Question: Answer the assessment question 3 Answer the assessment question Reclassify the transactions using the accrulas method of accounting in the table belowFill in the las

Answer the assessment question 3 Answer the assessment question Reclassify the transactions using the accrulas method of accounting in the table belowFill in the las table

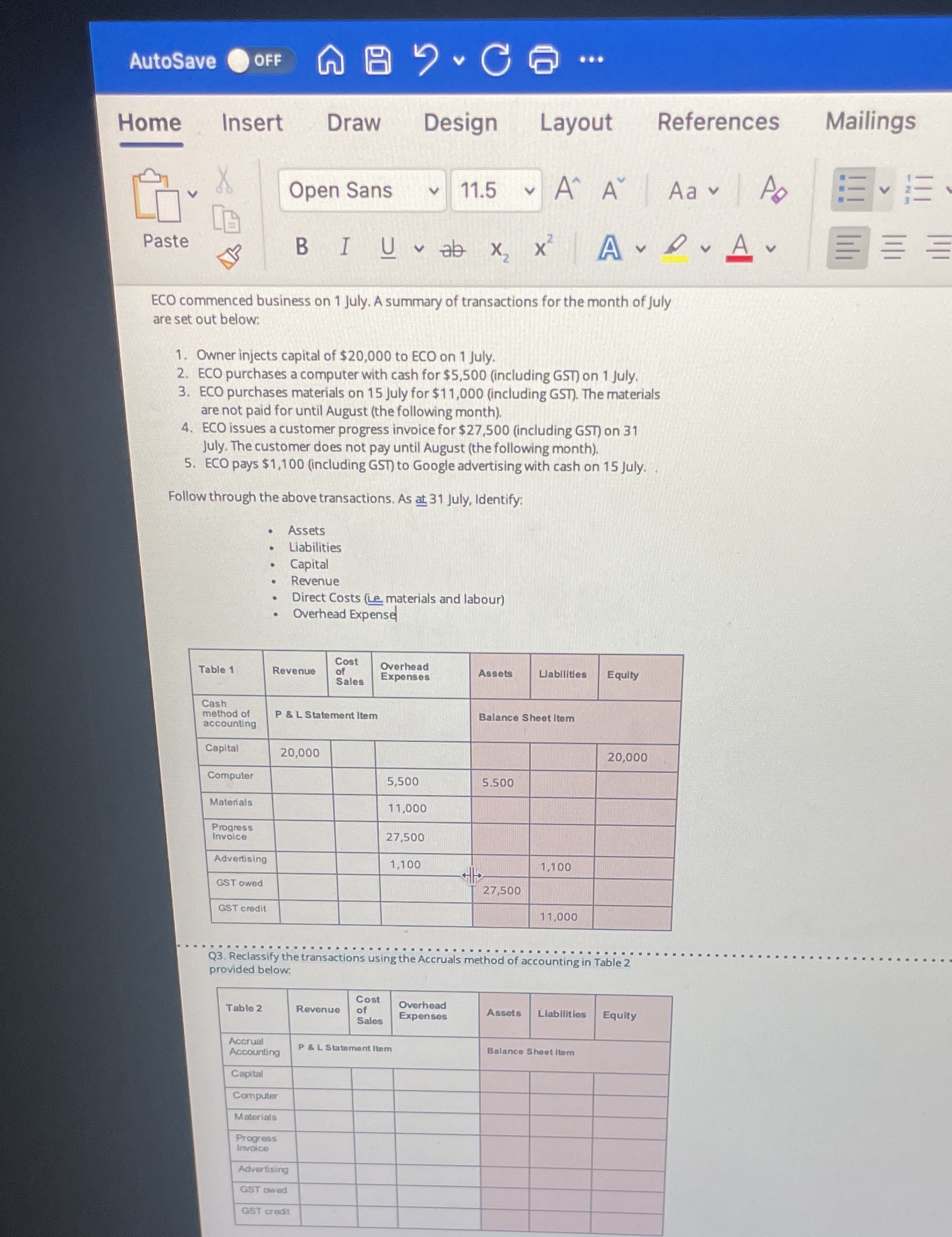

AutoSave OFF ABCG .. Home Insert Draw Design Layout References Mailings Open Sans 11.5 A A Aav Ap Paste BIUvab x x A DAY ECO commenced business on 1 July. A summary of transactions for the month of July are set out below: 1. Owner injects capital of $20,000 to ECO on 1 July. 2. ECO purchases a computer with cash for $5,500 (including GST) on 1 July. 3. ECO purchases materials on 15 July for $1 1,000 (including GST). The materials are not paid for until August (the following month). 4. ECO issues a customer progress invoice for $27,500 (including GST) on 31 July. The customer does not pay until August (the following month). 5. ECO pays $1,100 (including GST) to Google advertising with cash on 15 July. Follow through the above transactions. As at 31 July, Identify: Assets Liabilities Capital Revenue Direct Costs (Le materials and labour) Overhead Expense Table 1 Cost Revenue Overhead Expenses Assets Liabilities Equity Sales Cash method of P & L Statement Item Balance Sheet Item accounting Capital 20,000 20,000 Computer 5,500 5.500 Materials 11,000 Progress Invoice 27,500 Advertising 1,100 1,100 GST owed 27,500 GST credit 11,000 ..... . . . . . . . . . ...... . "... . . . .. . .. Q3. Reclassify the transactions using the Accruals method of accounting in Table 2 provided below, Cost Table 2 Revenue of Overhead Assets Sales Expenses Liabilities Equity Accrual Accounting P & L Statement Item Balance Sheet Item Capital Computer Materials Progress Invoice Advertising GST owed GST credit