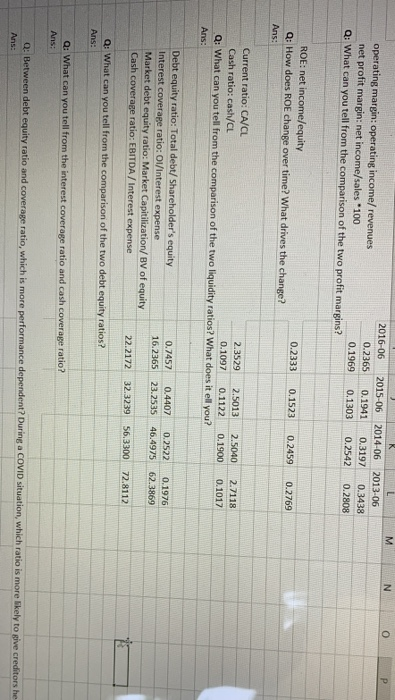

Question: answer te questions based on ratios given: M N 2016-06 2015-06 2014-06 2013-06 operating margin: operating income/ revenues 0.2365 0.1941 0.3192 0.3438 net profit margin:

M N 2016-06 2015-06 2014-06 2013-06 operating margin: operating income/ revenues 0.2365 0.1941 0.3192 0.3438 net profit margin: net income/sales 100 0.1969 0.1303 0.2542 0.2808 Q: What can you tell from the comparison of the two profit margins? ROE: net income/equity Q: How does ROE change over time? What drives the change? Ans: 0.2333 0.1523 0.2459 0.2769 Current ratio: CA/CL 2.3529 2.5013 Cash ratio: cash/CL 0.1097 0.1122 Q: What can you tell from the comparison of the two liquidity ratios? What does it ell you? Ans: 2.5040 0.1900 2.7118 0.1017 Debt equity ratio: Total debt/ Shareholder's equity Interest coverage ratio: 01/Interest expense Market debt equity ratio: Market Capitilization/ BV of equity Cash coverage ratio: EBITDA/ Interest expense 0.7457 16.2365 0.4407 23.2535 0.2522 46.4975 0.1976 62.3869 22.2172 32.3239 56.3300 72.8112 Q: What can you tell from the comparison of the two debt equity ratios? Ans: Q: What can you tell from the interest coverage ratio and cash coverage ratio? Ans: Q: Between debt equity ratio and coverage ratio, which is more performance dependent? During a COVID situation, which ratio is more likely to give creditors he Ans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts