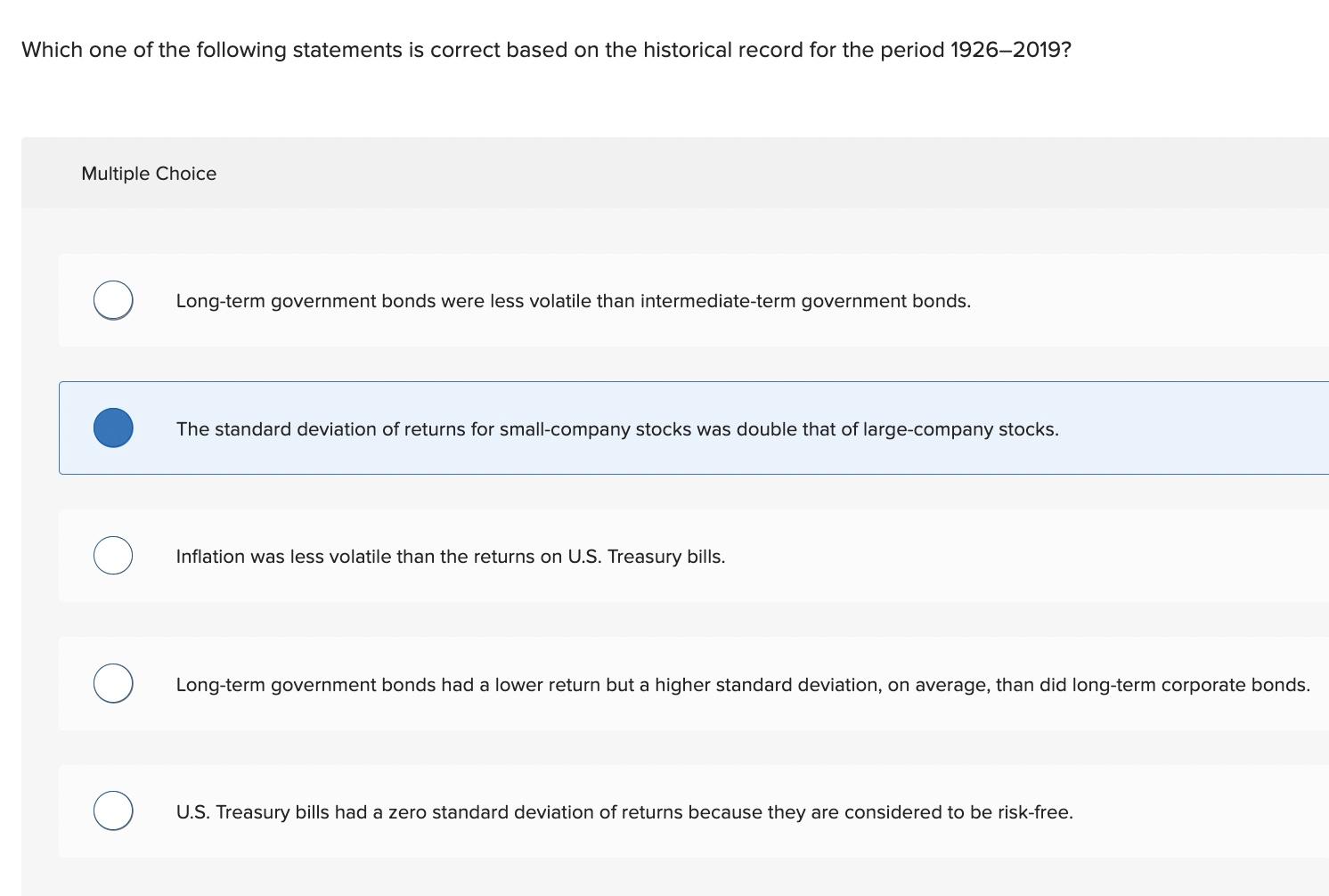

Question: Answer that is selected is wrong Which one of the following statements is correct based on the historical record for the period 1926-2019? Multiple Choice

Answer that is selected is wrong

Answer that is selected is wrong

Which one of the following statements is correct based on the historical record for the period 1926-2019? Multiple Choice Long-term government bonds were less volatile than intermediate-term government bonds. The standard deviation of returns for small-company stocks was double that of large-company stocks. Inflation was less volatile than the returns on U.S. Treasury bills. Long-term government bonds had a lower return but a higher standard deviation, on average, than did long-term corporate bonds. U.S. Treasury bills had a zero standard deviation of returns because they are considered to be risk-free

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts