Question: Answer?? Sun Tech Ltd. wishes to evaluate two alternative projects for increasing its production capacity to meet the rapidly growing demand for its product. After

Answer??

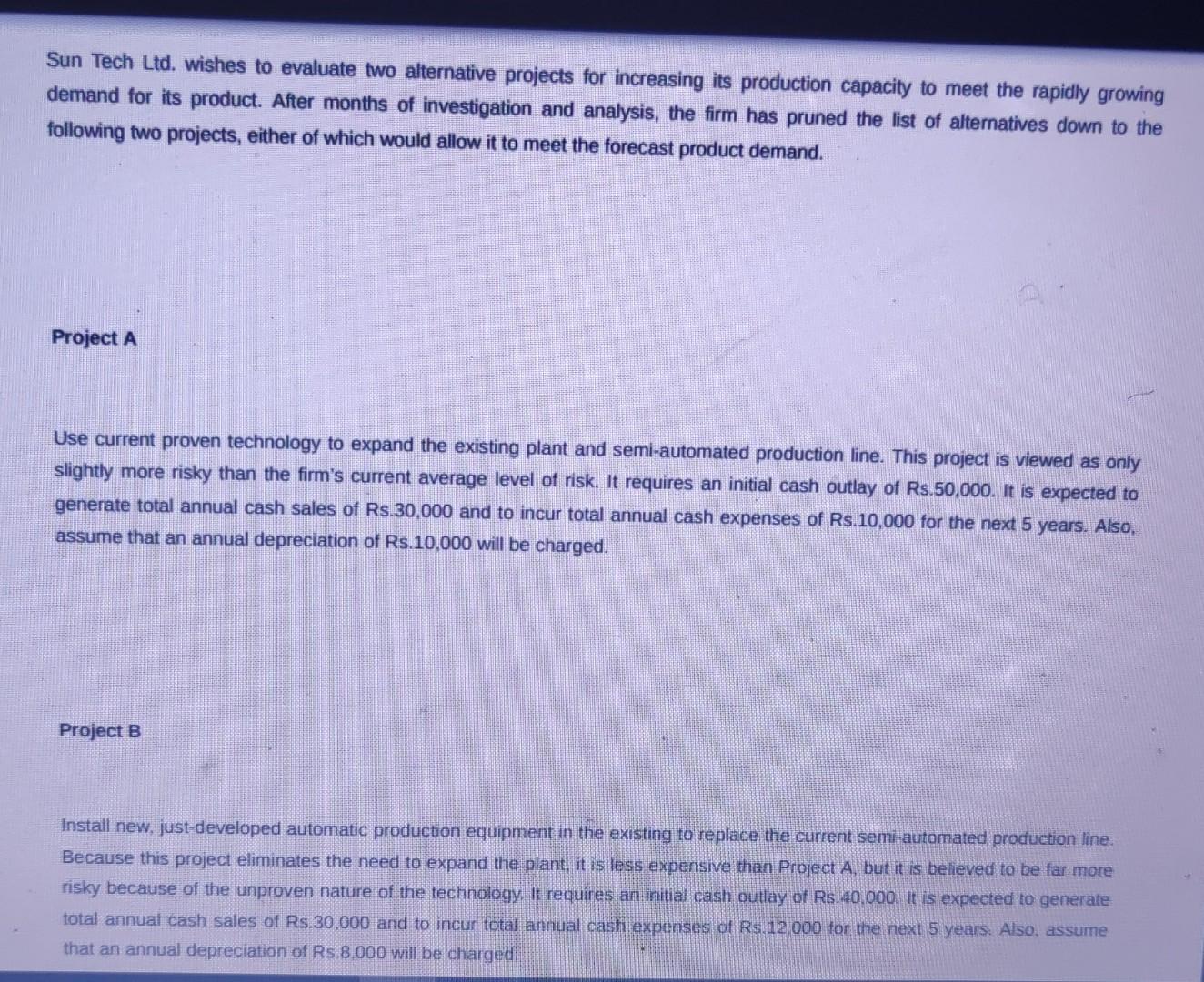

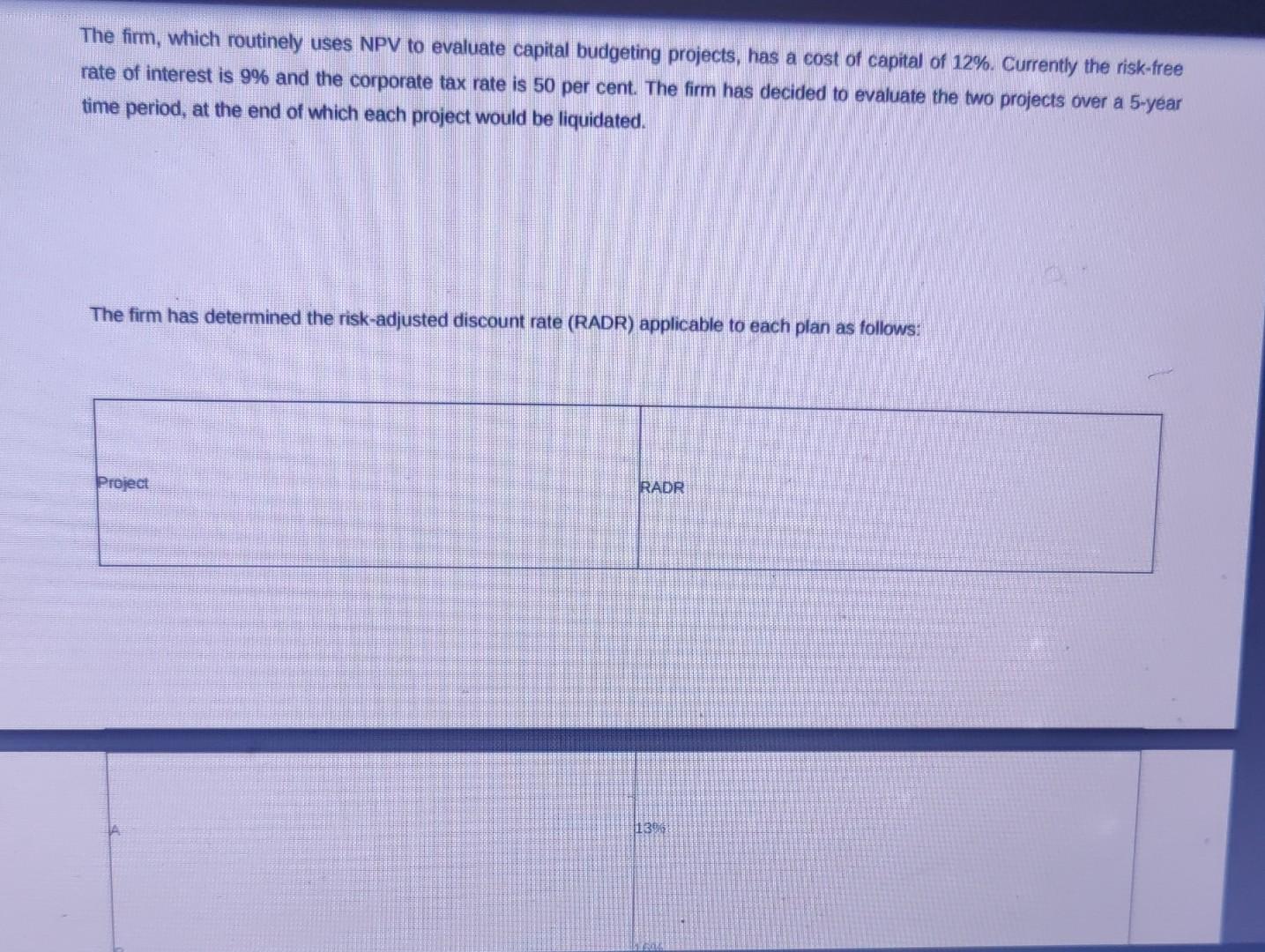

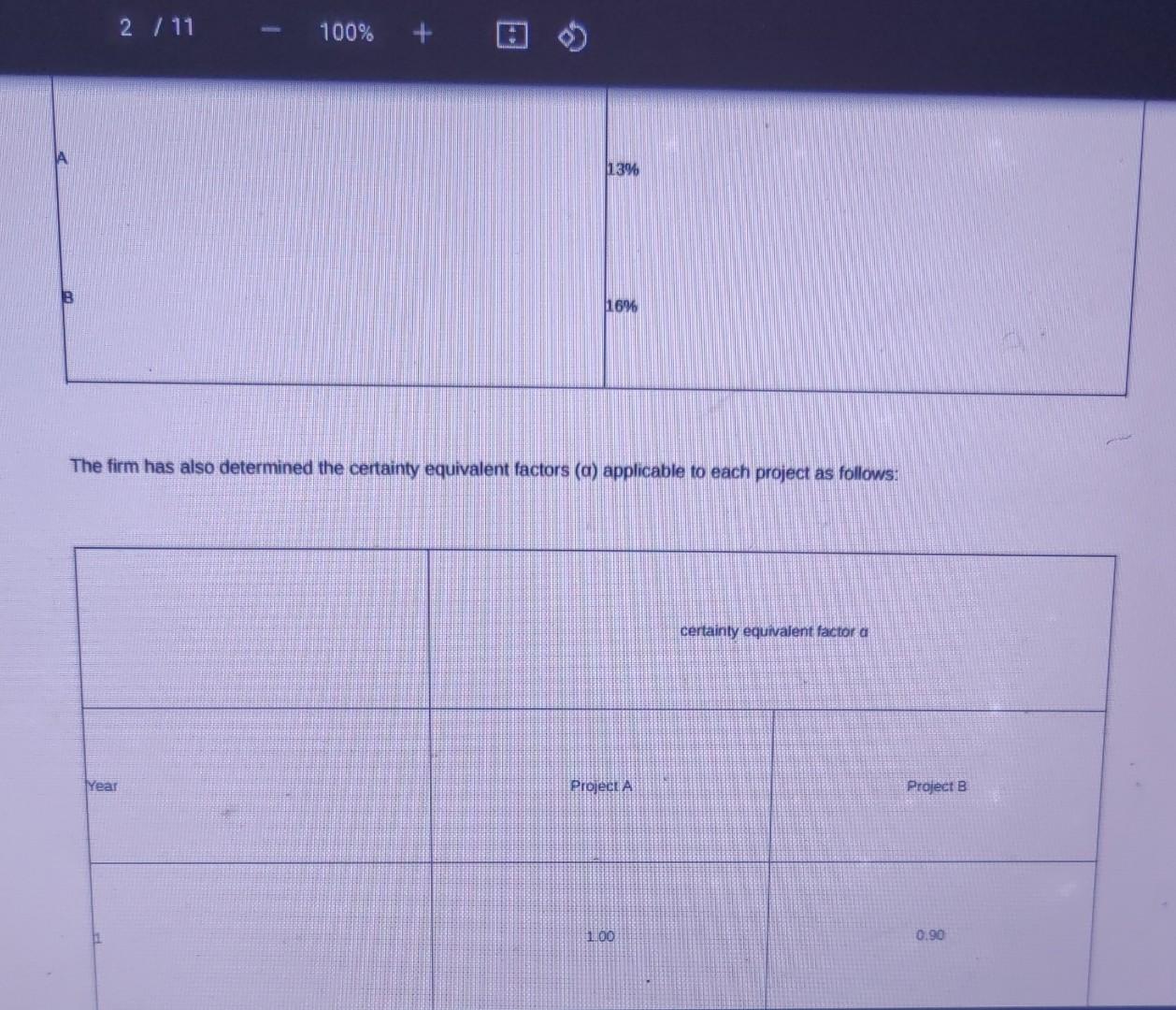

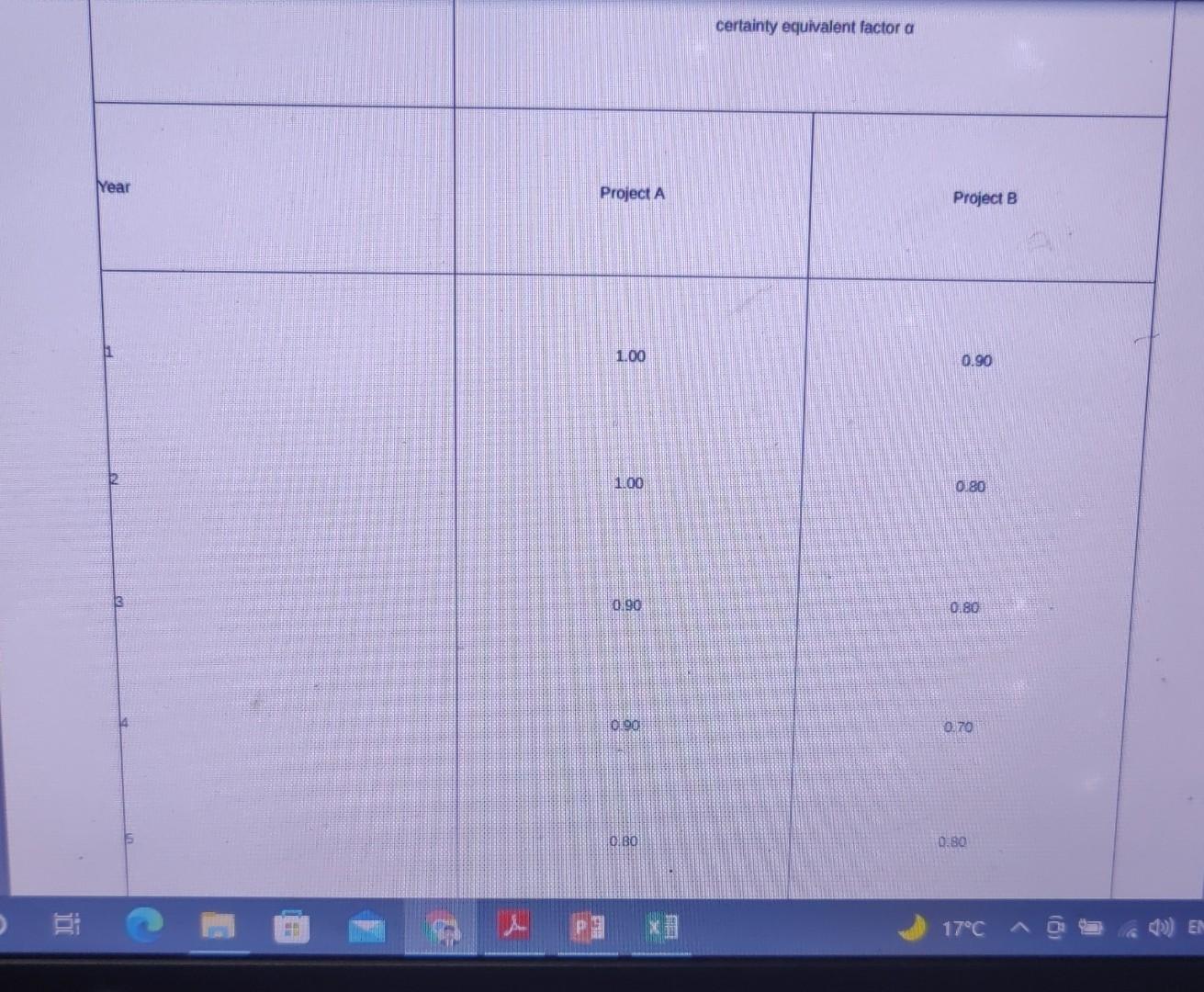

Sun Tech Ltd. wishes to evaluate two alternative projects for increasing its production capacity to meet the rapidly growing demand for its product. After months of investigation and analysis, the firm has pruned the list of alternatives down to the following two projects, either of which would allow it to meet the forecast product demand. Project A Use current proven technology to expand the existing plant and semi-automated production line. This project is viewed as only slightly more risky than the firm's current average level of risk. It requires an initial cash outlay of Rs.50,000. It is expected to generate total annual cash sales of Rs.30,000 and to incur total annual cash expenses of Rs.10,000 for the next 5 years. Also, assume that an annual depreciation of Rs.10,000 will be charged. Project B Install new, just-developed automatic production equipment in the existing to replace the current semi-automated production line. Because this project eliminates the need to expand the plant, it is less expensive than Project A, but it is believed to be far more risky because of the unproven nature of the technology. It requires an initial cash outlay of Rs.40.000. It is expected to generate total annual cash sales of Rs 30,000 and to incur total annual cash expenses of R$ 12,000 for the next 5 years. Also, assume that an annual depreciation of Rs 8.000 will be charged The firm, which routinely uses NPV to evaluate capital budgeting projects, has a cost of capital of 12%. Currently the risk-free rate of interest is 9% and the corporate tax rate is 50 per cent. The firm has decided to evaluate the two projects over a 5-year time period, at the end of which each project would be liquidated. The firm has determined the risk-adjusted discount rate (RADR) applicable to each plan as follows: Project RADR 1135 2 / 11 1 100% + |13% B 1696 The firm has also determined the certainty equivalent factors (a) applicable to each project as follows: certainty equivalent factor a Year Project A Project B 1.00 0.90 certainty equivalent factor a Year A Project A Project B 1 1.00 0.90 1.00 0.80 0.90 0.80 090 0.70 0.30 0.80 17C EN Required: a. Determine the net cash inflows of both the projects for each year. (4 Marks) b. Assuming that the two projects have the same risk as the firm, find NPV using the firm's cost of capital to evaluate their acceptability and relative ranking. Also find their PB period to evaluate their acceptability and relative ranking. (6 Marks) c. Recognizing the differences in project risk, calculate the NPV using the Risk-adjusted discounted rate approach and the Certainty equivalent approach to evaluate the acceptability and relative ranking of the two projects.(8 Marks) d. Compare and contrast your finding in parts b and c. Which project would you recommend? ( 2 Marks) Sun Tech Ltd. wishes to evaluate two alternative projects for increasing its production capacity to meet the rapidly growing demand for its product. After months of investigation and analysis, the firm has pruned the list of alternatives down to the following two projects, either of which would allow it to meet the forecast product demand. Project A Use current proven technology to expand the existing plant and semi-automated production line. This project is viewed as only slightly more risky than the firm's current average level of risk. It requires an initial cash outlay of Rs.50,000. It is expected to generate total annual cash sales of Rs.30,000 and to incur total annual cash expenses of Rs.10,000 for the next 5 years. Also, assume that an annual depreciation of Rs.10,000 will be charged. Project B Install new, just-developed automatic production equipment in the existing to replace the current semi-automated production line. Because this project eliminates the need to expand the plant, it is less expensive than Project A, but it is believed to be far more risky because of the unproven nature of the technology. It requires an initial cash outlay of Rs.40.000. It is expected to generate total annual cash sales of Rs 30,000 and to incur total annual cash expenses of R$ 12,000 for the next 5 years. Also, assume that an annual depreciation of Rs 8.000 will be charged The firm, which routinely uses NPV to evaluate capital budgeting projects, has a cost of capital of 12%. Currently the risk-free rate of interest is 9% and the corporate tax rate is 50 per cent. The firm has decided to evaluate the two projects over a 5-year time period, at the end of which each project would be liquidated. The firm has determined the risk-adjusted discount rate (RADR) applicable to each plan as follows: Project RADR 1135 2 / 11 1 100% + |13% B 1696 The firm has also determined the certainty equivalent factors (a) applicable to each project as follows: certainty equivalent factor a Year Project A Project B 1.00 0.90 certainty equivalent factor a Year A Project A Project B 1 1.00 0.90 1.00 0.80 0.90 0.80 090 0.70 0.30 0.80 17C EN Required: a. Determine the net cash inflows of both the projects for each year. (4 Marks) b. Assuming that the two projects have the same risk as the firm, find NPV using the firm's cost of capital to evaluate their acceptability and relative ranking. Also find their PB period to evaluate their acceptability and relative ranking. (6 Marks) c. Recognizing the differences in project risk, calculate the NPV using the Risk-adjusted discounted rate approach and the Certainty equivalent approach to evaluate the acceptability and relative ranking of the two projects.(8 Marks) d. Compare and contrast your finding in parts b and c. Which project would you recommend? ( 2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts