Question: ANSWER THE 3 QUESTION 1. 2. 3. Mr. X will retire at the age of 60 years. He wishes to have an amount of $200,000

ANSWER THE 3 QUESTION 1.

2.

3.

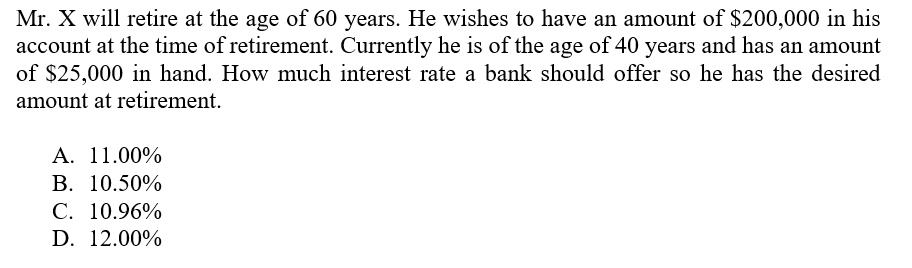

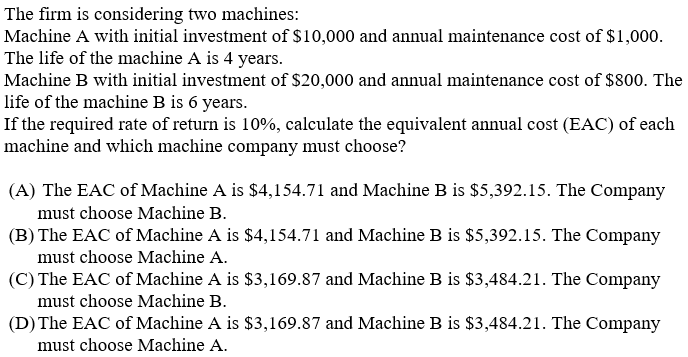

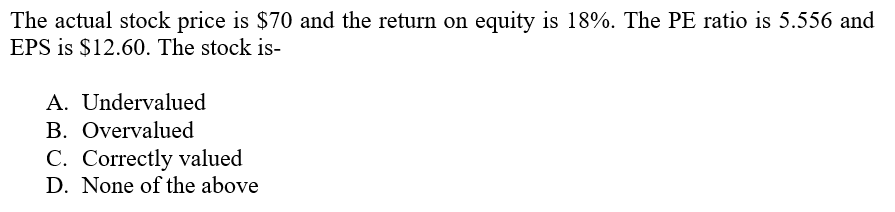

Mr. X will retire at the age of 60 years. He wishes to have an amount of $200,000 in his account at the time of retirement. Currently he is of the age of 40 years and has an amount of $25,000 in hand. How much interest rate a bank should offer so he has the desired amount at retirement. A. 11.00% B. 10.50% C. 10.96% D. 12.00% The firm is considering two machines: Machine A with initial investment of $10,000 and annual maintenance cost of $1,000. The life of the machine A is 4 years. Machine B with initial investment of $20,000 and annual maintenance cost of $800. The life of the machine B is 6 years. If the required rate of return is 10%, calculate the equivalent annual cost (EAC) of each machine and which machine company must choose? (A) The EAC of Machine A is $4,154.71 and Machine B is $5,392.15. The Company must choose Machine B. (B) The EAC of Machine A is $4,154.71 and Machine B is $5,392.15. The Company must choose Machine A. (C) The EAC of Machine A is $3,169.87 and Machine B is $3,484.21. The Company must choose Machine B. (D) The EAC of Machine A is $3,169.87 and Machine B is $3,484.21. The Company must choose Machine A. The actual stock price is $70 and the return on equity is 18%. The PE ratio is 5.556 and EPS is $12.60. The stock is- A. Undervalued B. Overvalued C. Correctly valued D. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts