Question: Answer the correct letter:) 5. A VAT- registered taxpayer can? a. Remit percentage tax in lieu of VAT b. Remit the VAT on a quarterly

Answer the correct letter:)

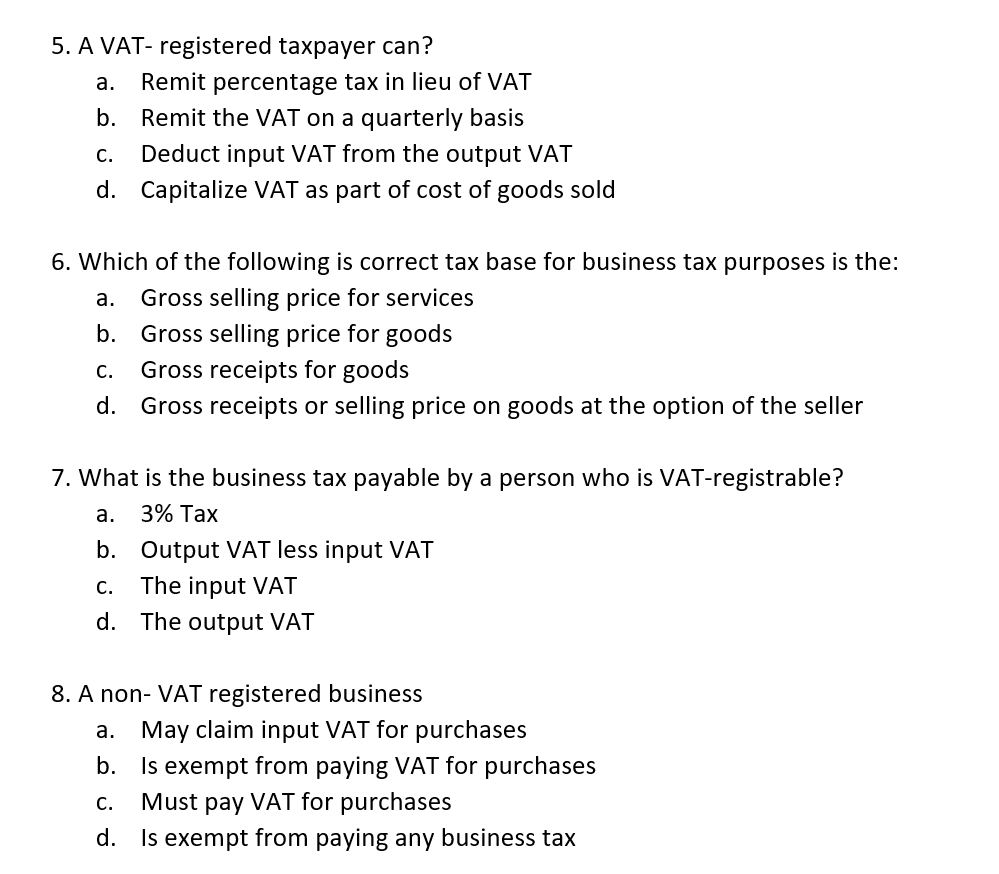

5. A VAT- registered taxpayer can? a. Remit percentage tax in lieu of VAT b. Remit the VAT on a quarterly basis c. Deduct input VAT from the output VAT d Capitalize VAT as part of cost of goods sold 6. Which of the following is correct tax base for business tax purposes is the: a. Gross selling price for services b Gross selling price for goods c. Gross receipts for goods d Gross receipts or selling price on goods at the option of the seller 7. What is the business tax payable by a person who is VAT-registrable? a. 3% Tax b. Output VAT less input VAT c. The input VAT d The output VAT 8. A non- VAT registered business a. May claim input VAT for purchases b Is exempt from paying VAT for purchases c. Must pay VAT for purchases d Is exempt from paying any business tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts