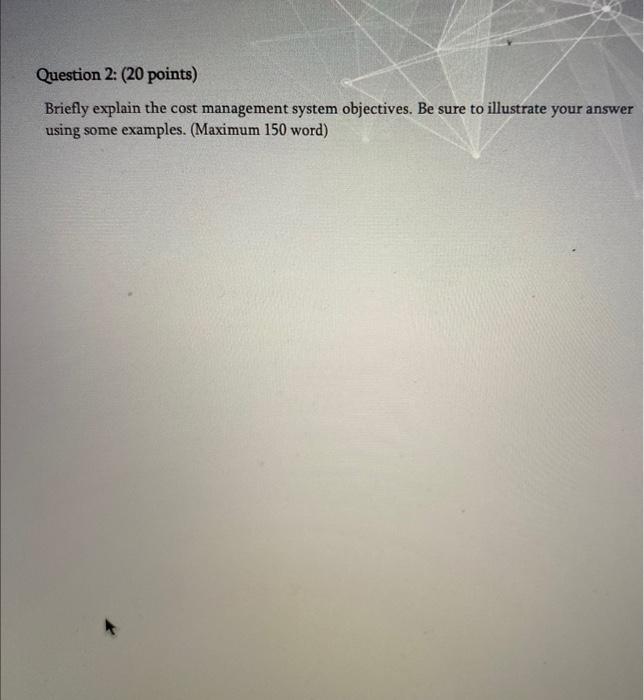

Question: Answer the first Photo Question 2: (20 points) Briefly explain the cost management system objectives. Be sure to illustrate your answer using some examples. (Maximum

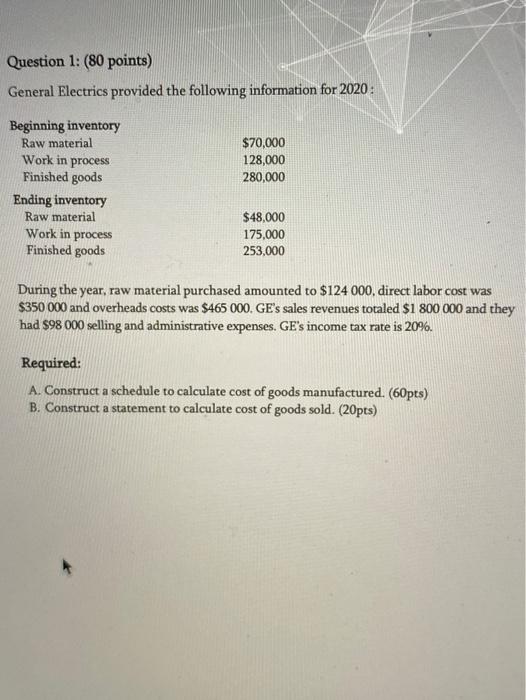

Question 2: (20 points) Briefly explain the cost management system objectives. Be sure to illustrate your answer using some examples. (Maximum 150 word) Question 1: (80 points) General Electrics provided the following information for 2020: $70,000 128,000 280,000 Beginning inventory Raw material Work in process Finished goods Ending inventory Raw material Work in process Finished goods $48,000 175,000 253,000 During the year, raw material purchased amounted to $124 000, direct labor cost was $350 000 and overheads costs was $465 000. GE's sales revenues totaled $1 800 000 and they had $98 000 selling and administrative expenses. GE's income tax rate is 20%. Required: A. Construct a schedule to calculate cost of goods manufactured. (60pts) B. Construct a statement to calculate cost of goods sold. (20pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts