Question: answer? The focus on traditional financial statements is data rather than cash flow, However, cash flow is important to investors, managers, and stock analysts. Therefore,

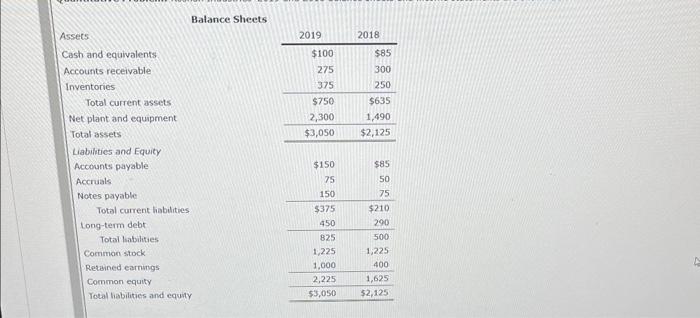

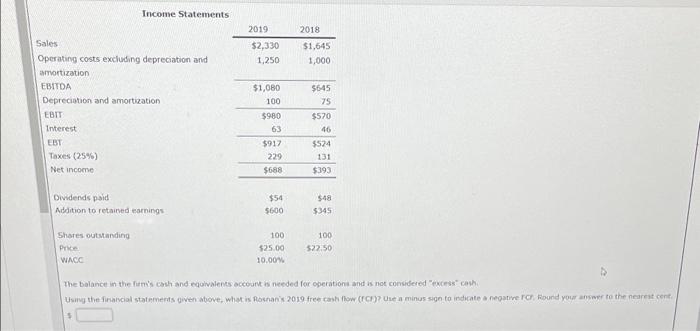

The focus on traditional financial statements is data rather than cash flow, However, cash flow is important to investors, managers, and stock analysts. Therefore, corporate decision makess and secunity analysts need to modify accounting data provided to them. An important modification is the concept of Iree cash flow (FCF). Many analysts regard FCF as being the single and most important number that can be developed from the accounting statements, even more important than net income. The equation for free cash llaw is: fCF = [CBIT (1T)+ Depreciation and amortization] - [Capital expenditures + ANet operating working capital] cash flow is the cosh flow actually available for payments to all investors (stockholders and debtholders) after the company has made investments in fixed assets, new products, and A negative FCF means that the company does not have sulficient lixed assets and working capital, and that it will have to raise new money in the markets to pay for thete investments. Negative FCF is not always bad. If FCF is negotwe because after tax operating income is negative thes is bad, because the compony is probably experiencino operating problemn. txceptions to this might be startup Quantitative Problemu tlosnan indistives' 2010 and 2018 balance sheets and income statements are shown below. Balance Sheets Assets Cash and equivalents Accounts receivable Inventories Total current assets \begin{tabular}{r|r} \hline 2019 & \multicolumn{1}{|c}{2018} \\ \hline$100 & $85 \\ 275 & 300 \\ 375 & 250 \\ \hline$750 & $635 \\ 2,300 & 1,490 \\ \hline$3,050 & $2,125 \\ \hline \end{tabular} Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current habilities tong-term debt Total labilities Common stock Retained earnings Common equity Yotal liabilities and equity \begin{tabular}{rr} $150 & $85 \\ 75 & 50 \\ 150 & 75 \\ \hline$375 & $210 \\ \hline 450 & 290 \\ \hline 825 & 500 \\ 1,225 & 1,225 \\ 1,000 & 400 \\ \hline 2,225 & 1,625 \\ \hline 53,050 & $2,125 \\ \hline \end{tabular} Income Statements The balance in the fient's cash and equivalems occourt is needed for operations and is not considered "ewcess' cash, 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts