Question: answer the all question please Directions: Use the given information to provide your answer. 1. Bilal Goldsmith broker has shown him two bonds. Each has

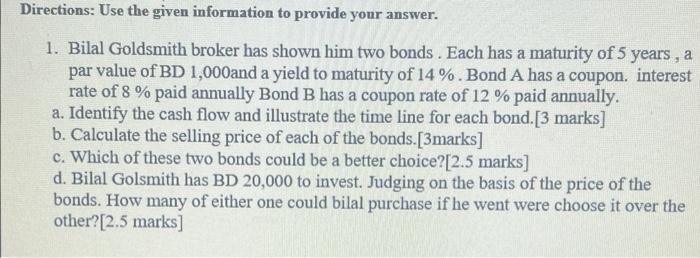

Directions: Use the given information to provide your answer. 1. Bilal Goldsmith broker has shown him two bonds. Each has a maturity of 5 years, a par value of BD 1,000 and a yield to maturity of 14%. Bond A has a coupon. interest rate of 8% paid annually Bond B has a coupon rate of 12% paid annually. a. Identify the cash flow and illustrate the time line for each bond.[3 marks] b. Calculate the selling price of each of the bonds.[3marks] c. Which of these two bonds could be a better choice? [ 2.5 marks] d. Bilal Golsmith has BD 20,000 to invest. Judging on the basis of the price of the bonds. How many of either one could bilal purchase if he went were choose it over the other? [2.5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts