Question: answer the all questions EB-E Listed below are ve procedures followed by Gilmore Company. 1. Employees are required to take vacations. 2. Any member of

answer the all questions

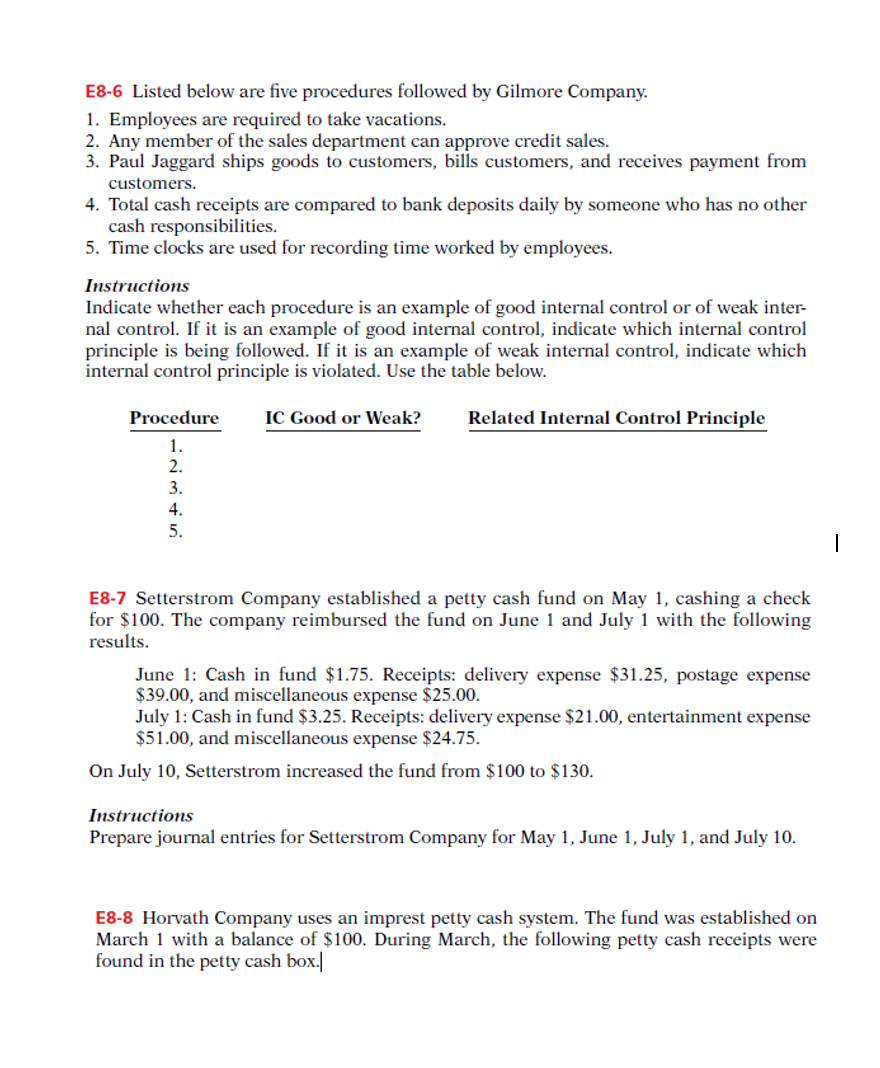

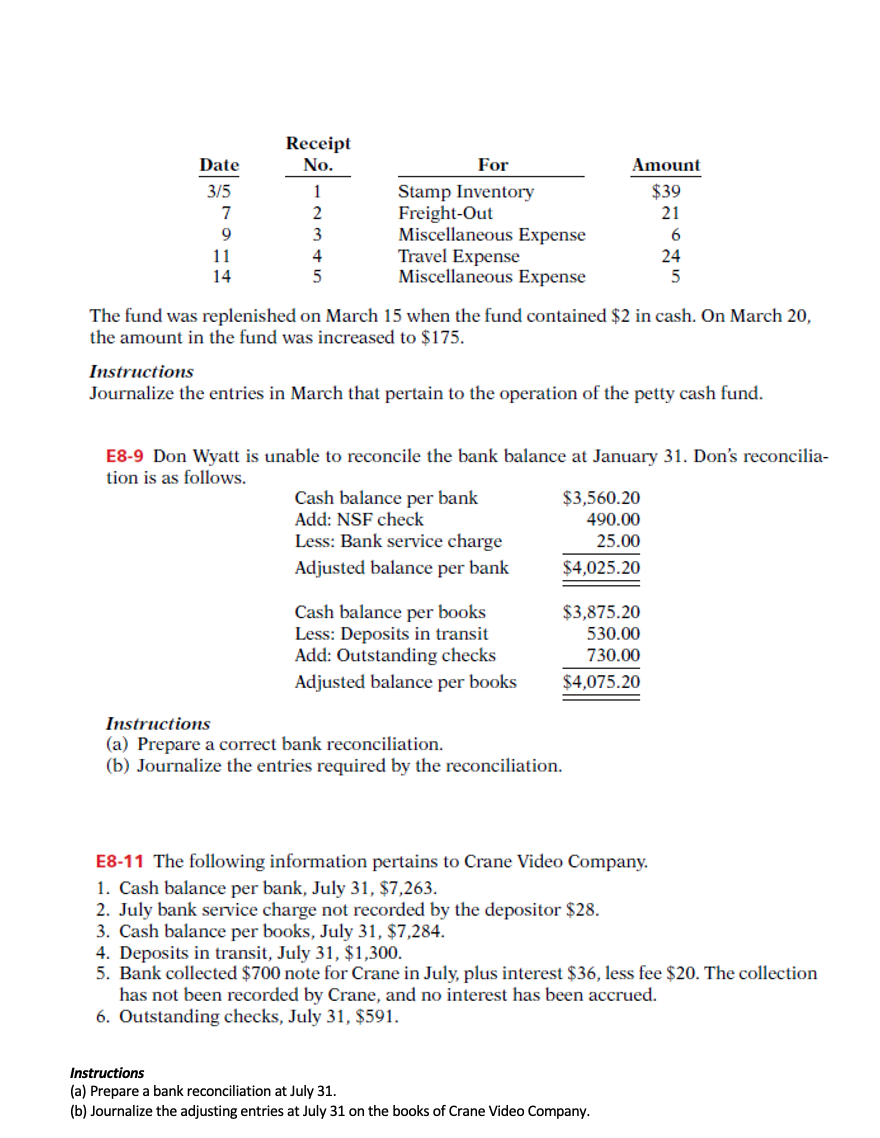

EB-E Listed below are ve procedures followed by Gilmore Company. 1. Employees are required to take vacations. 2. Any member of the sales department can approx-\"e credit sales. 3. Paul Jaggard ships goods to customers, bills customers. and receives payment from customers. 4. Total cash receipts are compared to bank deposits daily by someone who has no other cash responsibilities. 5. Time clocks are used for recording time worked by employees. Instructions Indicate whether each procedure is an example of good internal control or of weak inter- nal control. if it is an example of good internal control, indicate which internal control principle is being followed. If it is an example of weak internal control, indicate which internal control principle is violated. Use the table below. Procedure IC Good or Weak? Related Internal Control Principle 1. 2 3. 4. 5 Eli-7 Selterslrom Company.r established a petty cash fund on May 1, cashing a check for $100. The company reimbursed the fund on June 1 and July 1 with the following results. June 1: Cash in fund $1.75. Receipts: delivery expense $31.25, postage expense $39.00, and miscellaneous expense $25.00. July 1: Cash in fund $3.25. Receipts: deliVery expense $21.00, entertainment expense $51.00, and miscellaneous expense $24.75. On July 10, Setterstrom increased the fund from $100 to $130. Instructions Prepare journal entries for Setterstrom Company for Ma)r 1, June 1, July 1. and Jul),r 10. 158-8 Honrath Company uses an imprest petty cash system. The fund was established on March 1 with a balance of $100. During March, the following petly cash receipts were found in the petty cash b0x.| Receipt Date No. For Amount 315 1 Stamp Inventory $39 7 2 F reightwOut 21 9 3 Miscellaneous Expense 6 ll 4 Travel Expense 24 14 5 Miscellaneous Expense 5 The fund was replenished on March 15 when the fund contained $2 in cash. On March 20, the amounl in the fund was increased to $125. Instructions Journalize the entries in March that pertain to the operation of the petty cash fund. E8-9 Don Wyatt is unable to reconcile the bank balance at January 31. Don's reconcilia- tion is as follows. Cash balance per bank $3,560.20 Add: NSF check 490.00 Less: Bank service charge 25.00 Adjusted balance per bank $4,025.20 Cash balance per books $3,875.20 Less: Deposits in transit 530.00 Add: Outstanding checks 130.00 Adjusted balance per books $4,075.20 Instructions (3.) Prepare a correct bank reconciliation. (b) Journalize the entries required by the reconciliation. E8-11 The following information pertains to Crane Video Company. Cash balance per bank, July 31, $7,263. J uly bank service charge not recorded by the depositor $28. Cash balance per books, July 31. $7,234. Deposits in transit, Jul),r 31, $1,300. Bank collected $700 note for Crane in J uly, plus interest $36. less fee $20. The collection has not been recorded by Crane, and no interest has been accrued. Oulstanding checks, July 31. $591. P'PP'E'JT' 9' instructions {a} Prepare a bank reconciliation at July 31. [b] Journalize the adjusting entries at July 31 on the books of Crane Video Company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts