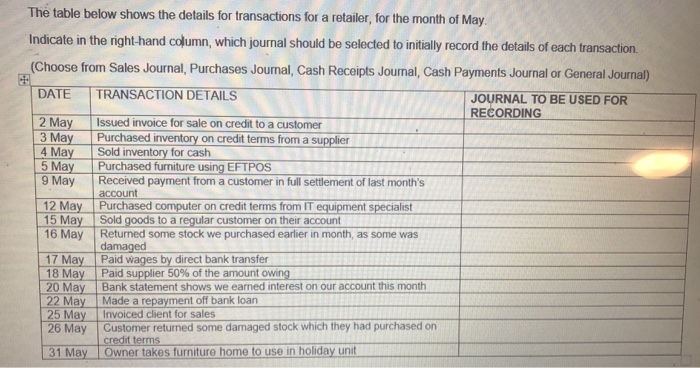

Question: answer the below journal to be used for recording.. The table below shows the details for transactions for a retailer, for the month of May

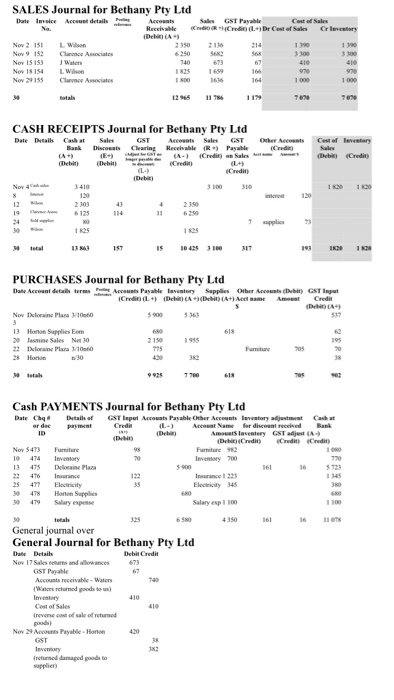

The table below shows the details for transactions for a retailer, for the month of May Indicate in the right-hand column, which journal should be selected to initially record the details of each transaction. (Choose from Sales Journal, Purchases Jounal, Cash Receipts Journal, Cash Payments Journal or General Journal) DATE TRANSACTION DETAILS JOURNAL TO BE USED FOR RECORDING 2 May Issued invoice for sale on credit to a customer 3 May Purchased inventory on credit terms from a supplier 4 May Sold inventory for cash 5 May Purchased furniture using EFTPOS 9 May Received payment from a customer in full settlement of last month's account 12 May Purchased computer on credit terms from IT equipment specialist 15 May Sold goods to a regular customer on their account 16 May Returned some stock we purchased earlier in month, as some was damaged 17 May Paid wages by direct bank transfer Paid supplier 50% of the amount owing 20 May Bank statement shows we earned interest on our account this month 22 May Made a repayment off bank loan 25 May Invoiced client for sales 26 May Customer returned some damaged stock which they had purchased on 31 May lOwner takes furniture home to use in holiday unit SALES Journal for Bethany Pty Ltd Date IveiceAccoust details GST Payable Receisable Nov 2 15LWilso Nov 9 152 Claence Associates 2350 2136 6250 5682 3 300 3 300 Nov 18 154 L Wisn Nov 29155 Clarce Associates 1 825 1 000 12966 1 179 7e% CASH RECEIPTS Journal for Bethany Pty Ltd Recelvable R Payale DebitDebit(Credit 3410 1001 2 350 6 200 96125 1 825 tetal 15 0425 3100 317 PURCHASES Journal for Bethany Pty Ltd Date Accoant detals termsAccounts Payable Iaventery Sapplies Other Accousts (Dubit) GST Inpat Cre t L)De (A Debit)(A+) Aeet same Amt Credit Debin( Nov Deloraine Plara 1/10t0 13 Honon Supplies Eom 22 Deloraine Plara 1/10 5 363 1 935 Furnitune 705 28 Horton Cash PAYMENTS Journal for Bethany Pty Ltd Date ChqDtails of GsT lsput Accousts Payable Cser Acceants levestory adjestat Cash at or dec paymeat for discount AmaestSlaventory Debt Credit GST adjust (A- 4 Furniture 474nvory Furniture 92 Invemtory 700 3 475 Deloraine Plaz 5 900 6723 476 Inuance 477 Elocticity 478 Hoen Supplies 479 Salary expse 122 Insurance 1 223 Electricity 345 Salary esp 1 00 4350 General journal over General Journal for Bethany Pty Ltd Nov 17 Sales eetarns and allowances GST Payable Accounts receivable-Waters Wators returned goods to us Cost of Sales Nov 29 Nocounts Payabile Hoton 182 nefurned damaged goods to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts