIN. The PAT NCF and output of appraisal techniques are provided for comparison with Floxin But remember, KCN is an independent project, not meant to compete with Floxin project. So you may consider Floxin as an independent project and make mestment decision. However, use KCN information to just give additional insights IK-CIN Year Profit After Tax Rs. In million 1 2 3 4 S Net Cash Flow Rs. In million 21.7 39.5 26.7 10.3 - 120 18 30.5 63.6 47.2 58.2 structions Proceed to compute the Profitability Index (P.I.) for Floxin project of Modern Pharma Ltd. The discount rate applicable for Modern Pharma is 15.00% p.a. LONs provided for common only Floxin Profitability Index Negative values should start with K-CIN 1.137 Mon Dec 28 2020 72007 AM For reference, purpose the details of Floxin is provided again from the base question. Use this information for answering the questions 15-21. Sum total of all these 7 sub-questions carries 20 marks Modern Pharma is considering the manufacture of a new drug, Floxin, for which the following information has been gathered Floxin is expected to have a product life cycle of seven years and after that it would be withdrawn from the market. The sales from this drug are expected to be as follows: Florin Year 1 2 3 4 Sales Rs. In mon 5 6 7 80 120 160 200 160 120 80 The capital equipment required for manufacturing Floxin is t 120 million and it will be depreciated at the rate of 25 percent per year as per the WDV method for tax purposes. The expected net salvage value after seven years is ? 25 million The working capital requirement for the project is expected to be 25 percent of sales. Working capital level is adjusted at the beginning of the year in relation to the projected sales for the year. At the end of 7 years, working capital is expected to be liquidated par, barning an estimated loss of 24 million on account of bad debt which, of course, will be a tax-deductible expense The accountant of the firm has provided the following estimates for the cost of Floxin Raw material cost: 30% of sales Variable manufacturing cost: 10% of sales Forced annual operating and maintenance costs: ? 10 million Variable selling expenses 10% of sales Overhead allocation excluding depreciation, maintenance, and interest: 10% of sales Fixed annual operating and maintenance costs: 10 million Mon Dec 28 2020 2283 AM Variable selling expenses: 10% of sales Overhead allocation excluding depreciation, maintenance, and interest: 10% of sales The incremental overhead attributable to the overhead are, however, expected to be only 5 percent of sales. The manufacture of Floxin will cut into the sales of an existing product thereby reducing its contribution margin by? 10 million per year The tax rate for the firm is 30 percent The discount rate applicable for Modern Pharma is 15.00% p.a. An additional information is provided to you regarding another independent project of Modern Pharma by name K-CIN. The PAT NCF and output of appraisal techniques are provided for comparison with Floxin But remember, KCN is an independent project, not meant to compete with Floxin project. So you may consider Floxin as an independent project and make mestment decision. However, use KCN information to just give additional insights IK-CIN Year Profit After Tax Rs. In million 1 2 3 4 S Net Cash Flow Rs. In million 21.7 39.5 26.7 10.3 - 120 18 30.5 63.6 47.2 58.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts